The RBC (TSX:RY) Canadian Discount Bond ETF (Ticker: RCDB), recently passed $1 Billion in assets, a momentous moment for any investment solution, as it is indicative of the investment strategy’s efficacy and the willingness of investors to utilize said solution in achieving their investment goals. This paper will examine RCDB’s underlying strategy and detail its recent performance.

RCDB’s Underlying Strategy

The RBC Canadian Discount Bond ETF provides investors with exposure to the performance of a diversified portfolio of primarily Canadian government and corporate bonds which at the time of purchase are trading below the weighted average price of the universe of Canadian short-term bonds to provide regular income while preserving capital.

Holdings are selected using a rules‑based investment approach that considers key characteristics, including term to maturity, credit quality, yield to maturity, and duration while also considering issuer diversification within the portfolio. While the ETF will primarily invest in short-term fixed income securities issued by the Canadian government and Canadian corporations, the manager has the ability to invest in short-term U.S. government bonds and short-term debt, denominated in U.S. dollars, issued by U.S. and foreign corporations.

RCDB’s Growth and Performance

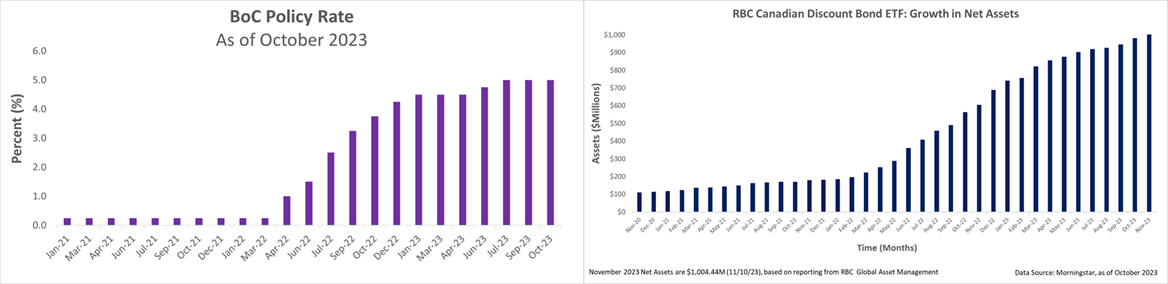

Against the backdrop of a rising interest rate environment, RCDB's short-term interest rate exposure has allowed it to garner fund flows from investors. As observed from the illustration below, there is an observable parallel between the Bank of Canada increasing its policy rate and the net asset growth of the ETF, over time.

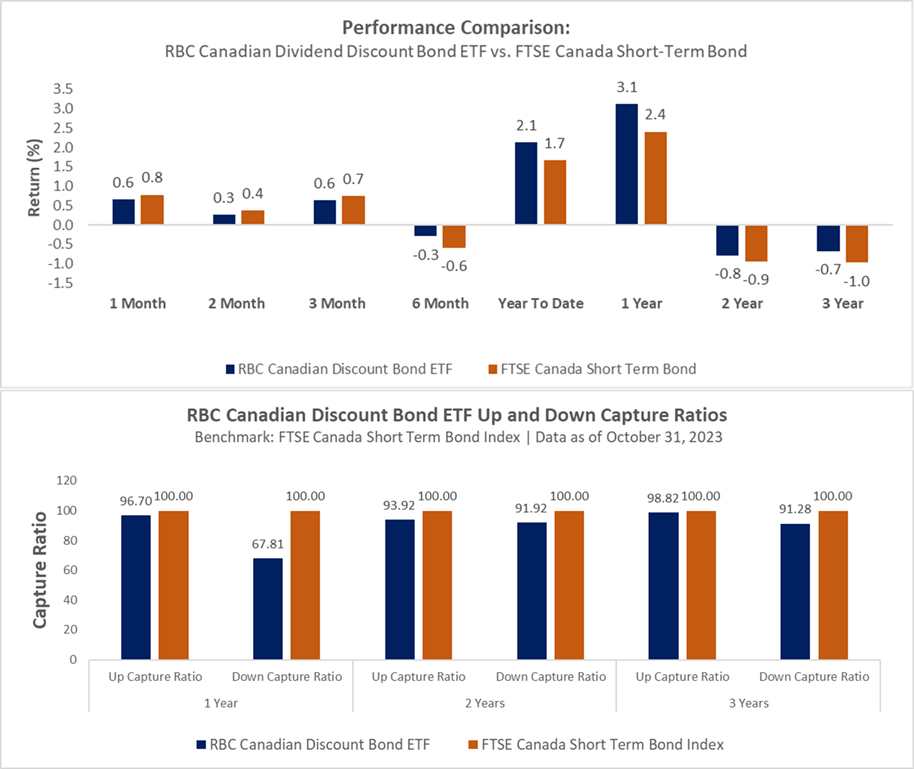

Regarding the funds’ performance, relative to the FTSE Canada Short Term Bond Index, the ETF has exhibited comparable returns over the short term, while outperforming over the long term; particularly on a year-to-date and one-year basis. Furthermore, in looking at the up and down capture ratios of the ETF, the fund has demonstrated that its investment strategy is capable of participating in the upside and limiting its loss exposure over varying time frames.

Takeaways

With the prevailing interest rate environment being a contributor to the fund’s overall performance, it should be expected that as the Bank of Canada and the U.S. Federal Reserve are cutting rates, there will be an impact on the fund’s performance. However, at this immediate juncture, with rates still being high and RCDB having dual exposure to both government and corporate bond instruments of a high-quality rating (i.e., the average credit rating of AA-), the ETF can still be of benefit to investors looking to derive regular income, while preserving capital.

This content was originally published by our partners at the Canadian ETF Marketplace.