-

Resilient Q2 earnings with robust growth: $1.69B net revenues (+30% YoY), showcasing strength in both subscription ($444M, +21% YoY) and merchant solutions ($1.3B, +34% YoY).

-

AI-driven innovations bolster merchant capabilities: Introduction of AI tools like Shopify (TSX:SHOP) Magic, Sidekick, and 15+ new APIs for enhanced checkout experiences; strategic marketplace expansions with Shopify Collective and Marketplace Connect.

-

Strategic shifts and global expansions fuel growth: Divestment from logistics in favor of partnerships like Flexport; strong presence in Europe and collaborations in markets like India, Japan.

Resilient Q2 2023 Performance

Shopify's Q2 2023 earnings report showcased a mixed performance, with the company exceeding expectations for EPS but falling short on GAAP EPS. However, Shopify outperformed in terms of revenue, exceeding expectations, and demonstrating strong growth. During Q2 2023, Shopify reported net revenues of $1.69 billion, representing a robust year-over-year growth rate of 30%. Subscription revenue reached $444 million, showing a 21% increase compared to the same period last year. Merchant Solutions revenue stood at $1.3 billion, reflecting an impressive year-over-year growth rate of 34%. These figures highlight Shopify's ability to generate substantial revenue streams from both subscription and merchant-related activities.

Harnessing the power of AI with product developments

Shopify's strategic advancements and business highlights during the quarter demonstrate its commitment to innovation and merchant success. The company introduced AI-enabled features and tools like Shopify Magic and Sidekick, empowering merchants with advanced capabilities. Additionally, Shopify expanded its marketplace footprint through initiatives like Shopify Collective and the Marketplace Connect app, providing merchants with access to major marketplaces such as Amazon (NASDAQ:AMZN) and eBay (NASDAQ:EBAY). The introduction of over 15 new APIs for enhanced checkout experiences further underscores Shopify's focus on customization and improving the customer journey.

Shopify's growth drivers include its robust revenue segments, with both subscription and merchant solutions contributing to its overall net revenues. The company's ability to adapt to the evolving e-commerce landscape and provide value-added services to merchants sets it apart from competitors. Shopify's strategic initiatives, such as divesting from logistics and partnering with Flexport, promise streamlined operations and enhanced fulfillment capabilities. The company's growing acceptance among enterprise merchants, its investments in AI-driven tools, and its strong presence in regions like Europe contribute to its ongoing growth and market appeal.

Harnessing data to improve e-commerce experiences is a crucial aspect of Shopify's strategy. The company's innovative approach, exemplified by its Summer '23 Edition and the introduction of new tools, differentiates it in the market and positions it as a comprehensive e-commerce ecosystem. Collaborations with partners like Amazon and strategic moves in global markets like India and Japan further fuel Shopify's growth and expansion.

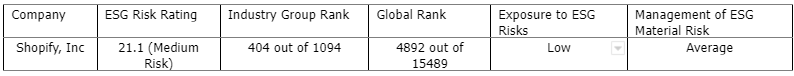

ESG Overview

Conclusion

Shopify Inc. has carved a significant niche in the e-commerce sector, marked by its remarkable growth and resilience. Its financial robustness, coupled with strategic innovations and a clear focus on merchant success, positions it as a formidable contender. The company's foray into AI, market diversification, and strategic alliances further bolster its potential to near the bullish price target of $80.00 in the forthcoming year. Notably, Shopify's decision to pivot away from the capital-intensive logistics sector, opting instead for external partnerships, exemplifies its adaptive strategy. However, given the competitive e-commerce landscape and its current high valuation, investors should tread with caution. External factors, such as market uncertainties or intensified competition, could potentially sway the stock closer to the bearish target of $52.00. Continuous monitoring of Shopify's performance and market indicators remains paramount for informed investment decisions.

Disclosure: We don’t hold position in the stock.