It was a difficult week for the dollar, stocks and commodities last week, to say the least. The Chinese yuan, which had been a catalyst for some recent volatility, stabilized, and actually finished the week slightly firmer. A dovish read of the FOMC minutes and the continued decline in oil prices dampen ideas that the Fed would hike interest rates in the middle of next month.

The 2-Year US Treasury yields eased more than nine basis points to 0.61%. Slower world growth and the sell-off of US stocks helped push the 10-Year yield below 2.05%. It had approached 2.50% in the second week of June.

The US dollar took a drubbing against the major currencies, only rising against the Australian and Canadian dollars. The Dollar Index was firm in the first half of the week, posting the week's high on Wednesday, near 97.08. It posted an outside down day then and proceeded to spend the rest of the week offered. It fell through the 61.8% retracement objective of the run-up from mid-June (~93.55) to the early August high (~98.33).

The Dollar Index has convincingly violated a neckline of a possible double top that was created by the push above 98.00 in July and August. The minimum objective of the pattern is near 94.30. The 200-day moving average in just above 94.65. Below there are the May and June lows near 93.15 and 93.55 respectively.

Short-covering helped lift the euro to its best level in two months; poking through $1.13 for the first time since June 23. Technical indicators are consistent with additional gains, with the May and June highs in the $1.1410-35 area the next immediate targets. Above there, potential exits toward $1.1500-$1.1535. We note that the 200-day moving average is just $1.1335, and the euro had not traded above it since early July 2014. A note of caution comes from the Bollinger® Bands. The upper band is near $1.1290. Support is now seen near $1.1200.

The sell-off in stocks and decline in US yields spurred short covering of the yen as well. The dollar fell through its 100-day moving average near JPY122.30, which also corresponds to a 61.8% retracement of the greenback's gains off the July 8 low near 120.40 and the early August high near JPY125.30. The dollar finished below the lower Bollinger Band (~JPY122.90). The July low and the 200-day moving average (~JPY120.70) is the next target, with intermittent support near JPY121.

The speculative short sterling position was not nearly as extended as the euro and yen, so it is not surprising it failed to show similar momentum. In addition, sterling was supported by ideas that the BOE would also be raising rates, and the heightened fears of global deflation undermine a source of fundamental support. Sterling is knocking on the $1.5700 level but has not closed above it for nearly seven weeks. If it does, the next target is near $1.58. Initial support is seen near $1.5660 and then $1.5600. It probably takes a break of $1.5560 to take the pressure off the upside.

The Canadian dollar is not particularly interesting from a technical point of view. The US dollar traded mostly between about CAD1.3015 and CAD1.3180 since August 13. Oil prices have fallen by about 5% during this period while the two-year interest rate differential between the US and Canada has been flat near 30 bp. The broader range is CAD1.2950 to CAD1.3200. The RSI suggests that the Canadian dollar is vulnerable; that the range affair will be resolved to the loonie's downside. There is little meaning chart resistance between CAD1.3200 and CAD1.4000

The Australian dollar has recorded lower highs for six consecutive sessions. It found support near $0.7290. If it cannot get above the $0.7380-$0.7400 area, the technical indicators may turn down again. There seems to be little in terms of fundamental or technical considerations that argue against a test on $0.7000 in the period ahead.

Oil prices were drilled again. The front-month October light sweet crude oil futures contract has fallen each week since mid-June (ten-week losing streak). A convincing break of the $40 level brings the late-08 and early-09 lows near $32.50 into view. The lower Bollinger Band is near $39.25. Initial resistance is seen near $43.00. Despite the long declining streak, there is no compelling reason to think an important bottom in place.

The US 10-year Treasury yield fell 13 bp last week. It is approaching important psychological support near 2.0%. It is also the upper end of the bottom carved out in late-March and the month of April. The 200-day moving average near 2.14% may now serve as resistance.

The S&P 500 dropped nearly 5.8% last week to post the biggest weekly decline of the year. It finished at its lowest level since last October, which was almost four standard deviations below the 20-day moving average (~1961). This, more than the RSI and MACD, warns that the market is over-extended. Lows in the S&P 500 over the past two years have mostly been signaled by a one or two-day reversal. These are often characterized by testing or making a new low, and then recovering to close near the highs. Sometimes this has been followed by a gap higher opening. Investors may want to monitor the price action and await such a technical signal that a low is in place.

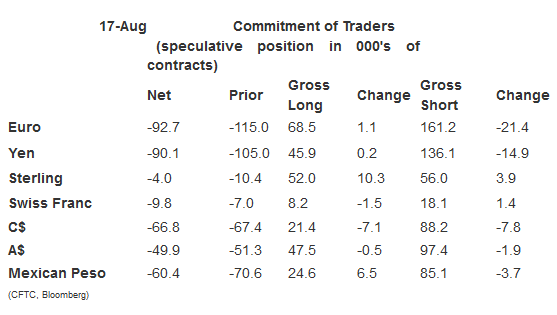

Observations from the speculative positioning in the futures market:

1. There were three significant gross position adjustments by speculators in the reporting period ending August 17. The gross short euro position was cut by 21.4k contracts to 161.2k contracts. The gross short yen position was reduced by 14.9k contracts, leaving 136.1k. The gross long sterling position rose by 10.3k contracts to 52.0k.

2. There were a few distinct patterns. While the short euro and yen positions were cut, there were small adds to the gross longs. The net short euro position of 92.7k contracts was the smallest in two months. Speculators reduced gross long and short Australian and Canadian dollar positions. Gross short positions were generally reduced. The 3.9k contract in the gross short sterling position (to 56k) and the 1.4k contract increase in the gross short Swiss franc position (to 18.1k) are the two exceptions.

3. The net long speculative 10-year Treasury position was culled by 40.5k contracts to 7.3. This was primarily a function of bulls taking profits. They liquidated 46.5k contracts to 453.7k. The bears covered 6k short positions, leaving 446.4k contracts.

4. The net long speculative light sweet crude oil position was trimmed by 15.3k contracts to 212.6k. The gross longs were trimmed by 5.7k contracts to 473.2k. The gross short position increased by 9.6k contracts to 262.6k.