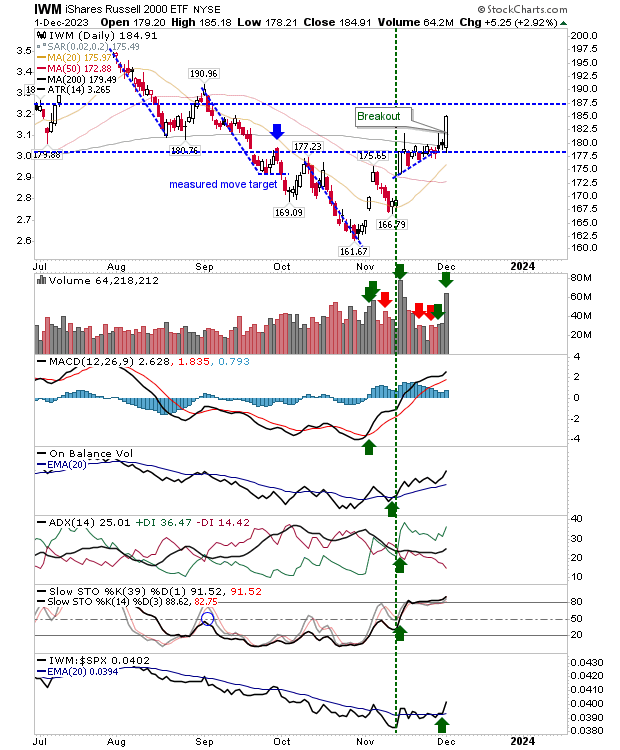

After weeks of toying with the 200-day MA, the Russell 2000 (IWM) pushed through this moving average with ease on higher volume accumulation.

Technicals have been net positive since the start of the bullish ascending triangle, but Friday's move has not only cleared price resistance it has also managed to accelerate relative outperformance against the S&P 500.

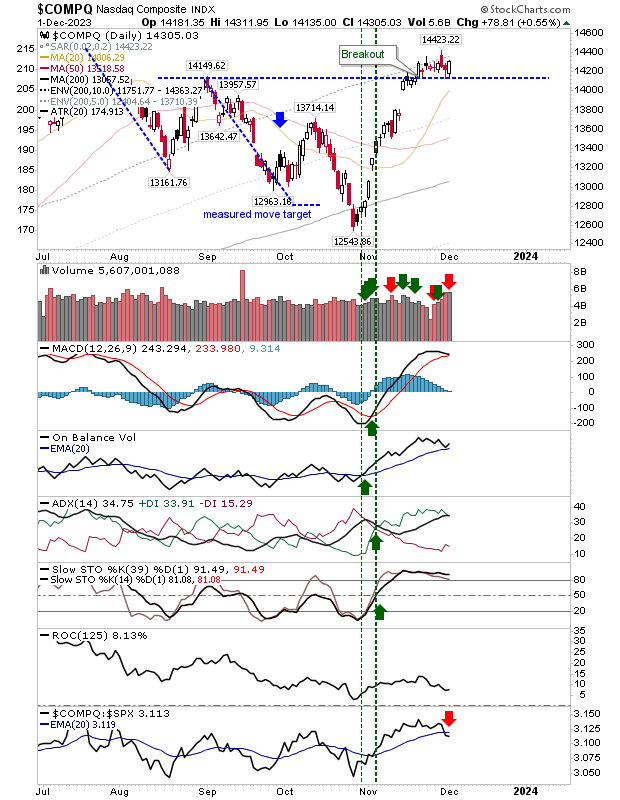

The Nasdaq has been holding its breakout despite the narrow range of available support. Technicals are net positive, although the index has started to fall behind in relative performance against the S&P 500 and Russell 2000.

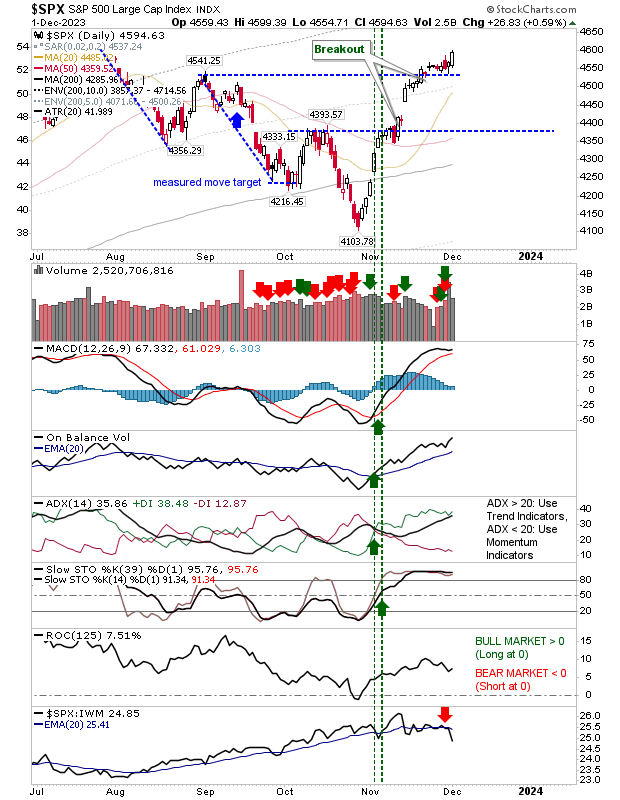

The S&P 500 has likewise pushed itself away from support with excellent bullish strength. Yes, it has underperformed against the Russell 2000, but as long as November breakout support can hold it will be well-placed to challenge all-time highs.

We finished last week with a substantial bullish development across indexes. With Santa fast approaching, we have the potential to have them near 52-week highs before the year is out.

We have come a long way since my crash warning in October. Things can change very quickly and you need to be willing to call yourself wrong or face painful denial to your portfolio.