- Stocks corrected further last week as the tech rout continued.

- Looking ahead, the 2024 presidential race may impact market sentiment, but history shows minimal effect on stock performance.

- In this article, we will look at the factors that will decide market trend in the months ahead.

- Unlock AI-powered Stock Picks for Under $8/Month: Summer Sale Starts Now!

While the S&P 500 recently hit new highs, a sudden shift has gripped the market. The index has undergone a correction, while the Dow Jones posted gains over the past week.

But the most dramatic move came from the Russell 2000, the small-cap benchmark, which surged by a staggering 11.5% in its best 5-day performance ever against the S&P 500.

This historic rally raises a crucial question: Could this be the beginning of a long-awaited rotation towards undervalued small caps?

Let's delve deep to see if the stars are aligning for more interest rate cuts after September, paving the way for a bull run in small caps.

Small Caps Still Undervalued

Last week, the S&P 500 hit its 38th all-time high of 2024, but then things changed. Weakness set in, led by the technology sector. The Dow closed slightly up, but the S&P 500 fell by 2.42%, marking its worst week since April. The Nasdaq dropped 4.26%, breaking its six-week positive streak.

In addition, we witnessed a historic run by small-caps. The Russell 2000 posted its best 5-day performance against the S&P 500 ever, rising 11.5%.

To understand the significance of this rally, such a jump has only been seen 5 other times in the past 30 years: The dot-com bubble, the Great Financial Crisis, the debt downgrade in 2011, LCTM and Covid.

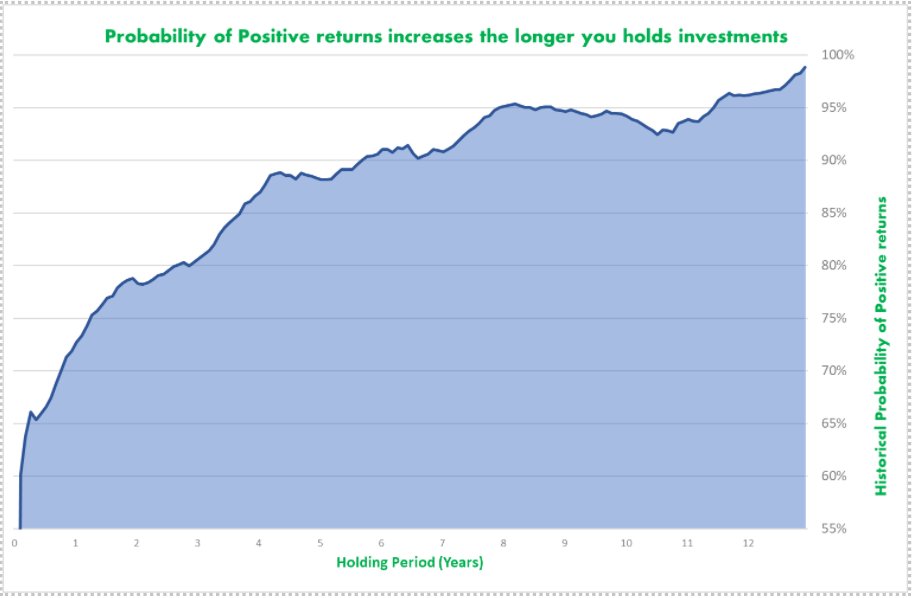

If recent trends signal a rotation, this could be promising news. Historically, small-cap stocks haven’t been this undervalued compared to large caps since 1999—a period that sparked 13 years of small-cap outperformance.

This trend often coincided with Federal Reserve rate cuts. As inflation shows signs of improvement and the Fed is expected to reduce rates by two or even three cuts, small-caps typically thrive in such conditions.

Copper Vs. US 10-Year Signals More Rate Cuts Are Likely After September

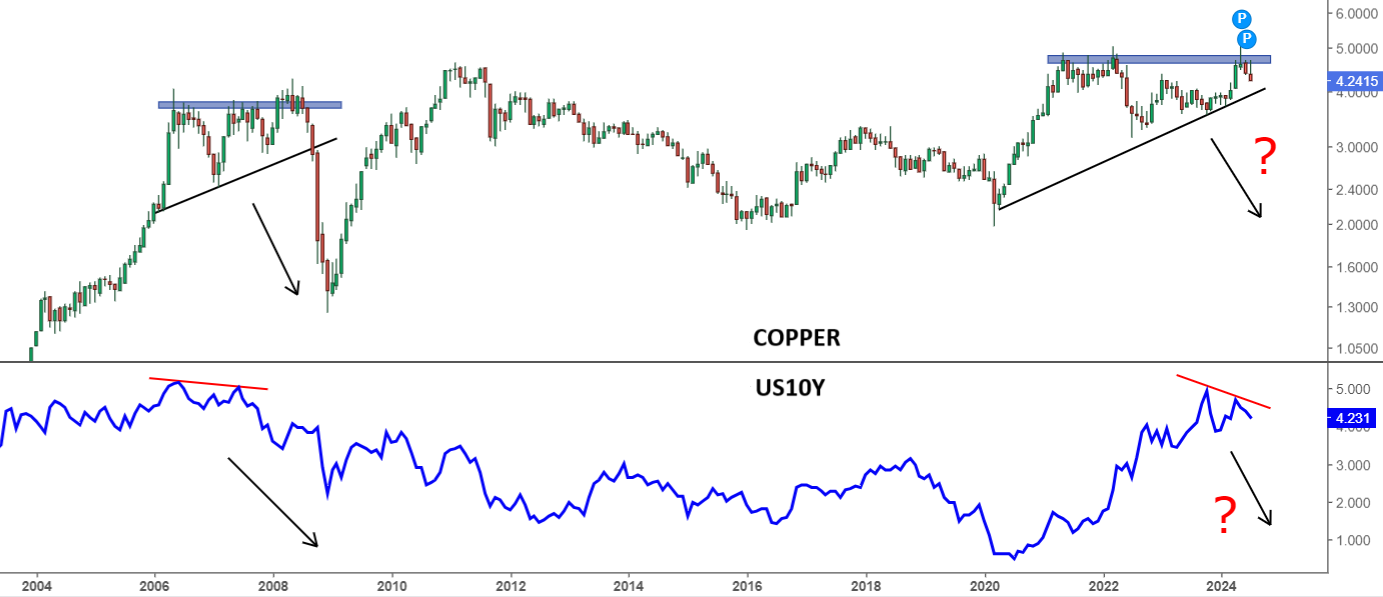

Copper prices might provide valuable insights into future interest rate trends. By analyzing the relationship between copper prices and the 10-year Treasury bond yield, we can gauge potential shifts in monetary policy.

The chart above compares copper prices with the 10-year Treasury yield on a monthly basis. In 2006, copper formed a reversal pattern coinciding with the peak of Treasury bond yields, just before the Great Financial Crisis.

Today, a similar monthly reversal pattern is emerging, suggesting that interest rates may be poised to decline.

Economy Remains Healthy, Boosting the Soft Landing Scenario

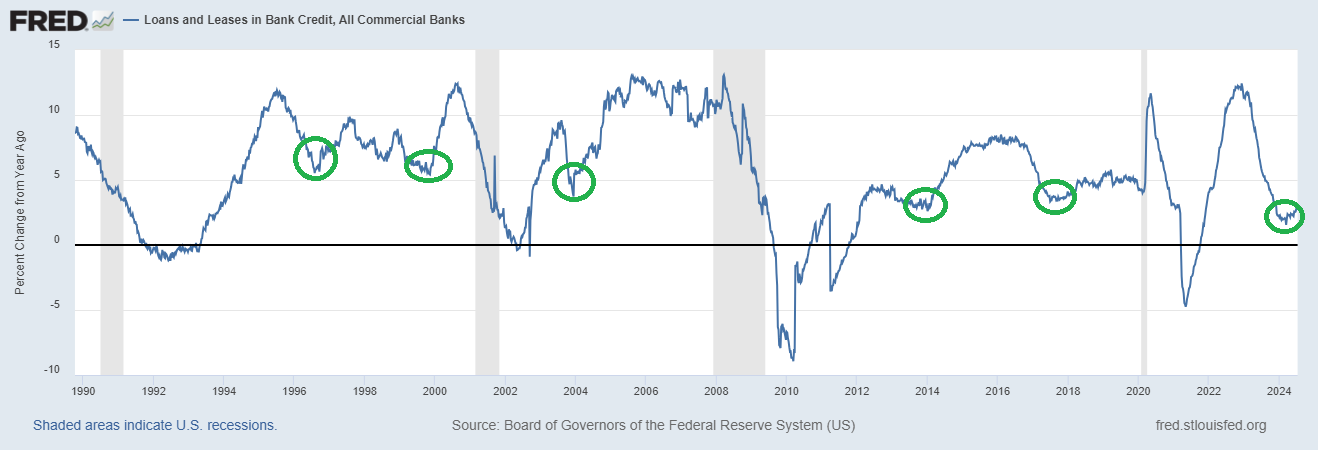

Recent data reveal that credit growth in the U.S. is picking up pace, driven by increased loan and lease activity from commercial banks. The latest surge in credit creation mirrors previous rebounds observed in 1996, 1999, 2003, 2014, and 2018—historically, these upticks have delayed recessions by several years.

While some economic indicators are signaling a slowing economy, this fresh wave of macroeconomic data suggests robust economic growth and accelerating momentum.

***

This summer, get exclusive discounts on our subscriptions, including annual plans for less than $8 a month!

Tired of watching the big players rake in profits while you're left on the sidelines?

InvestingPro's revolutionary AI tool, ProPicks, puts the power of Wall Street's secret weapon - AI-powered stock selection - at YOUR fingertips.

Don't miss this limited-time offer!

Subscribe to InvestingPro today and take your investing game to the next level!

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, counsel or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. I would like to remind you that any type of asset, is evaluated from multiple perspectives and is highly risky and therefore, any investment decision and the associated risk remains with the investor.