If you switched on the TV or flicked to a news website (nobody reads a physical newspaper anymore, right?) this morning then you would have seen a mention of the oil price hitting $50 per barrel.

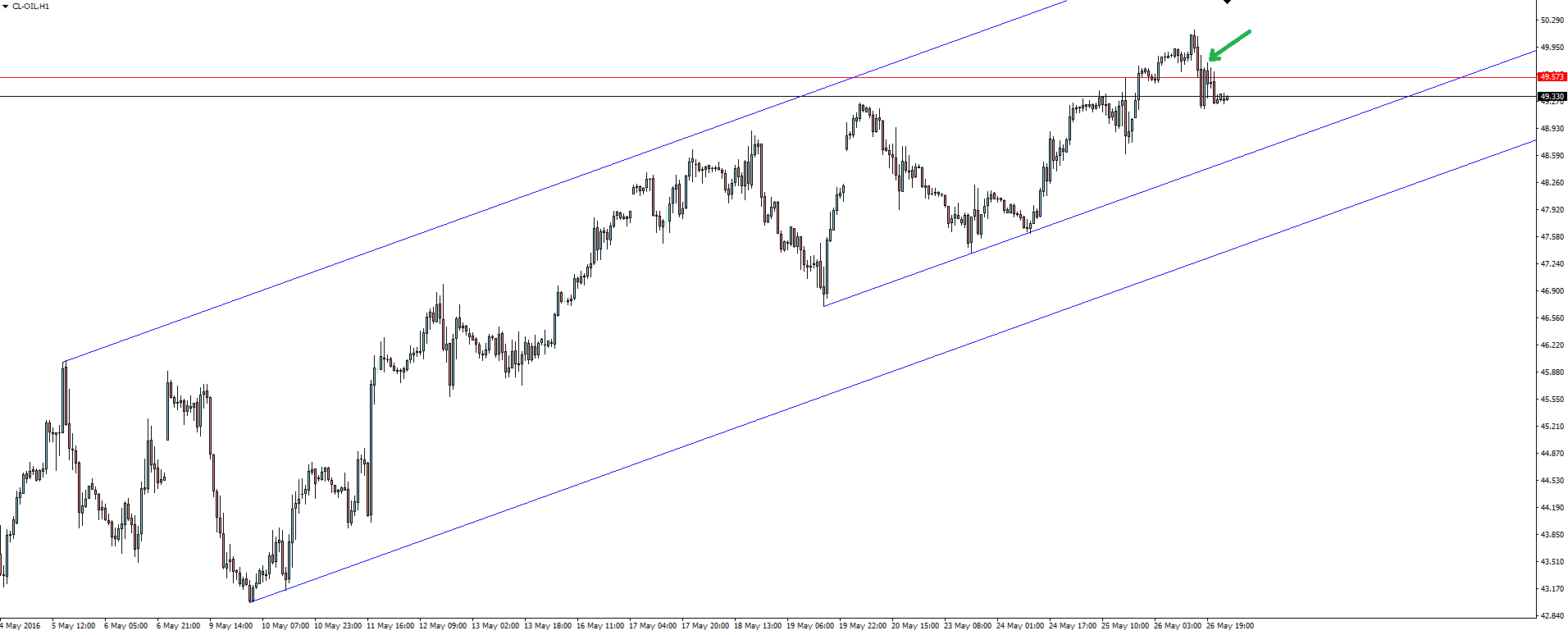

On Wednesday, our chart of the day featured the oil support/resistance zone.

But one aspect that we didn’t speak about that has been hammered in the media is that oil is also approaching this $50 level. One of the roundest numbers in the decimal system and one of the most significant psychological levels as a result.

Have you ever wondered why when you go to the supermarket, you see things priced for $9.95, rather than the fully rounded $10.00? This is because when you glance at the price, your brain automatically registers it as being ‘much cheaper’ than if you see something for a full $10.00. Even though in reality, the difference is negligible.

Well the same concept that retail uses to help you part with your hard earned can be applied to financial markets and the concept of psychological levels acting as support/resistance.

$50.00 per barrel sounds a lot more expensive than $49.95 per barrel.

Type oil into Google and look at the plethora of headlines featuring the magic $50 price. The perfect example showing why price would react here whether it looks significant on your charts or not.

With the $50 psych level acting as possible resistance, traders with a short bias will be looking to sell any re-test of either the zone itself, or previous intraday swing lows.

Pending how aggressive you are, the above chart shows the first such retest which you can manage your risk around.

Charts of the Day:

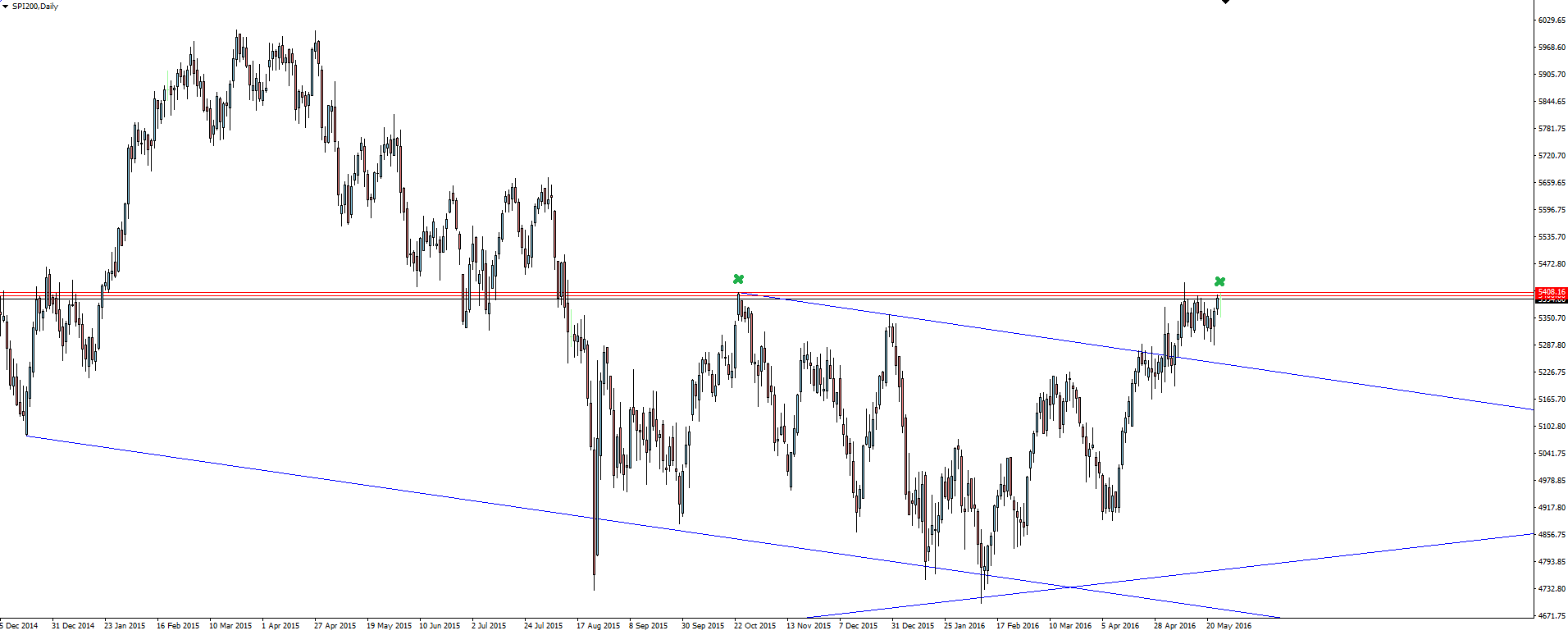

Speaking of psychological levels…

The 5400 level in the Australian SPI200 market is one that price is also having a hard time breaking out from.

Always looking for a confluence to add to the argument, I’ve marked the 5400 level on the daily as well as the swing high that stands out just above.

On the Calendar Friday:

ALL G7 Meetings

USD Prelim GDP q/q

USD Fed Chair Yellen Speaks

Risk Disclosure: In addition to the website disclaimer below, the material on this page prepared by Vantage FX Forex does not contain a record of our prices, low spreads or solicitation to trade. All opinions, news, research, prices or other information is provided as general news and Forex education material – not as investment advice. Consequently any person acting on it does so entirely at their own risk. The experts writers express their personal opinions and will not assume any responsibility whatsoever for the actions of the reader. We always aim for maximum accuracy and timeliness, Australian Forex Broker Vantage FX shall not be liable for any loss or damage, consequential or otherwise, which may arise from the use or reliance on this service and its content, inaccurate information or typos. No representation is being made that any results discussed within the report will be achieved, and past performance is not indicative of future performance.