TSX futures rise as U.S. inflation data, Trump-Putin meeting loom large

Satellite launch provider Rocket Labs USA Inc. (NASDAQ:RKLB) has been one of the most actively traded stocks on the market. It is coming off its most successful quarter yet, marked by record top-line growth and superb expansion in its backlog. Moreover, buoyed by its rapid growth trajectory, analysts are upbeat about its march toward breaking even. Additionally, despite the impressive surge in value, it still has room to run, fueled by positive developments and potential interest rate cuts later in the year.

As we look ahead, Rocket Lab's skyward trajectory is tough to ignore. Its spectacular second-quarter showing was backed by the success of its small satellite launch vehicle, Electron, with the upcoming launch of its Neutron medium-lift rocket serving as a key catalyst. Moreover, following its successful Mars-bound spacecraft dispatch, expect further spikes in its value.

With that in mind, let's dive deeper into the company's growth narrative and explore why it will continue rewarding its investors.

Company backgroundRocket Lab was established in 2006 by engineer Peter Beck and has quickly established a leadership position in the aerospace industry. The company designs and launches small satellites into space for clients to deliver data and other services. Moreover, it builds rockets that effectively carry these satellites for various purposes like communication, weather monitoring and scientific research. Since the get-go, Rocket Labs sought to solidify its positioning in its niche by evolving into an end-to-end space company.

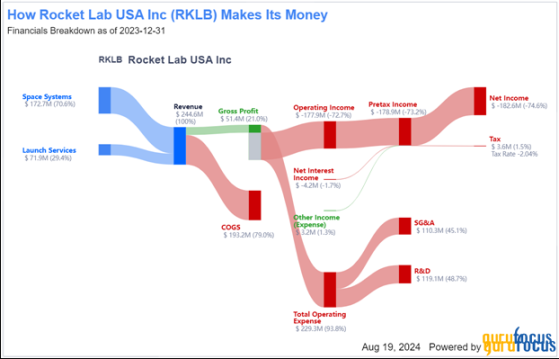

Rocket Lab currently generates 70.60% of its sales from the Space Systems segment and the remaining 29.40% from its Launch Services division. Moreover, with aims to encompass the entire space value chain, we will likely see multiple new revenue streams emerge soon.

On the profitability front, the company reported a loss of 5 cents per share, but topped estimates by a couple of cents. This mirrored results from the prior-year quarter when it posted identical earnings while surpassing expectations. Additionally, despite the healthy expansion in sales, Rocket Lab experienced a slight drop in gross margins. Despite the uninspiring bottom-line showing, the basic earnings per share stands at -38 cents, but forward projections signal a positive shift, forecasting a loss of 29 cents per share this year and an upswing to a loss of 19 cents in 2025.

Rocket Lab's outstanding performance was spearheaded by Electron, its small orbital launch vehicle. Electron is the most frequently launched rocket globally outside of SpaceX this year. Additionally, it achieved the rare feat of reaching 50 launches faster than any other commercially developed rocket. Its growing demand is underscored by the 17 new launches it signed this year, with a total contract value of $141 million.

Looking ahead, its Neutron rocket could potentially revolutionize the medium-sized satellite launch market. Company management has set an ambitious number for the medium-lift rocket, targeting a $10 billion launch market by 2025. Moreover, recent results have shown it is already on an encouraging track, led by successful hot-fire tests of its Archimedes engine, setting the stage for a swifter inaugural launch.

Financial strength and profitability positioning Arguably, the two biggest aspects to consider in Rocket Lab's narrative are its financial strength and path to profitability.

Perhaps the biggest downer with the company is its bottom-line positioning, considering it has yet to break even. Over the past four years, Rocket Lab's net loss has grown by an average of 61%, but in the last couple of years, this growth rate has slowed to around 25% on average. On a positive note, the company has maintained a positive gross margin since 2022, with an impressive 162% growth over the past year.

Moreover, the key metrics highlighted in its profitability rank snapshot below point to a healthy improvement compared to its historical performance. However, when compared to the industry and overall market, Rocket Lab still has plenty of work ahead to catch up. A lot of it is linked to its operational expenses, which form a sizeable 78% of its total sales. While the company has successfully reduced research and development expenses as a percentage of sales from 67% in 2021 to 44% as of last year, there is still plenty of progress to be made.

On the top-line front, though, the company continues to impress despite the relatively muted growth last year. Revenue growth has averaged at 111% since 2021 and 41% on a trailing 12-month basis. Additionally, Rocket Lab ended the first quarter with over $1 billion in backlog, with about 42% expected to be realized within the next 12 months, setting the stage for another strong year of superb top-line expansion.

Further, Rocket Lab's financial strength remains a concern. As shown in the snapshot above, it lags behind both the industry and its historical performance across the first three key financial metrics. Its debt-to-equity ratio stands at 1.04, which is the highest it has been in the past decade.

Another worrying factor is the gap between Rocket Lab's debt load and cash balance, as illustrated in the chart below.

While the company had a sizeable cash buffer in 2021 and 2022, its reserves dropped substantially last year, narrowing the gap with its debt levels. The trend raises concerns over its ability to maintain financial stability while managing its obligations effectively, particularly if cash flow challenges plague its business.

Despite the challenges, the consensus is Rocket Lab is positioned to scale up and achieve profitability within the next three years. The analyst estimates suggest the company is well on its way to achieving a positive earnings per share figure by 2026. Its earnings are projected to recover from negative values and approach zero by 2026, signaling potential profitability. Operating cash flow per share is also anticipated to improve, although it is forecasted to remain in the negatives until 2026.

Market performance and upside potentialAs discussed earlier, Rocket Lab has significantly outperformed the broader market across multiple timeframes. Over the past week, the stock surged by over 6% and climbed more than 29% in the past month. Over the past six months, the stock has jumped by 59%, with a year-to-date increase of 26%.

RKLB Data by GuruFocus

The chart above illustrates Rocket Lab's stock price and its 26-day, 50-day and 200-day exponential moving averages. The 26-day EMA is the most price-sensitive, followed by the 50-day EMA and the 200-day EMA.

From the chart, we can see that the stock has oscillated around these EMAs, indicative of fluctuations in investor sentiment and evolving market dynamics. However, for the most part, we've seen its stock price above the three EMA lines, signaling bullish momentum. Additionally, its stock price consistently trends above the shorter-term 26-day and 50-day EMAs, pointing to bullish momentum of late.

Author created based on stock price data

The bullishness is confirmed by charts depicting the Moving Average Convergence Divergence and Signal lines. The MACD line (blue) is calculated by subtracting the 26-day EMA from the 12-day EMA, while the Signal line (red) is a nine-day EMA of the MACD line.

MACD crossovers above the Signal line signal buying opportunities. From the chart, we can see the MACD line hovers over the Signal line for the bulk of the time period, indicating an uptrend. Moreover, the MACD recently crossed the Signal line, pointing to a buying opportunity.

Moreover, from the snapshot above, we can see the stock is poised for stellar growth, with an average 12-month price target of $7.48, reflecting more than a 7% bump from its current price of $6.96. Additionally, the highest analyst target points to a potential jump to $10.

On top of that, GuruFocus estimates an even more optimistic GF Value of $12.89, indicating an impressive upside of more than 85%. Analysts' consensus continues to favor the stock, with the majority assigning a "Buy" or "Outperform" rating. Moreover, with projected 2026 sales, the estimated price-sales ratio is likely to be 3.91, offering a significantly more attractive valuation than the current 10.41 times sales multiple.

Bottom lineRocket Lab is in an excellent position to continue delivering the goods for its investors. Of late, we have seen its top-line grow spectacularly, averaging north of 40% growth on a year-over-year basis.

Moreover, it boasts a robust backlog of $1.07 billion, a healthy financial footing and more than $490 million in cash and equivalents. Furthermore, the Electron rocket has solidified its position as a small satellite launch market leader, contributing immensely to its impressive performance. Looking ahead, the upcoming launch of the Neutron rocket could usher in a new era of growth for the business, with its foray into the medium-lift market by 2025.

Rocket Lab's technicals point to more upside ahead. The stock has consistently trended above its key moving averages, pointing to bullish momentum. The MACD line hovering above the Signal line further supports a positive outlook, indicating a potential buying opportunity. Hence, with its innovative approach, solid financials and strategic positioning in the space industry, Rocket Lab is poised to deliver substantial long-term returns ahead.

This content was originally published on Gurufocus.com

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.