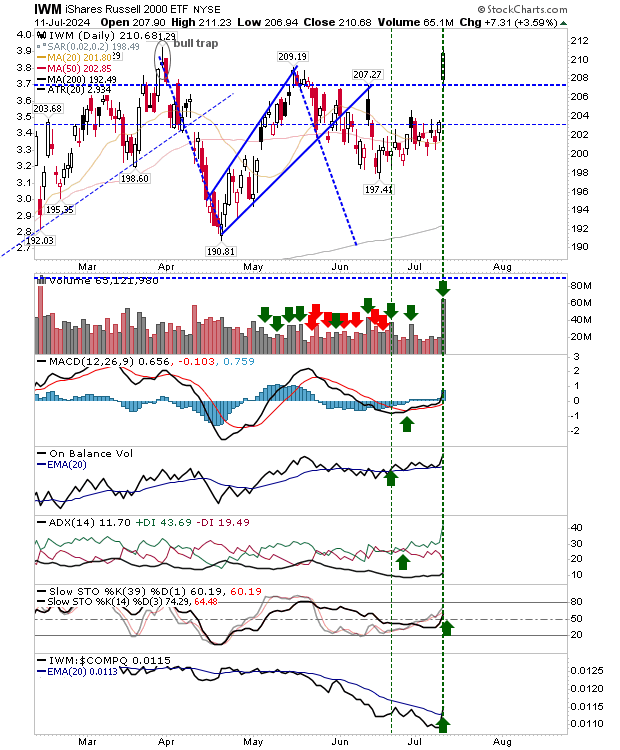

The Russell 2000 (IWM) gapped higher with a gain of over 3% as both the S&P 500 and Nasdaq took a hit, the latter nearly shedding 2%.

In the long run, this may be more bullish for the broader market, even if profit-taking was the order of the day.

The Russell 2000 ($IWM) didn't look back after the reaction to yesterday's economic data. It surged, then surged some more. Technicals are net positive and relative performance has swung back in Small Caps favor. The volume also rose in confirmed accumulation.

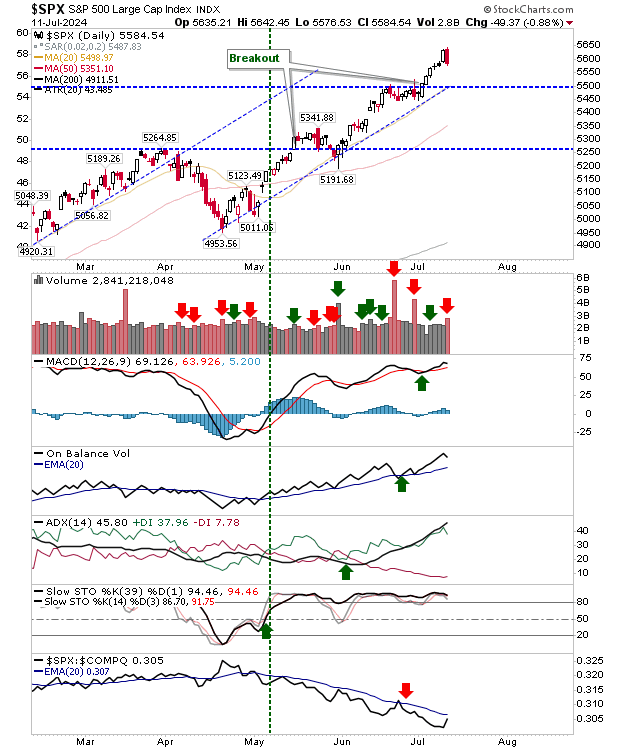

The S&P 500 gave back the day before yesterday's gain on confirmed distribution. Despite yesterday's loss, there won't be any real damage until there is an undercut of breakout support at 5,500. At this point, a test of the 20-day MA - also at 5,500 - looks likely.

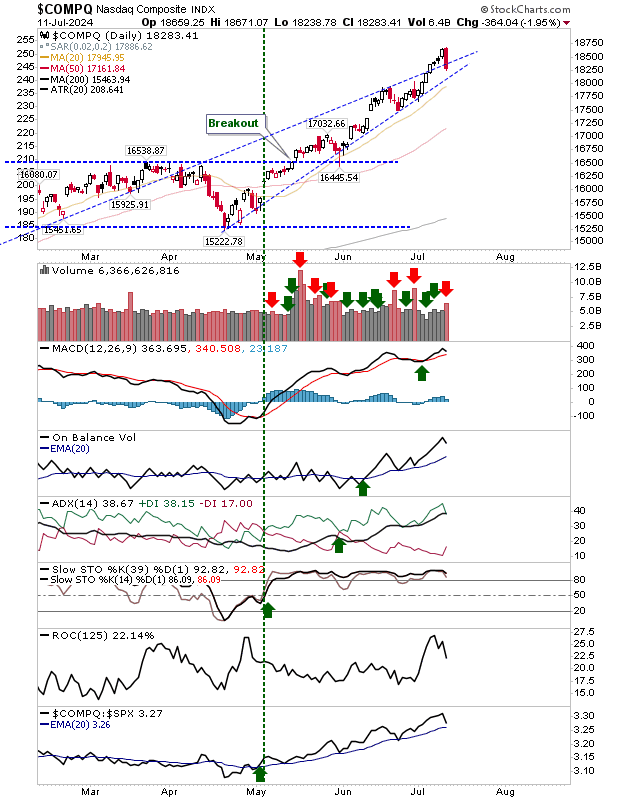

The Nasdaq had over-extended itself by 20% from its 200-day MA. It's very close to the 95% of historic price extremes for the index and a 'strong' sell signal. Given that, yesterday's loss should come as no surprise.

Further profit-taking seems likely, but I would not be surprised to see an undercut of the former 'wedge' and 20-day MA. Look for support at 17,750 and take it from there; a deeper correction is likely to go all the way to the 50-day MA.

Assuming tomorrow doesn't deliver a change on yesterday's action, then we have a successful challenge on the weekly chart 'bull trap' in the Russell 2000, and topping candlesticks in the Nasdaq and S&P 500.

We may be looking at a larger trend shift, or at least, a stall in the trend for the Nasdaq and S&P 500, but bulls have something to work with for the Russell 2000.