The Sahm Rule is getting airplay, but Sahm is not what I am, it is just one non-exceptional and somewhat lagging indicator of the coming recession.

“We are pointed toward recessionary dynamics”

Well, that's obvious.

Claudia Sahm talks about the “big lever still to pull” by the Fed. That being a plethora of interest rate cuts. Sahm talks about the unemployment rate, and other things indicative of recession.

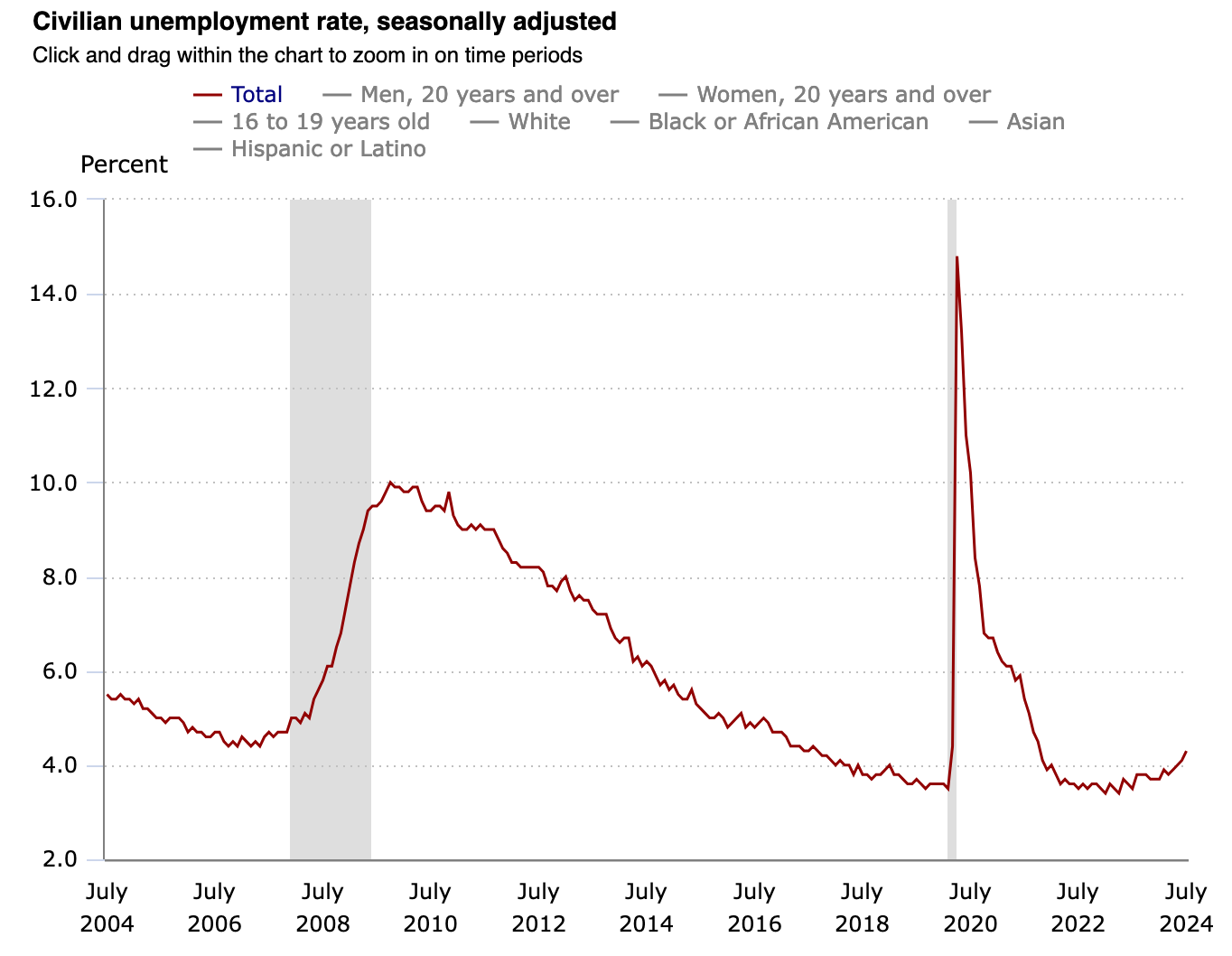

Here is the latest BLS graph of the unemployment rate, which we have been tracking for its base/bottom and anticipated upturn. As we wrote previously:

We have also been noting the bottom and base in the unemployment rate for many months. Well, that base is breaking to the upside and looks like a stock that a bottom feeder might buy. Unfortunately, if this base breaks out to the upside and gains traction you can say hello to the new counter-cycle.

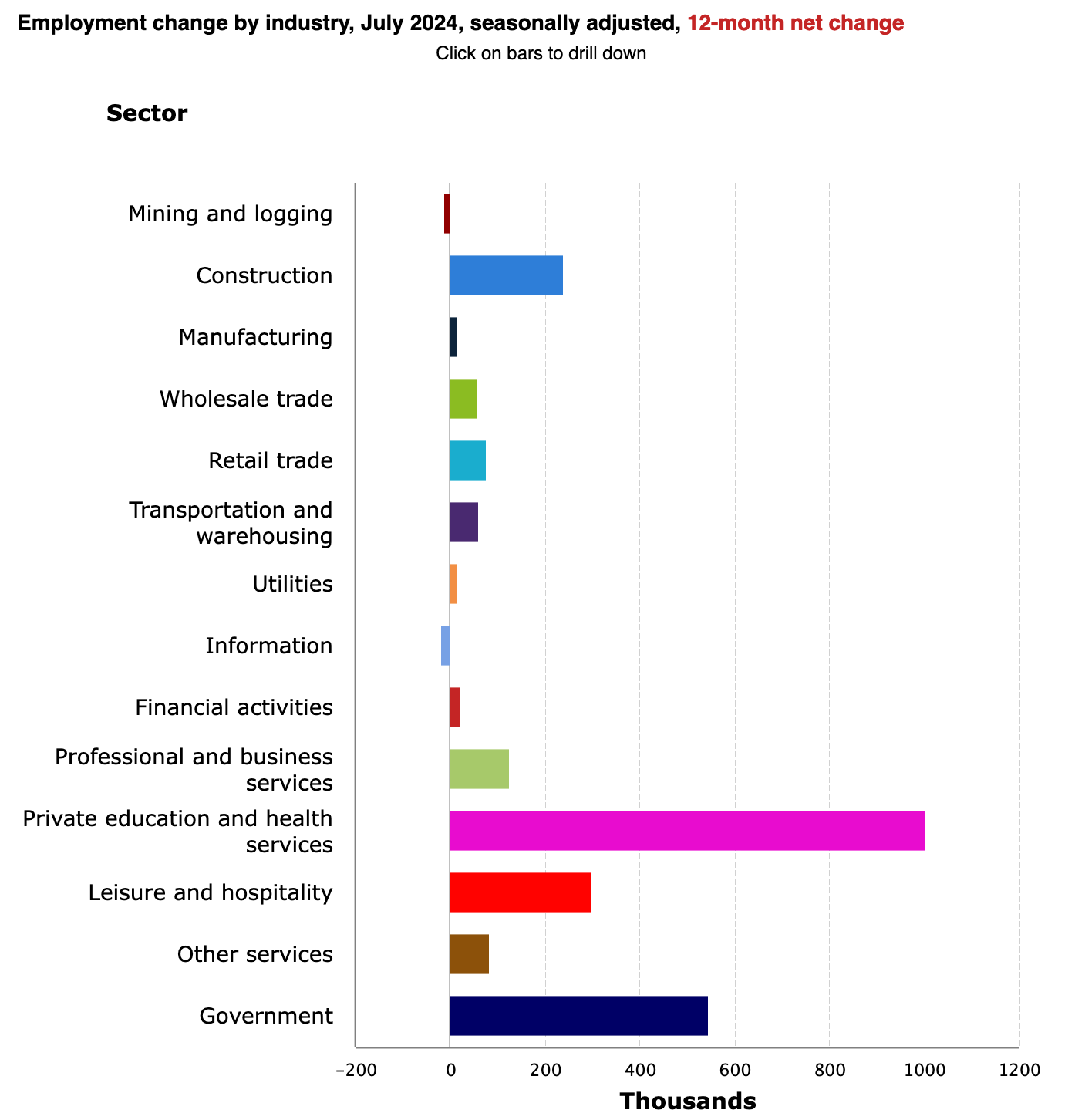

While I am getting sidetracked on Friday’s July Payrolls report, let’s take a look at the 1-year view of industries * that have driven the economy. Its makeup is not pretty. Also from #821:

Here is the 1 year view. It shows the segments that have done the heavy employment lifting over the last 12 months, instead of a one month snapshot. The trend is embedded Education and Health services first, and unprecedented (in my experience) government hiring second! Oh and that productive economic engine (sarcasm), Leisure & Hospitality, third. This in a supposedly strong economy. No, it is not and it has been slipping for months while the monthly jobs report keeps up some sort of appearances. Somebody tell the Emperor that his clothes are all in the laundry.

* Scary to think of government as an industry, eh?

Anyway, back to the Sahm article and video, she and Diane Swonk both resoundingly agree that we are not in a recession (which is obvious). They go on about the Fed rate cuts to come (which is obvious too). But they give surface-level media sound bites. Ear candy. Swonk does come up with a classic line though:

“Soft landings are hard.”

Yeah, they are, Diane. That is another way of saying there is no such thing as a soft landing, only routine recessions. I don’t think there is going to be much that is routine about the one on the horizon.

In the video Rick Santelli gets on the right track talking about market signals distorted by policy stimulus but then he falls right off the track almost immediately with this:

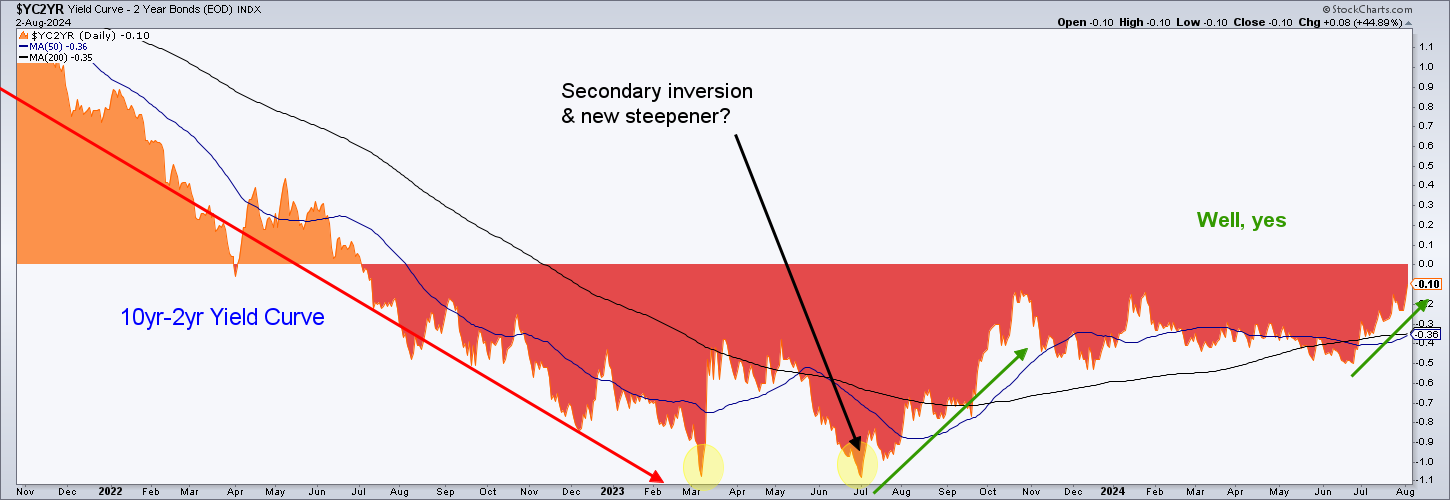

Just think about the yield curves and inversions and what they usually signal and how they may have been distorted by the huge amounts of QE

It is not the flatting to inversion that brings the pain. It is the subsequent steepening and un-inversion. Of late, the 10-2 yield curve is steepening under deflationary pressure, which has been our preferred macro situation. Again, from NFTRH 821:

Here is the daily view of the 10-2 yield curve. Our original view was that the secondary extreme to the inversion was THE inversion low about a year ago. That obviously is still the case. The fledgling 2023 uptrend from July to October then took a good, long sideways test but retained its trend change potential. Recent market stress and the deflationary upturn in the curve is in the process of confirming an oncoming curve steepener.

The yield curve tends to flatten and invert with an economic boom and steepen and un-invert with an economic bust. Friday’s July Payrolls report may have triggered realization for more market participants, but we’ve been noting a trend of slow economic deceleration for months now.

And the curve has not even un-inverted yet. Although this week may have something to say about that. Deflationary winds, they be a blowin’. And right on schedule for a mid-summer market correction that I’ve been evaluating with respect to ‘routine or more profound?’ I’ll now take B, Alex.

Upcoming will be the answer to the “healthy correction or start of the bear market?” question. Today is looking to be quite dynamic, but the state of pre-market sees indexes and some key equity leaders still in the “healthy correction” category. It’s going to be a fun week, either way.

Really fun for those who are short (that does not include me, although cash and short/medium-term Treasury bonds are quite enough fun for the relatively conservative likes of me). Here we do not speak of gold, which is taking a hit, but is the best risk manager of all on the big picture. Right now it is shaking off the inflation obsessed fleas.

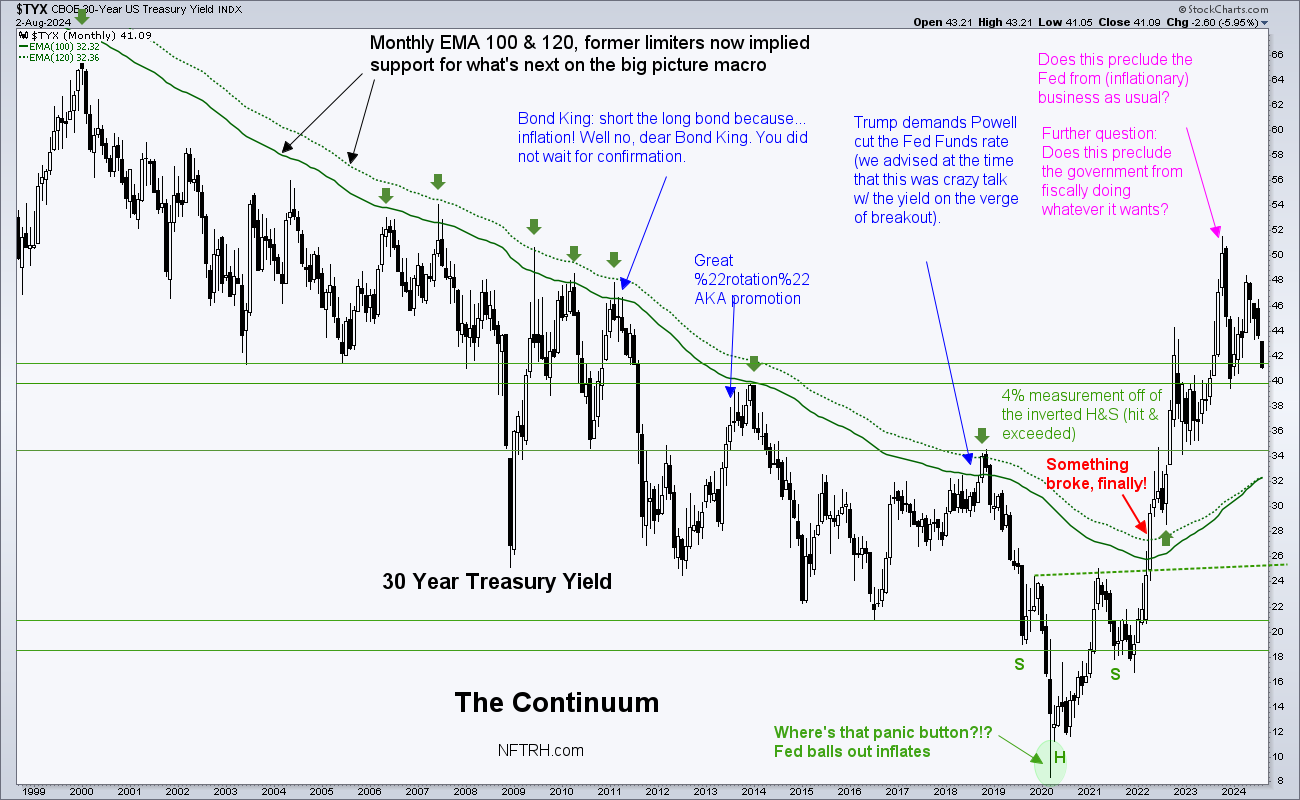

A final thought; they go on about rate cuts as if the Fed we had over the last few decades will be the Fed we have during the upcoming financial crisis. And again from NFTRH 821:

It appears that the next phase we have expected is in progress. That phase is a reaction after the big move in bond yields to the upside. The reaction has been expected to be disinflationary to deflationary. In my opinion we can get similar boom/bust cycles to those that have played out periodically since Greenspan took the system down the rabbit hole of magical monetary policy 24 years ago. But the resulting dovish monetary policy during the bust cycles will not work as well as it did over 2 decades of the Continuum’s downtrend (2002-2022).

During those phases the markets would attempt to go through natural down cycles after previous up cycles, only to be met with a fire hose of liquidity through QE, MMT, manipulation and monetization almost at will and onDemand because the whites of the deflationary monster’s * eyes were clearly in view.

* Deflation is only a monster because a highly leveraged debt-for-growth monetary/financial system cannot handle mass liquidation of its assets, which in the modern financialized economy, IS the economy. A more traditional economy, based on saving and productivity, would take it as a healthy cleaning prior to the next up cycle.

#821 continues:

So at this time I think that the broken trend marker (monthly EMA 100/120) will form a battle ground from which proof or negation of the new UP trend in long-term yields will take place. If we are indeed in a new interest rate regime (I believe so) on the macro I would expect much financial anxiety at 3.2% to 3.3% on the long bond. That is the area that the moving average limiters have risen to. It is now a potential Fed panic point to the next down cycle.

One interpretation that keeps coming to the fore for me is that policymakers, formerly perceived as financial heroes (to the asset owner classes) within the ongoing and unbroken Keynesian debt-scheme, will be exposed as third rate parlor tricksters by a bond market that would technically still be in big picture rebellion mode even with a yield decline to 3.2%.

There are few aspects of financial markets that are sure bets. But one of them is that listening to and reacting to the financial media in real time will be bad for your financial health. The mouthpieces are telling us what we already knew or should have known months ago, back in 2023 even.

The market is sure to be fun this week and the job right now is to interpret the question of whether this is the anticipated mid-summer correction to clear the pipes or the start of the bear market.