By Kathy Lien, Managing Director of FX Strategy for BK Asset Management.

It was another rocky day in the foreign-exchange market with the dollar seesawing in and out of positive territory. Gains in the early North American trading session evaporated as 10-year Treasury yield turned negative. With no major U.S. economic reports on the calendar this week, the greenback took its cue from U.S. rates. With that in mind, the tax-reform battle has been a challenging one with senators fighting to keep key items like the $1M mortgage cap and electric-car credit in the bill. Contrary to the Trump Administration's and market’s high hopes, rating agencies are skeptical of the economic benefit. According to Fitch, there will be a temporary economic boost, but the tax plan will be revenue negative and would blow-out the deficit. Thankfully this long-term impact won’t affect USD's near-term price action. The House plans to finish its work this week and bring the plan to a vote next week. There’s a good chance that the bill will pass the House by the end of this month but it may have more difficulty in the Senate where the GOP majority is slimmer. Either way, the dollar will bounce when the bill passes the House and how it trades after will depend on the difficulties it has in the Senate. No U.S. economic reports were released Tuesday but we finally got to hear from FOMC board member Quarles, the newest member of the policy-making committee and, unfortunately, he didn’t reveal anything insightful about his policy stance. Thursday will be much of the same with only jobless claims on the calendar. However President Trump is slated to meet with South Korean President Moon Tuesday evening and again on Wednesday and there’s no doubt North Korea will be on the agenda. If he increases pressure on NK publicly, USD/JPY will suffer.

Although EUR/USD fell to a fresh 3-month low Tuesday, it ended the day well above 1.1550. The intraday recovery can be partially credited to reports that key ECB policymakers challenged the central-bank pledge to keep its bond-buying program going until inflation improves. Board members Coeure, Weidmann and Galhu preferred to tie overall stimulus – not just the QE program – to their inflation goals. Of course they were voted down by other members of the governing council who did not want to broaden the language at this time. So at the end of the day, this report should have been a nonevent for the euro and in many ways it was as euro did not solidify its gains until the dollar started to fall. The latest Eurozone economic reports were mixed with German industrial production taking an unexpectedly large tumble. The retail PMIs also declined, reflecting weaker consumer demand in October. The only good news was Eurozone retail sales, which ticked higher in September. Technically, the EUR/USD still appears to be headed lower but waiting to sell closer to 1.1610 may be better than underneath the round number.

The commodity currencies continue to be the biggest movers. For the first time in 5 trading days, USD/CAD rebounded against the U.S. dollar on the back of falling yields and less-hawkish comments from Bank of Canada Governor Poloz. He said that with inflation behaving well within BoC's normal zone of tolerance, the bank will be cautious in adjusting its policy rate in the future and will be guided by incoming data. While Poloz acknowledges that the economy will need less stimulus over time and growth could be above trend, the “surprising persistence” of excess capacity and low wages means there won’t be another rate hike this year. According to interest-rate futures, investors expect the next round of tightening in late spring or early summer. For USD/CAD, that means we could see a more significant move above 1.28.

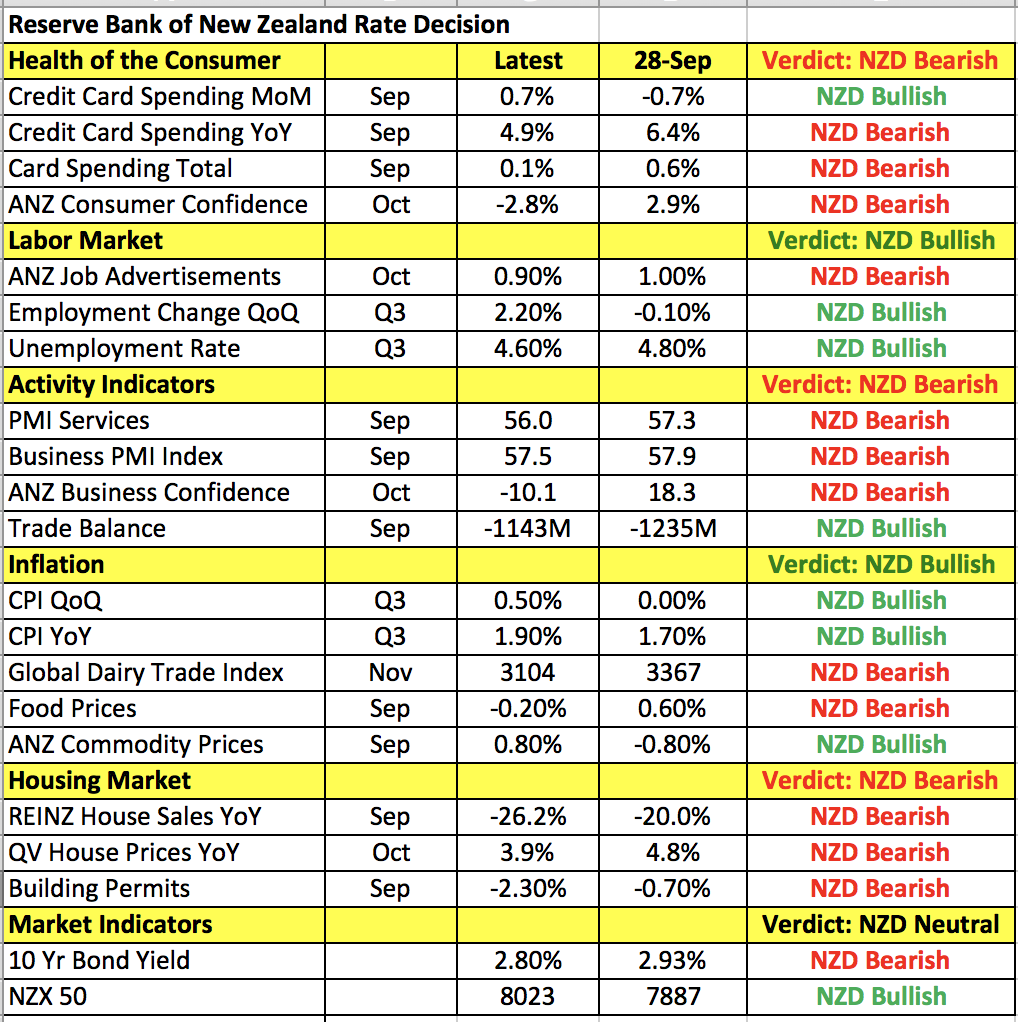

The Reserve Bank of Australia’s monetary policy announcement passed with very little fanfare. Although AUD/USD traded higher after the rate decision because the central bank did not lower its GDP forecast, the Australian dollar ended the day sharply lower. The focus now shifts to the Reserve Bank of New Zealand. Dairy prices fell 3.5% at Tuesday’s auction, the 3rd straight fall and the largest price decline since January, which took the index to its lowest level in 7 months. The Reserve Bank of New Zealand has plenty of reasons to remain dovish. Although labor-market conditions improved and consumer prices ticked higher in the third quarter, retail sales, consumer and business confidence, housing-, manufacturing- and service-sector activity deteriorated since their last monetary policy meeting. When they last met, the RBNZ expressed concern about inflation and identified it as a reason why policy will remain accommodative for a considerable period of time. While CPI increased, deterioration elsewhere will keep the statement dovish, leading to weakness for the New Zealand dollar. Aside from the RBNZ rate decision, China’s trade balance was also scheduled for release Tuesday evening and the report could affect how AUD and NZD trade.

Last but certainly not least, sterling ended the day unchanged against the U.S. dollar, which is actually a remarkable feat considering that the currency traded as low as 1.3109 before the London close. House prices in the U.K. rose more than expected in October but Brexit remains the main focus. European envoys meet on Wednesday to discuss what they want from the U.K. transition deal. Both EU and British negotiators will be at the meeting and the EU’s goal is to present a united stance, issue demands that will set the stage for a summit in mid-December. In the lead up to the summit, May’s team is growing increasingly conciliatory, allowing EU citizens the right to appeal if they are denied permission to live in the country after it leaves the Union. There’s also talk that May wants to kick-start trade talks by accepting the GBP53 billion Brexit payment that the EU has been demanding. In the past, Britain has only offered to pay a third of that amount, but if they are willing to front the whole bill, it will be a strong start that could help encourage smooth negotiations.