- Rio Tinto (LON:RIO) has outperformed the NASDAQ QQQ over the past 5 years

- With slowing growth in demand for steel and falling prices, the outlook is not favorable

- RIO’s performance is largely dependent on sales to China

- For tools, data, and content to help you make better investing decisions, try InvestingPro+.

Rio Tinto (NYSE:RIO), the second-largest metals and mining company in the world, has performed very well over the past 3-to-5-year period. The 3- and 5-year annualized total returns are 15.8% and 20.2% per year, respectively. This has been a good run for metals and mining stocks, with the iShares MSCI Global Metals & Mining Producers ETF (NYSE:PICK) returning a total of 19.4% per year and 15.7% per year over the past 3- and 5-year periods. For context, the 5-year annualized total return for the NASDAQ 100 (via QQQ) is 19% per year.

RIO has fallen by 11.5% in the last month on concerns about global demand for metals. Its share price is about 25% below the 12-month high close of $94.65 recorded on May 11, 2021. The resurgence of COVID lockdowns in China has been a blow to the outlook for iron ore and other commodities. China has also announced plans to limit steel production, which puts substantial downward pressure on iron ore. For context, China represents more than 57% of RIO’s global revenues. China is also expanding its domestic iron ore production. In addition, the more aggressive Fed stance and other factors, like the slight inversion of the yield curve in March, have investors worried about slowing growth and the possibility of a global recession.

Source: Investing.com

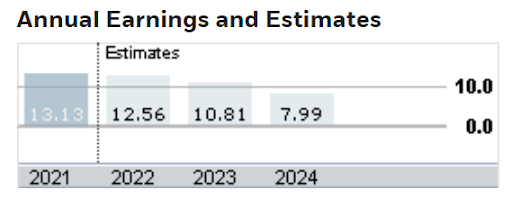

The consensus outlook for EPS growth for RIO over the next 3-to-5-year period is -13.7% per year due to slower growth in demand for steel, after years of high demand for construction, spurred by very low interest rates. Steel prices shot up between November 2020 and November 2021, but have since dropped about 30%.

Source: E-Trade

I last wrote about RIO on August 23, 2021, when the shares were trading at $72.38. At that time, I assigned a bullish/buy rating. Over the period since that post, RIO has returned a total of +3.8% (including dividends) vs. -7.0% for the S&P 500 (SPY). Any analysis of a company like RIO is sensitive to assumptions about commodity prices, interest rates, and global economic growth. In analyzing RIO, I relied on two forms of consensus outlooks. The first is the well-known Wall Street analyst consensus. The second is the market-implied outlook, which represents the consensus view among buyers and sellers of options. RIO has very limited coverage by equity analysts, but the prevailing view was bullish and the consensus 12-month price target was more than 40% above the share price at that time. The prices of options on RIO supported a somewhat bullish view as well. The option implied volatility for RIO was moderate, which was somewhat unexpected. Given these two bullish consensus outlooks, along with favorable fundamentals (rising inflation and, specifically, a big increase in steel prices), a bullish overall rating was the obvious choice.

For readers who are unfamiliar with the market-implied outlook, a brief explanation is needed. The price of an option on a stock reflects the market’s consensus estimate of the probability that the stock price will rise above (call option) or fall below (put option) a specific level (the option strike price) between now and when the option expires. By analyzing the prices of put and call options across a wide range of strike prices, all with the same expiration date, it is possible to calculate a probable price forecast that reconciles all of these options prices. This is the market-implied outlook. For a deeper explanation than is provided here and in the previous link, I recommend this monograph from the CFA Institute.

With eight months since my last analysis of RIO, I have updated the market-implied outlook through to the end of 2022 and compared it with the outlook provided by the equity analysts.

Wall Street Consensus Outlook For RIO

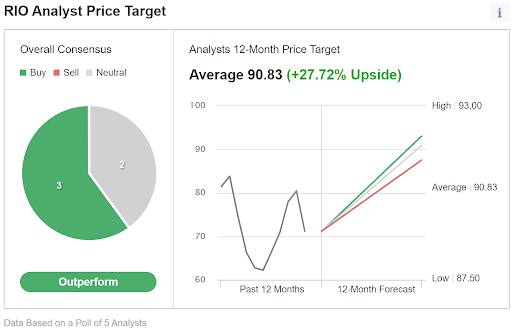

As I noted in my previous post, the analyst coverage for RIO is very thin. E-Trade calculates consensus outlooks based on the views of ranked analysts who have published opinions over the past three months. There are only four analysts that meet E-Trade’s criteria and only one has issued a 12-month price target, $92, or 29% above the current share price. Of the four analysts, one assigns a buy rating, while three rate RIO as a hold. This is the least analyst coverage that I have seen for a globally-dominant firm with a market cap greater than $100 billion.

Investing.com calculates the Wall Street consensus by combining the views of five analysts. The consensus rating is Outperform and the consensus 12-month price target is 27.7% above the current share price.

Source: Investing.com

While research has demonstrated the predictive value of the Wall Street consensus, the small number of analysts included in the results for RIO leads me to discount the consensus in forming my opinion.

Market-Implied Outlook For RIO

I have calculated the market-implied outlook for RIO for the 8.6-month period from now until Jan. 20, 2023, using the prices of options that expire on this date. I selected this specific option expiration date to provide a view through the end of 2022 and because the January options tend to be among the most actively traded. The average bid and ask prices for at-the-money options on RIO are 2% away from the mid-point price (bid price 2% below and ask price 2% above), which suggests an active market for the options.

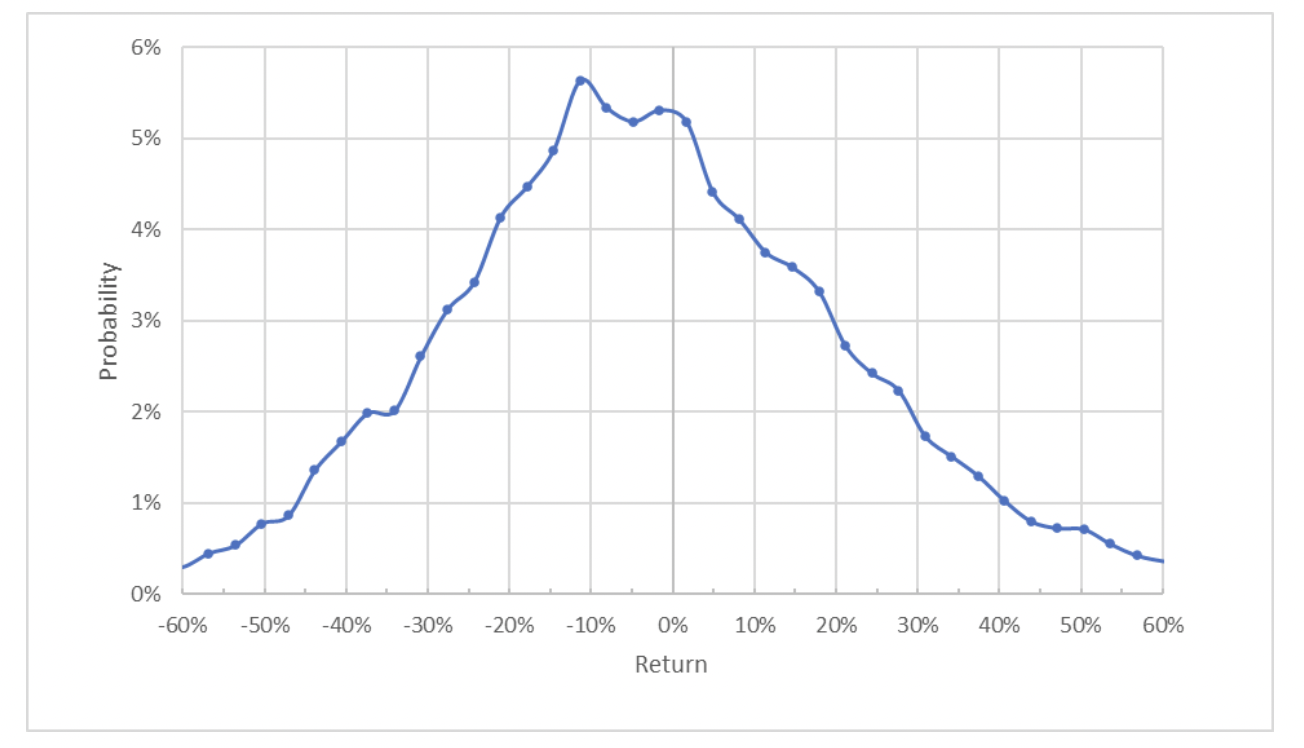

The standard presentation of the market-implied outlook is a probability distribution of price return, with probability on the vertical axis and return on the horizontal.

Source: Author’s calculations using options quotes from E-Trade

The market-implied outlook for RIO is tilted to favor negative returns, a bearish orientation. The maximum probability corresponds to a price return of -13.4% over the 8.6-month period. The expected volatility calculated from this outlook is 37%.

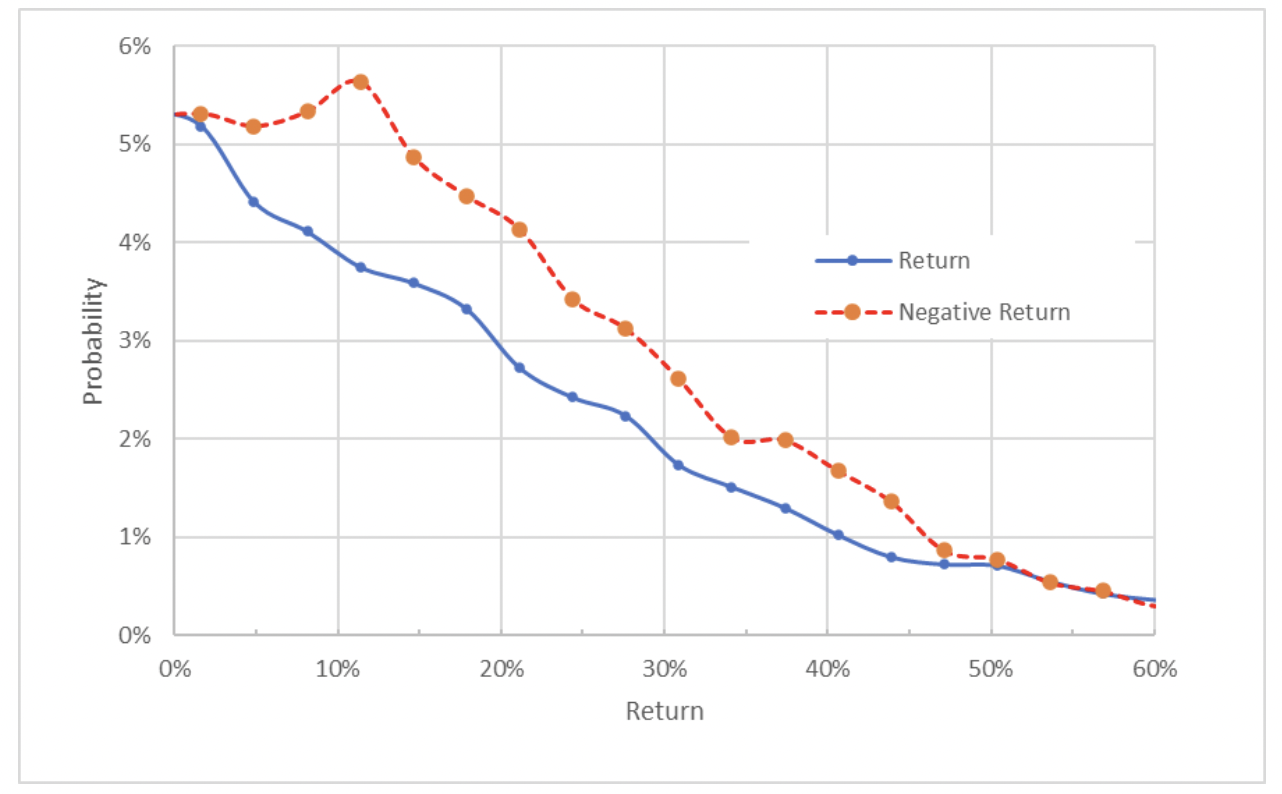

To make it easier to directly compare the probabilities of positive and negative returns, I rotate the negative return side of the distribution about the vertical axis (see chart below).

Source: Author’s calculations using options quotes from E-Trade

This view really highlights the bearish tilt to the market-implied outlook. The probability of having a negative return is consistently higher than the probability of having a positive return of the same magnitude (the red dashed line is above the solid blue line across the majority of the chart above).

Theory suggests that the market-implied outlook is expected to have a negative bias because investors, in aggregate, tend to be risk-averse and, subsequently, overpay for downside protection (put options). There is no robust way to measure whether such a bias exists, however. Even considering that the market-implied outlook may overestimate the probabilities of losses, this market-implied outlook is bearish, based on my experience with these outlooks.

Summary

RIO has performed very well for investors over the past five years, recently bolstered by surging Steel prices in 2021. As demand outlooks, especially in China, weaken and steel prices have fallen rapidly from previous highs, the outlook for the next year is not favorable. The global low interest rates that boosted construction have been replaced by rising rates. The number of analysts following RIO is small, but the prevailing view is that the shares are underpriced. Given the relative lack of research coverage, I don’t put much weight on these outlooks. The market-implied outlook to early 2023 is somewhat bearish, in contrast to the market-implied outlook that I calculated in August. I am changing my rating on RIO from bullish/buy to neutral/hold.

Looking to get up to speed on your next idea? With InvestingPro+ you can find

- Any company’s financials for the last 10 years

- Financial health scores for profitability, growth, and more

- A fair value calculated from dozens of financial models

- Quick comparison to the company’s peers

- Fundamental and performance charts

And a lot more. Get all the key data fast so you can make an informed decision, with InvestingPro+. Learn More »