The Bank of Canada (BoC) raised rates in their most recent interest rate policy announcement, after holding in the previous two sessions. As stated in their accompanying press release, the BoC decided to increase rates, as they believed the monetary policy was not sufficiently restrictive to bring supply and demand back into balance and return inflation sustainably to the 2% target. But most notably, the BoC believes that interest rates may have to rise further to restore price stability.

As central banks globally signal their intention to increase interest rates, bond prices are declining, but their yield generation is increasing. So, what opportunities reside within this evolving rate environment for fixed income investors?

The floating rate bond value proposition

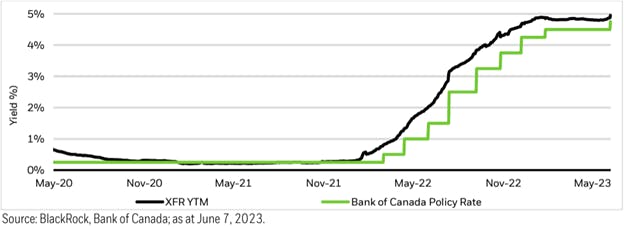

As the name suggests, floating rate bonds are tied to a short-term benchmark rate that adjusts periodically over time, but more importantly, floating rate debt can play an important role in a diversified portfolio due to its ability to generate a relatively high level of income, while also having low price sensitivity to interest changes. As the BoC and other central banks continue to raise rates, the income generated from floating rate debt contributes to the overall return performance of a portfolio. This dynamic is exemplified when looking at the iShares Floating Rate Index ETF (XFR), a proxy for Canadian floating rate bonds. As the BoC policy rate increases, the yield for the ETF will rise in tandem.

Floating rate debt can also be a ballast within one’s portfolio. Given the inverse relationship between the price and yields of fixed-rate bonds, as market interest rates rise, a low fixed coupon rate may no longer be attractive—the price will generally fall to make its yield more in line with market interest rates. However, floating rate instruments don’t suffer from this dynamic - because their coupons adjust with market interest rates, their prices don't need to, making them very stable.

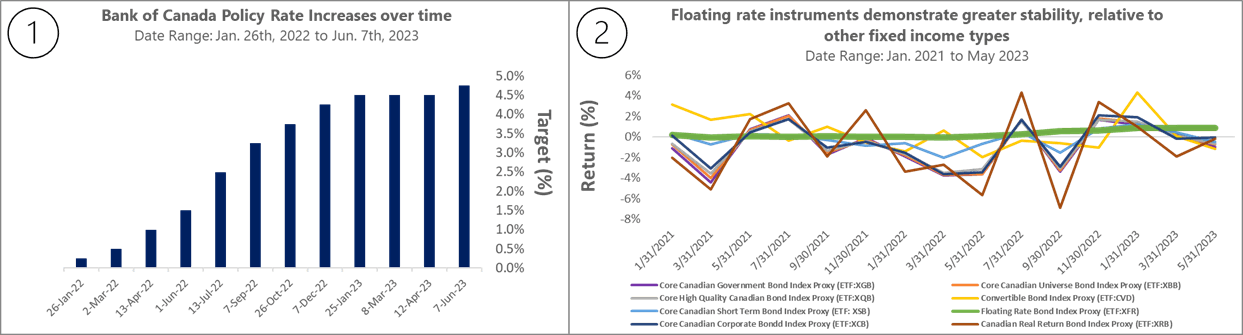

This dynamic is exemplified when contrasting the performance of floating rate debt relative to other fixed income types. As illustrated in the following charts, as the BoC has gradually increased rates (panel #1), the floating rate debt instrument (see panel #2) exhibited a less volatile investment profile, due to its ability to adjust to the prevailing rate environment. However, the return performance for other fixed income types swung wildly throughout the same period, making for a volatile investment experience. Please note, panel 2 uses the iShares Floating Rate Index ETF as a proxy for Canadian floating rate bonds and other iShares ETFs as a proxy for other bond segments.

Source: Bank of Canada, YCharts; as of June 12, 2023.

For bond investors, as the BoC raises rates, floating rate debt should be considered as a portfolio inclusion, given its income generation and low interest rate sensitivity. For investors seeking exposure to Canadian floating rate debt instruments, the iShares Floating Rate Index ETF (XFR) is a passively managed solution that tracks the FTSE Canada Floating Rate Note TR Index; providing fulsome pure-play exposure to the Canadian floating rate debt segment.

Alternatively, Dynamic Active Investment Grade Floating Rate ETF (DXV) and CIBC (TSX:CM) Active Investment Grade Floating Rate Bond ETF (CAFR) are actively managed solutions that provide exposure to floating rate bonds, with a particular focus on ensuring that strong credit quality is reflected within the holdings of each strategy.

For bond investors seeking to mitigate interest rate risk in a portfolio, and gain some upside in a rising rate environment, these solutions are worth consideration for one’s portfolio.

This content was originally published by our partners at the Canadian ETF Marketplace.