On the conference call, CEO Brian Faith said: “With continued strong bookings, a record $179 million funnel, and some very significant eFPGA contract proposals pending, we remain confident that we’ll deliver greater than 30% year-over-year revenue growth in 2024.”

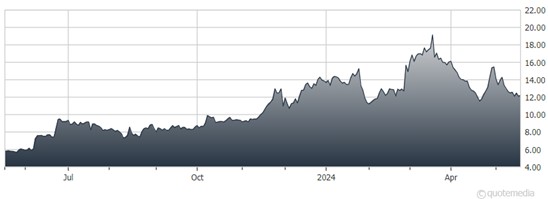

QuickLogic Corp. (QUIK)

They are projecting June quarter revenue will be up significantly year-over-year, but show a sequential decrease from Q1 to the low point for this year. They continue to be cash flow positive and solidly profitable for the full year. June quarter revenue should be up 55% from last year to $4.5 million, with pro forma earnings from breakeven to three cents a share.

QuickLogic Corp (NASDAQ:QUIK) has a major system-on-a-chip (SOC) contract shipping now where their eFPGA technology is used for Artificial Intelligence (AI) acceleration, which is a necessary function in most AI applications. This will be a rapidly growing application that is better served by eFPGA technology than a processor running the acceleration algorithms in software. eFPGA IP can be reprogrammed to adapt to changes in acceleration algorithms and performs acceleration more quickly using much less power than a processor-based solution.

Recommended Action: Buy QUIK.