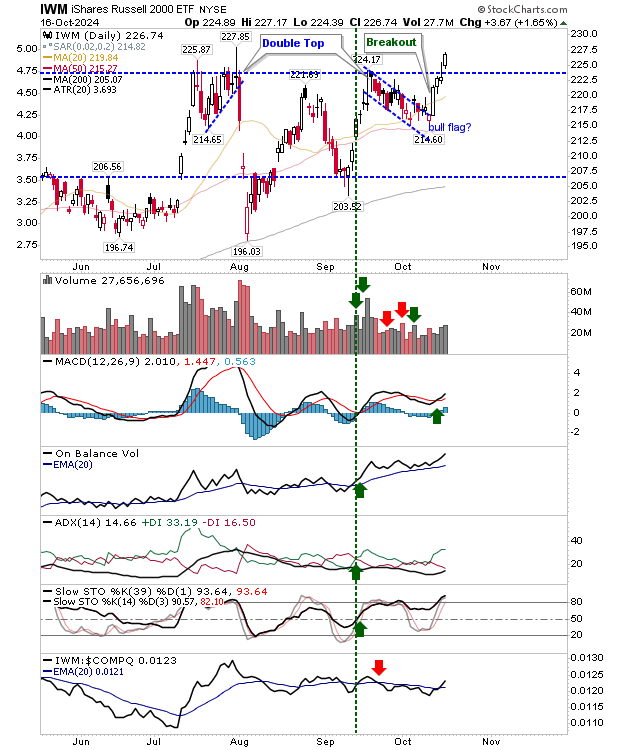

The Russell 2000 (IWM) joined the S&P 500 as managed to push to a new closing high (although just shy of a new all-time high). This has been a 3-year journey for the index, and marks an important milestone as part of the secular bull market continuation - which kicked off in 2012 - but started with the generational low in 2009. Only the Nasdaq is left to join the party.

In addition to the breakout, the Russell 2000 ($IWM) enjoyed a return to relative outperformance against the Nasdaq, and booked two consecutive accumulation days to add to the net bullish technical picture. All good here.

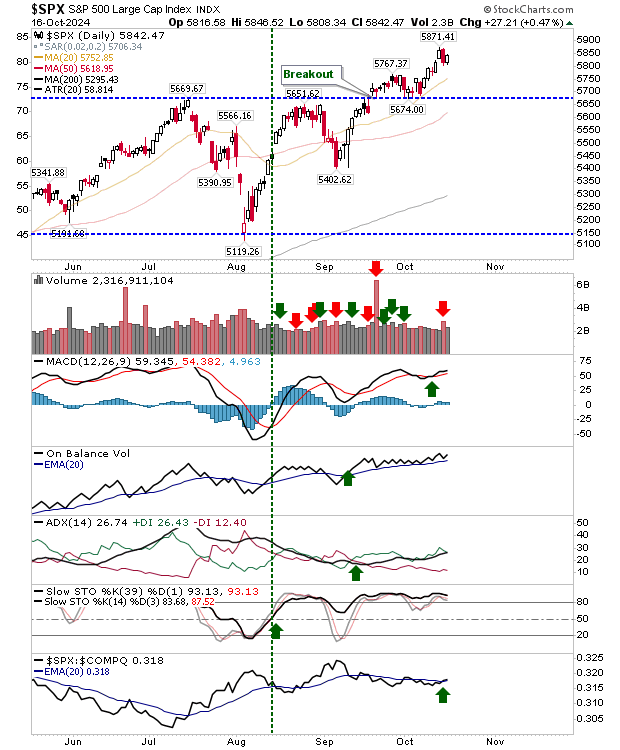

Little to say about the S&P. It's chugging along in bullish form. Volume has been quiet, bar yesterday's confirmed distribution. Technicals are net bullish, including its outperformance relative to the Nasdaq.

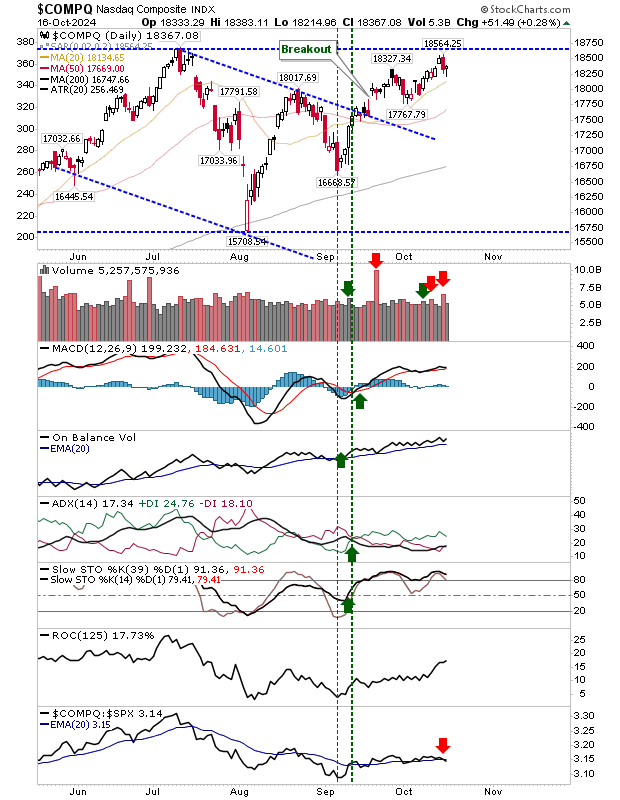

The Nasdaq is lurking just below its July high and is well-placed to drive a breakout. Yesterday's modest bullish 'hammer' just above its 20-day MA is another reason for optimism.

As with the S&P, it booked a distribution day yesterday, and given gains in peer indices, it's underperforming relative to them, but not to any worrying degree.

For later today, we won't want to see a break of yesterday's lows. Modest loses are okay. Intraday loses are fine. But we will want to see a strong last hour to show that buyers are lurking and willing to defend and buy 'value'.

There are a number of economic data points to influence premarket; if data disappoints, then look for a gap down at the open, but if buyers then step in it could prove to be a very positive day.