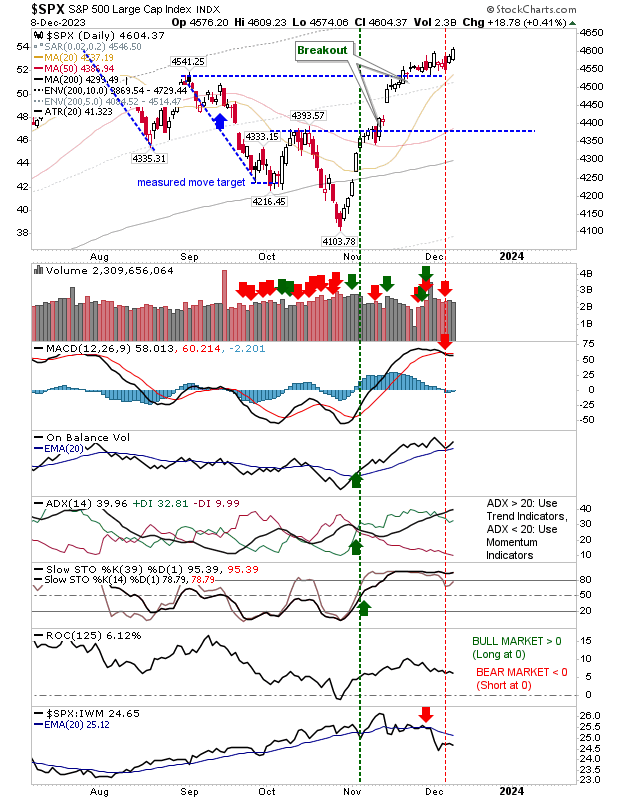

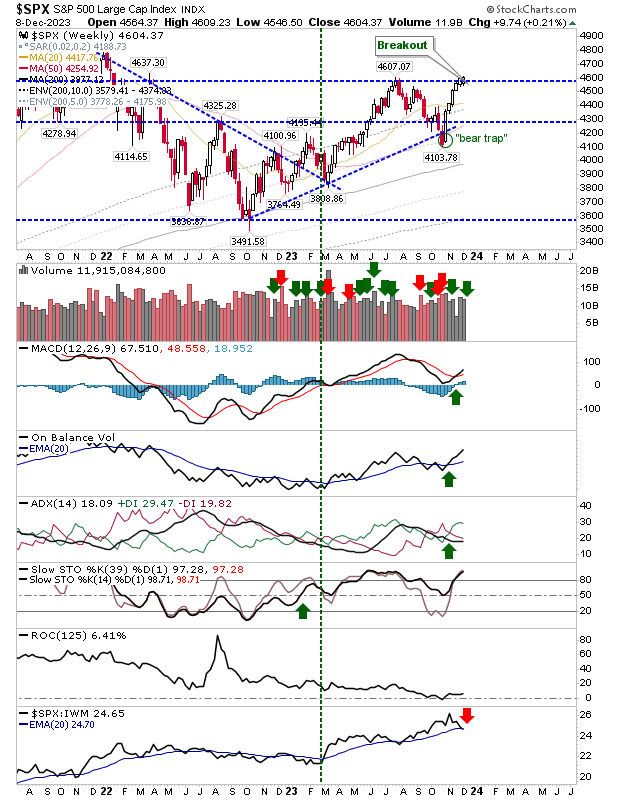

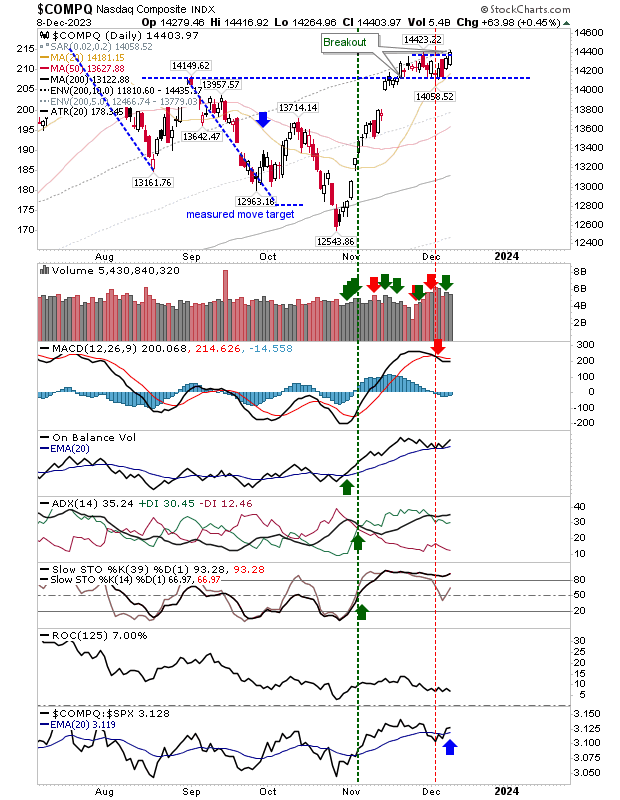

The last couple of weeks have seen the Nasdaq and S&P 500 move to-and-fro in a consolidation trading range, digesting the gains from the October rally, but Friday's finish pushed markets out of this trading range.

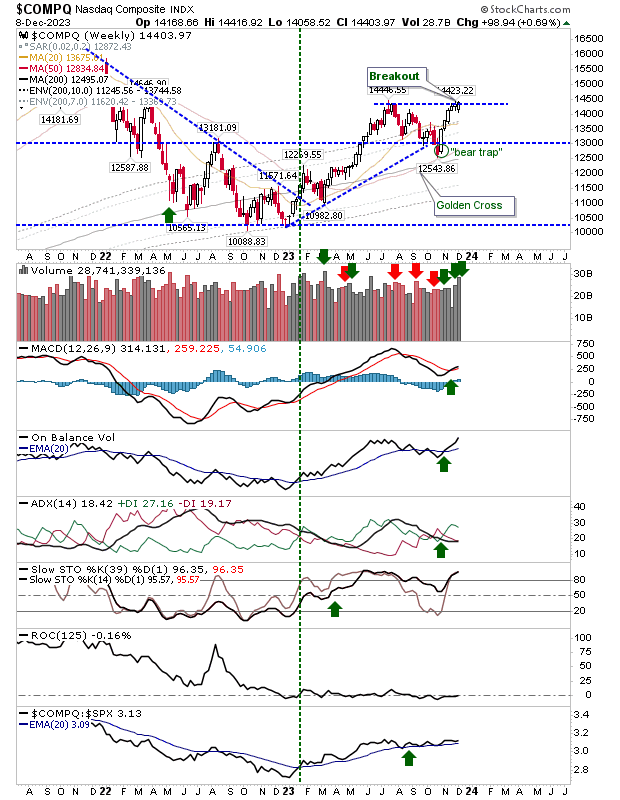

Friday's finish also improved the weekly timeframe charts, confirming breakouts on these timeframes.

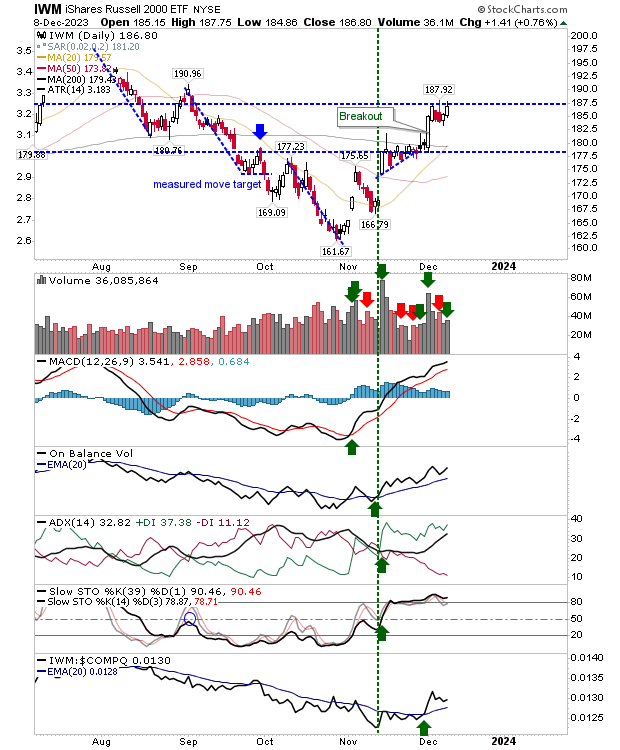

The Nasdaq is outperforming the S&P 500, but is underperforming against the Russell 2000 (IWM).

There is still plenty of room to build the right-hand side of its base, so even if the index has already banked good gains, there is still plenty of more in the tank.

Technicals for the weekly timeframe Nasdaq are net positive.

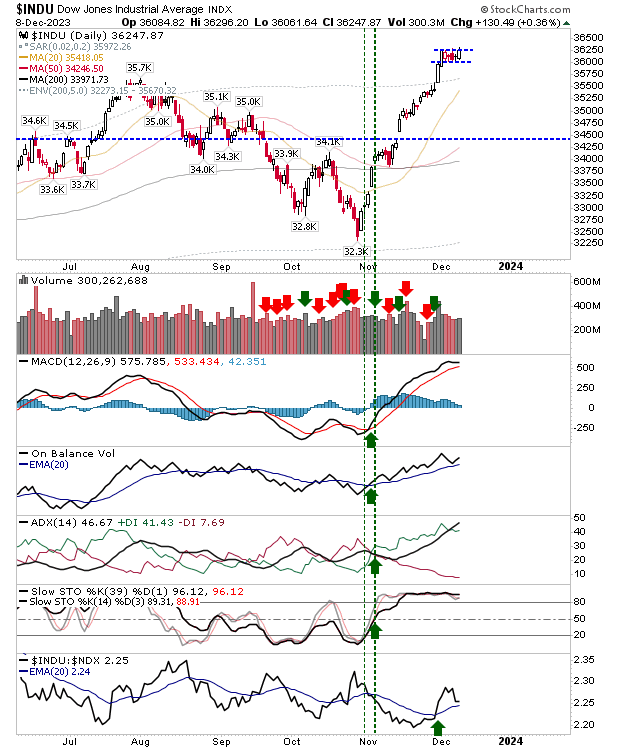

Not to be excluded, the Dow Industrial Index has shaped a bullish consolidation and looks ready to break higher in line with peer indexes.

The Russell 2000 ($IWM) broke from its small 'bull flag', but didn't quite break the high established earlier in the week. However, I would be looking for such a move over this week.

Going forward, I would be looking for all indexes to continue where they left off on Friday.

Where we need to be careful is if indexes reverse back into the consolidation, then I would be looking at 'bull traps'. However, for now, action across the board is bullish.