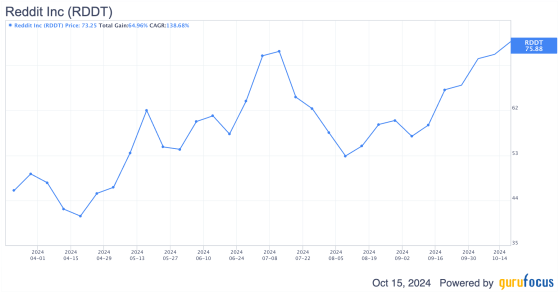

Reddit (NYSE:RDDT) is potentially one of the most hyped recent IPOs on the U.S. stock market, having gone public in March this year. Since then, it's not surprising that Reddit's shares have experienced significant volatility. The stock has hit 52-week highs of $78.08 (reached at the peak of the bull market) and lows of $37.35 (a month after its initial surge).

Reddit's shares are currently trading near their all-time highs, above $75 per share. While the volatility over the past six months highlights the challenges of valuing an IPO for a social media platform like Reddit, the company has clearly delivered strong operational results. Not only is Reddit already profitable, but more importantly, its active user base is growing at a much faster pace than non-Meta competitors like Snap (NYSE:SNAP) and Pinterest (NYSE:NYSE:PINS).

While Reddit appears to be on track for long-term gains, with a robust growth story, its current valuation remains a concern for many skeptics betting against the stock.

Although Reddit is still in the early stages of growth and trades at a more attractive market value compared to some of its larger peers, I believe the stock is at least fairly priced at its current level, based on Wall Street projections and more conservative estimates that factor in sustained growth rates. Given that Reddit's investment thesis hinges on future growth and its valuation multiples are stretched, I believe it's prudent to adopt a margin of safety.

For this reason, I would consider buying the stock during a market correction, when prices drop to at least below $60. In this article, I will dive into Reddit's business model, recent results, and why I maintain some skepticism regarding its current valuation.

Understanding Reddit's Business ModelReddit is today one of the most widely used and influential social networks, often described as "the front page of the internet" due to its essence-driven and community-centric nature, allowing users to interact anonymously. This aspect often leads to the creation of authentic and relevant content, thereby attracting more users and, consequently, revenue.

However, the truth is that while the platform has existed since 2005 and boasts impressive traffic figures, Reddit may not have fully optimized its user monetization strategies, although it has made significant progress in this area. The major challenge for Reddit is to ensure that its monetization continues to grow and align with the increased retention of active users on the platform, considering its unique characteristics.

A key part of Reddit's identity comes from the type of users it attracts and the content they create. Generally speaking, Reddit users see the platform as a break from the more polished and curated environments of other social networks. Take Meta Platforms'(NASDAQ:META) Facebook (NASDAQ:META) and Instagram, for examplethey're often all about showcasing the best, most picture-perfect moments, making them a big hit for ad monetization. On the flip side, Reddit is more about raw, authentic interactions, which doesn't always translate as well for advertisers.

This difference in user behavior means that while ads on platforms like Instagram might see high engagement, Reddit faces a tougher challenge. Many posts on Reddit carry not safe for work labels, creating hurdles for brands trying to advertise their products. Plus, Reddit's user base generally isn't too keen on ads, which makes it even harder to drive purchases through advertising.

Given these challenges, Reddit's main goal is to convince its shareholders that the platform has more to offer than just ad revenue. While these alternative monetization efforts are still in the early stages, Reddit is investing heavily in new projects aimed at boosting ad performance and exploring other revenue streams. For example, in Q1, the company spent $437 million on research and development (R&D)almost twice what it earned in revenue during that period. Even though, in Q2, Reddit's R&D fell sharply to $143 millions.

Looking ahead, Reddit has laid out a plan to diversify its revenue sources beyond just ads. Part of this strategy involves data licensing, where companies can pay to access real-time data from anonymous, public conversations on Reddit through APIs (application programming interfaces).

Where Reddit Stands NowSince its IPO in March, Reddit's stock has seen a 19% increase, putting the company's market value just shy of $10 billion. With $1.7 billion in cash and investments, its enterprise value comes in at $7.6 billion.

Digging into the financials, Reddit brought in $981 million in revenue over the past year, but it's still barely turning a profit. The company reported $574 million in net loss over the past twelve months, but that number is inflated due to stock-based compensation from the IPO. The more telling figures are an adjusted EBITDA of just $66 million and a free cash flow of only $23 million. This leaves Reddit with a sky-high valuationover 350x cash flow and 55x forward EBITDA.

It's no wonder short interest in the stock is over 7.4%. However, some investors still see Reddit as a massively under-monetized platform with huge potential. To put things in perspective, Reddit's average revenue per user (ARPU) is less than $3, compared to Facebook's more than $10. Because of Reddit's platform model, profitability could soar if revenue keeps growing. In the first half of this year, Reddit's revenue jumped by $177 million, with $135 million of that going straight to EBITDA.

Source: Reddit's Investor Relations

Reddit's profit margins (nearly 90%) could quickly improve as long as its revenue continues to climband climb it has. Revenue was up 21% in 2023, and the trailing 12-month figure shows an even faster growth rate of 37%.

While Reddit is working on expanding its monetization, a big part of its growth still comes from optimizing its ad business. On top of that, its data licensing deals, like the ones with Google (NASDAQ:GOOGL), OpenAI, and Sprinklr, brought in at least $200 million. It's also interesting to note that Reddit saw a big jump in web traffic not long after partnering with Google.

On Reddit's Growth and ValuationWhen considering Reddit's market cap of above $12.4 billion, it doesn't seem excessively high, especially compared to Pinterest at $22 billion and Twitter, which was sold for over $50 billion. However, there are concerns regarding Reddit's management and its handling of expenses. It's puzzling why a company with an 89.5% gross margin hasn't generated significant net profits yet. After all, Reddit has been around since 2005, has spent nearly a billion dollars on R&D, and is only now rolling out basic features like spell check and autocomplete.

The big question is whether Reddit can sustain its current user growth rate of 50%. The platform has been adding around 10 million daily active users (DAUs) sequentially, which isn't sustainable in the long run. While we might see growth rates above 50% for the next few quarters, they are likely to taper off thereafter.

Since 2022, Reddit reported a revenue trendline at 25% (see chart below). Following its IPO in 2024, Reddit has seen revenue growth of 48% in Q1, 53% in Q2, and is projected to reach 51% in Q3. However, it's important for investors to recognize that sustaining such a CAGR in the long term is practically impossible. Analysts project Reddit's revenues will grow at a CAGR of approximately 22.3% from December 2024 to December 2027, reaching $2.16 billion.

If we assume that the EBITDA margin remains at 14%, in line with what was reported in Q2, this would imply a projected EBITDA of approximately $432 million based on the future revenue projection of $2.16 billion by the end of 2027.

It's important to recognize that EBITDA margins should improve over time as the company gains better control over R&D spending and diversifies its revenue streams. However, given Reddit's strong balance sheet, with a debt-to-equity ratio of less than 1.5%, I believe the company does not need to prioritize margin improvement through cost-cutting measures. Such cuts can be costly in the long run, especially for a company still in its early growth stages.

Additionally, assuming capital expenditures (CapEx) remain at $12 million per year until the end of 2027, this would result in a free cash flow (FCF) of $382 million in 2027. With 165.9 million outstanding shares and the current stock price of $74.99, the market is valuing Reddit stock at about 32.61x its free cash flow per share, which seems appropriate for a company with strong growth prospects.

Multiplying the FCF per share of $2.30 (calculated from the $382 million FCF) by the target P/FCF of 32.6, we arrive at a fair price of $75 per share, aligning with current levels. However, if I apply a 20% margin of safety to this target, the adjusted price would be around $60, which is where I would feel more comfortable initiating a bullish position.

Final RemarksReddit's journey since its IPO has progressed well, showcasing its vast potential. The platform's unique community-driven model and rapid user growth are impressive, but the challenge lies in effectively monetizing that engagement. The big question is how sustainable this growth will be at such high levels. I believe that maintaining a CAGR of 22% over the next four years, with stable margins from a conservative perspective, indicates that the stock is fairly priced. Any more optimistic scenario leaves room for upside, in my analysis.

However, for now, I'll be sitting on the sidelines. I believe it's prudent to project a 20% margin of safety given the uncertainties around execution. I would prefer to buy the stock during a correction, ideally when it trades closer to $60 per share. In summary, I'm cautiously optimistic about Reddit's future, but successful execution will be key.

This content was originally published on Gurufocus.com