One of the most popular ETFs throughout last year was the Schwab U.S. Dividend ETF (SCHD). Despite higher-than-expected losses in 2023 due to its large allocation to U.S. financial sector stocks, the ETF remains popular among dividend investors due to its above-average yield, quality screeners, and low 0.06% expense ratio.

Recently, Charles Schwab (NYSE:SCHW) took a different approach by electing to expand their fixed-income lineup. On July 11th, 2023, the firm launched the Schwab High Yield Bond ETF (SCYB) on NYSE ARCA. This new ETF augments numerous existing Schwab bond ETFs, including the popular Schwab U.S. Aggregate Bond ETF (SCHZ), the Schwab Short-Term U.S. Treasury ETF (SCHO), and the Schwab 5-10 Year Corporate Bond ETF (SCHI).

However, none of the aforementioned ETFs offer exposure to non-investment grade bonds, and this is where SCYB differs. By targeting high-yield issuers, the new ETF offers investors a way to access higher-yielding fixed-income assets in an ETF wrapper, which significantly boosts liquidity, diversification, and tax-efficiency. Here's all you need to know about the new ETF.

Brief primer on high-yield bonds

Also known as "junk bonds", high-yield bonds are fixed-income instruments rated "below investment grade" (i.e., lower than BBB) by major credit rating agencies. Due to their much higher probability of default, these bonds usually pay much higher interest rates to compensate prospective investors for the much higher credit risk.

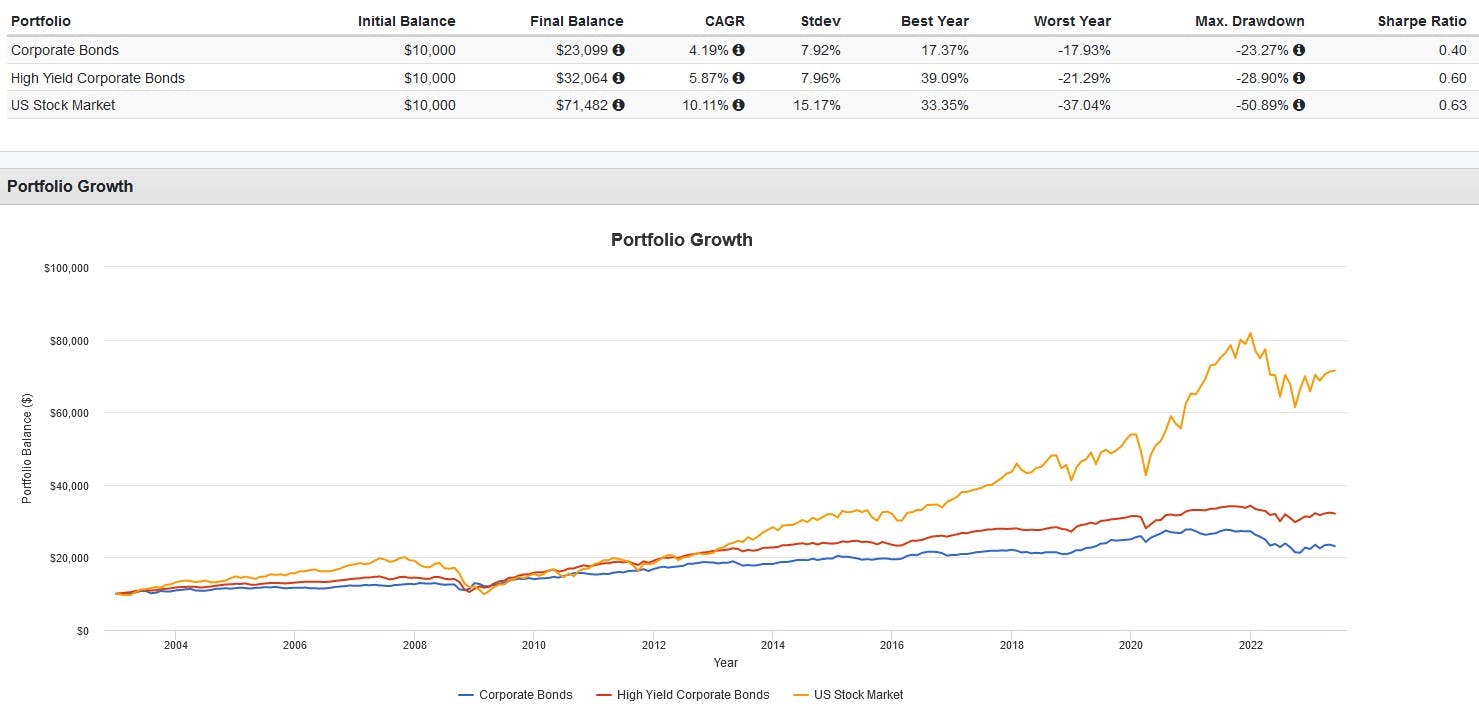

Compared to investment-grade bonds, high-yield bonds have some advantages. The most significant is the potential for potential for a higher return. Since these bonds come with a higher risk, issuers need to offer higher interest rates to attract investors. Case in point, from 2003 to the present U.S. high yield bonds have outperformed investment-grade corporate bonds, but still lose to equities.

The return potential for high-yield bonds also depends on the ongoing financial health of its issuer. Should a company's financial health recover, its bond ratings may be upgraded to investment-grade, which can result in a price appreciation of its bonds in the secondary market.

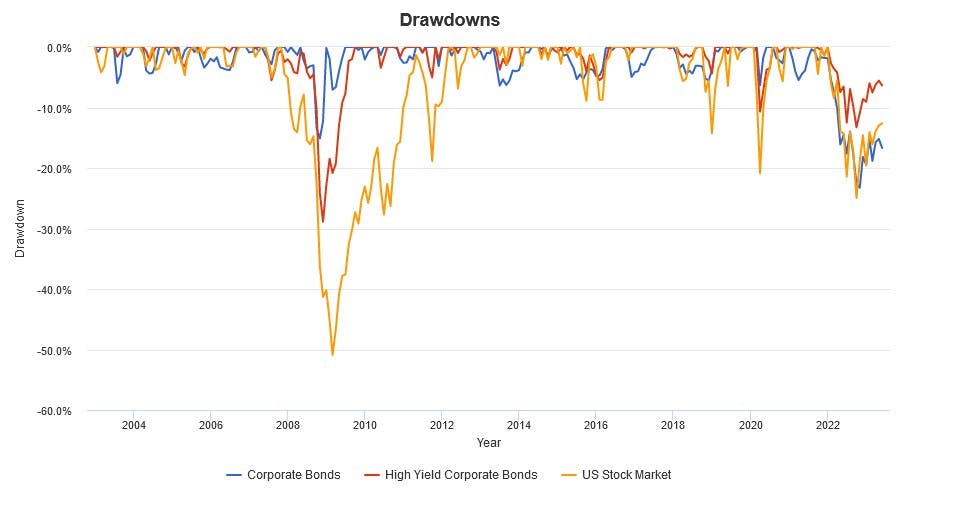

However, these advantages are offset by numerous risks. Chief among them is default risk – the chance that the issuer will miss out on interest payments of the principal investment. This is reflected in the higher drawdowns experienced by high-yield bonds during times of market turmoil and economic crisis:

SCYB versus competitors

SCYB debuts against some heavyweight contenders in the high-yield bond ETF space, namely the iShares iBoxx $ High Yield Corp Bond ETF (HYG), the iShares Broad USD High Yield Corporate Bond ETF (USHY), and the SPDR Bloomberg High Yield Bond ETF (JNK).

All three ETFs possess high assets under management (AUM), with HYG sporting $15.4 billion, USHY sitting at $9.1 billion, and JNK trailing at $8.3 billion. In terms of fees, USHY is the cheapest at 0.15% (waived down from 0.22%), JNK in the middle at 0.40%, and HYG being the priciest at 0.48%.

All three ETFs are index-based, with HYG tracking the Markit iBoxx USD Liquid High Yield Index, USHY tracking the ICE (NYSE:ICE) BofA US High Yield Constrained Index, and JNK tracking the Bloomberg High Yield Very Liquid Index. All feature monthly distributions, with JNK and HYG also sporting options chains.

In terms of benchmark, SCYB will track the ICE BofA US Cash Pay High Yield Constrained Index. This index selects its portfolio with a focus on ensuring liquidity and issuer diversification. Bonds in this index must be below investment-grade (based on an average rating between Moody's, S&P, and Fitch), possess at least 18 months to maturity at time of issue, and have a fixed coupon schedule among other criteria.

However, SCYB will be able to invest up to 20% of its net assets in securities not included in its index and use futures contracts and other derivatives to manage interest rate risk. Given the constraints with tracking the holdings high-yield bond indexes perfectly, SCYB will also employ a sampling technique to avoid having to hold less liquid issues.

There's no data available on SCYB's portfolio metrics yet, but I expect its average yield-to-maturity and duration to be in the range of what HYG, USHY, and JNK possess, of around 8.5% and 3.5 years respectively. This is the range generally expected of "aggregate" high-yield bond ETFs that don't focus on one particular end of the yield curve.

Finally, affordability is one of SCYB's main selling points. Schwab has come out swinging with a focus on low fees, looking to undercut all three competitors with an expense ratio of just 0.10%. This is significantly lower than the three ETFs mentioned earlier, which will likely be enticing for buy-and-hold income investors that don’t need the very tight bid-ask spreads and options chain of HYG.

This content was originally published by our partners at ETF Central.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.