By Kathy Lien, Managing Director of FX Strategy for BK Asset Management.

Monday’s sharp sell-off in sterling gave investors a taste of the volatility they can expect in the foreign-exchange market this week. There are a number of important events on the calendar guaranteeing active trading but instead of excitement, there’s anxiety in the financial markets. The upcoming U.S. presidential election and Brexit give investors plenty to worry about. While Monday's focus was on Britain, the next month see the market cycle between these two event risks. Brexit is a problem for not only the U.K. but markets around the world. Let's not forget how quickly and aggressively U.S. stocks plunged when Britain voted to leave the European Union. When the new leadership took over, its lack of urgency restored stability to the financial markets but over the weekend, U.K. Prime Minister Theresa May said she would trigger Article 50 by the end of March 2017. A date has been set, which means the pressure on sterling will increase as the deadline nears. Along these lines, rallies over the next 5 months could be shallow. The U.K. economy is actually doing pretty well with manufacturing activity accelerating according to the latest PMI report. But the government will probably kill those improvements by putting immigration ahead of economic access.

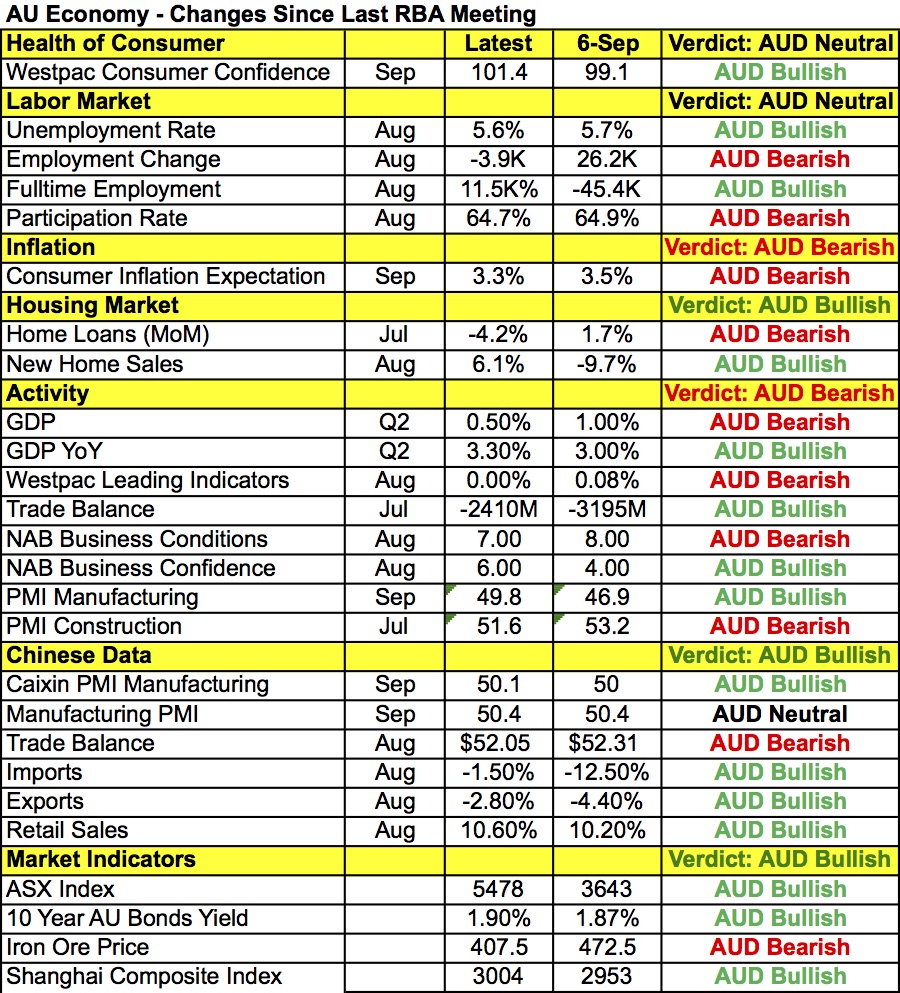

The Reserve Bank of Australia was slated to meet Monday night with a new central-bank governor at the helm. Phillip Lowe, former RBA deputy governor succeeded Glenn Stevens and investors will be paying close attention to the new governor’s tone. Chances are he is going to play it safe and maintain the central bank’s upbeat outlook. The last time RBA convened, it expressed confidence in the trend of growth and the labor market. When Lowe spoke last month, he said the labor market is not as strong as the unemployment rate suggests and that inflation is expected to remain low for some time. Taking a look at the table below, there has been as much improvement as deterioration in Australia’s economy since the last monetary policy meeting with broad improvements in China. So while RBA Governor Lowe may be optimistic, the main takeaway will be patience. AUD may fall on this but at a time when the central banks of the U.K., Eurozone, Japan and New Zealand are considering more stimulus, a neutral bias will make any declines shallow. In fact, we believe the better trade is to be long AUD pre-RBA. Meanwhile, the New Zealand dollar dropped on risk aversion while the Canadian dollar extended its gains as oil pushed higher.

The U.S. dollar traded higher against all of the major currencies Monday with the exception of AUD and CAD. Manufacturing activity rebounded in September after contracting in August. The improvement was stronger than expected and helped USD/JPY extend its gains for the fifth straight trading day. Japan’s Tankan’s survey was also lower than anticipated but given the strength of the Japanese yen, the fact that it did not fall more than 1 point in all measures was good news. There are no major U.S. or Japanese economic reports schedule for release Tuesday. Rising U.S. yields helped to keep the dollar bid. We believe this week’s nonfarm payrolls report will be positive for USD/JPY. Taking a look at various measures that we will explore in greater detail as the week progresses, there’s strong reason to believe that job and wage growth improved last month.

The euro also came under selling pressure as investors realized that Deutsche Bank's (NYSE:DB) lower settlement deal with the U.S. Department of Justice has not been confirmed. There was a media report on Friday saying that DB reached an agreement to lower the penalty to $5.4 billion from $14 billion and while talks are underway, investors need a deal to be official before they are willing to put DB behind them. The problem is that a lower number has now been thrown out so if the actual settlement is higher and closer to $10 billion, the euro could still be punished as a result. Either way, the range for EUR/USD has been 1.1160 to 1.1300 and our bias is to the downside.