“China, Japan, inflation, deficits, and QT, oh my!” – The chant of bond traders watching yields creep higher.

Despite the highest yields in 15 years, some bearish bond traders think they can go much higher. In their minds, China, Japan, burgeoning fiscal deficits, inflation, and QT present tailwinds for much higher yields.

We have written several articles explaining why entrenched long-term economic growth trends and associated low inflation, coupled with high and increasing leverage, all but ensure lower interest rates. This article defends our thesis and helps us better appreciate the bearish concerns weighing on bond traders.

As the quote below from Peter Atwater states, the “easiest explanation” is usually the most popular, but that doesn’t make it correct. The concerns we discuss make for good headlines and may temporarily affect bond yields, but are they worthy of much higher yields?

Our Bullish Bond Thesis

We have written extensively on our bullish thesis for bonds. Before reviewing the recent concerns of bearish bond traders, we provide links and quotes from our most recent bond articles.

Stocks Vs. Bonds: Where Should You Allocate for the Next 10 Years?:

History, analytical rigor, and logic argue that long-term buy-and-hold investors should shift their allocations from stocks toward bonds.

The Government Can’t Afford Higher for Longer, Much Longer:

If you disagree with our economic rationale for lower rates, this analysis may persuade you that the Fed and government don’t have any options but lower interest rates.

Why You Should Consider Buying Treasury Bonds Now:

In other words, the most hated asset class of 2022 may perform much better than stocks when a recession occurs. So, yes, individuals have a significant value opportunity to buy government bonds today.

China

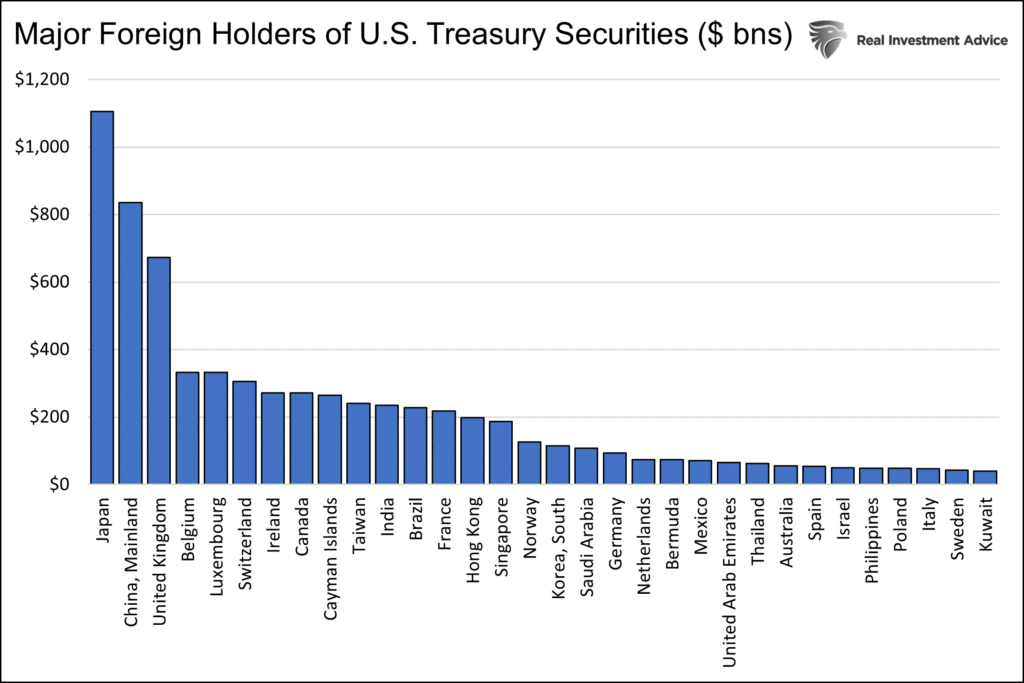

Rumors are circulating that China will sell U.S. Treasury securities to support its currency. China is the second largest foreign holder of Treasuries.

Might China sell some of its Treasury securities? Yes, their holdings of U.S. bonds fluctuate all the time. However, such action could do more harm than good for China.

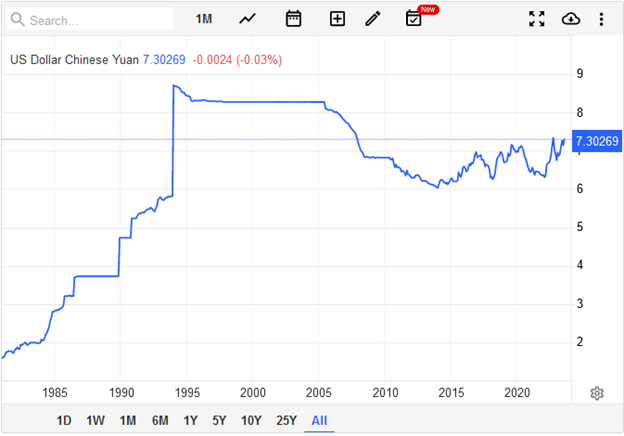

The yuan now sits at 2007 lows. (The graph charts how much yuan it costs to buy one dollar. Therefore, the recent upward trend is a devaluation of the yuan.)

Unlike the post-pandemic U.S. economic surge, China’s recent reopening has done little to revitalize growth. In mid-August, China unexpectedly cut interest rates to spur activity. China’s struggling economy and actions to combat it further weakened the yuan.

China risks further currency devaluation if it stimulates economic activity with lower rates and fiscal spending. A weak yuan versus the dollar is good for China as it promotes exports.

However, it also incentivizes capital outflows, putting additional pressure on the yuan. If, instead, China decides to support the yuan, it will likely have to sell Treasury securities. Such could prove detrimental if U.S. bond yields increase, further enticing capital outflows.

Currency manipulation would not likely be prolonged or entail too much Treasury selling. Further, they will probably sell short-term bills to limit realizing losses on their long-term bonds. Additionally, Treasury securities make up a quarter of their foreign reserves, meaning they have other dollar assets to sell beyond Treasuries.

Bottom line: Even if China sells bonds, the effect will be temporary, and they would likely sell short-term bills that have little impact on long-term yields. If they instead focus on the economy, a weaker yuan will stimulate their economy and increase capital flows from China which could bolster U.S. bonds on the margin.

Japan

The Bank of Japan (BOJ) recently changed how they manage yields, aka yield curve control (YCC). They will now conduct “flexible” market operations. The BOJ had a hard cap on ten-year yields at 0.5%. Consequently, they would intervene in markets when yields hit 0.50% to ensure they did not rise above 0.5%.

The new policy increases the cap to 1.0% but allows them to manage markets so yields don’t immediately rise to 1.0%. Given Japan’s high indebtedness, rising inflation, poor demographics, and negligible economic growth trends, they risk economic catastrophe if they lose control of yields.

Over the last 20-plus years, the BOJ has used massive amounts of liquidity to keep interest rates extremely low. Low Japanese yields, and poor stock market returns, incentivized many Japanese individuals and pension funds to buy U.S. assets.

Many such investors bought U.S. Treasury bonds. Additionally, a weak yen and meager rates allowed hedge funds to borrow yen, convert to dollars, and buy U.S. assets in a carry trade. Some of this capital from Japan ended up in the U.S. Treasury markets.

Bottom line: Higher yields in Japan may cause some Japanese investors to sell U.S. bonds and buy Japanese bonds. However, even at 1%, the yield is still woefully below U.S. bonds at 4-5%. Further, the yen has been weakening.

A weakening yen incentivizes Japanese investors to keep money in dollars. Lastly, the carry trade is often short-term in nature. Short-term borrowing rates in Japan are still near zero percent. Unless that changes, most carry trades are likely to persist.

Conclusion

China and Japan may cause temporary dislocations in the bond markets. However, we stress any such events are likely to be very short-lived with inconsequential longer-term effects.

Further, if their actions create liquidity issues or bond yields spike, the Fed and Treasury may take action to minimize their effect on bond markets.

We maintain a strongly convicted view that bond yields will fall in the medium term. It’s highly doubtful that monetary or currency policy actions taken by China or Japan to stabilize their economy or markets will alter our view.

The next article will focus on the domestic factors that give bearish bond traders hope that higher yields are in order.