- Silver is currently stuck in a consolidation phase.

- China, a key driver of the metal's demand, is experiencing a slowing GDP growth.

- But, the grey metal has other tailwinds in its favor that could spark a bull run in the coming months.

- Unlock AI-powered Stock Picks for Under $8/Month: Summer Sale Starts Now!

Silver could be poised to shine in the coming months, with analysts basing its bright long-term prospects on rising demand and supply constraints.

However, the prospect of slowing demand from China remains a concern. In recent history, China has played a key role in driving demand for the metal.

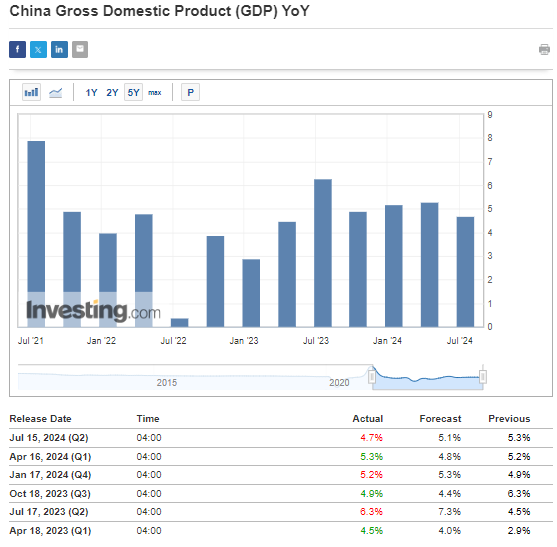

The country's recent GDP data was underwhelming, raising concerns about a potential demand slowdown in the coming months.

But, it has other tailwinds that support a growing demand as rate cuts are on the horizon and the downtrend in the US inflation continues to boost silver's bullish case.

Technically, the grey metal needs to break out of the current consolidation range to mount an attack on this year's high, which lies just below $33.

Underwhelming Economic Data From China Remains a Concern for Silver Bulls

China's government has set an ambitious growth target of 5%, yet recent macroeconomic indicators tell a different story. GDP growth, a critical metric, has come in at 4.7% year-on-year, falling short of the anticipated 5.1%.

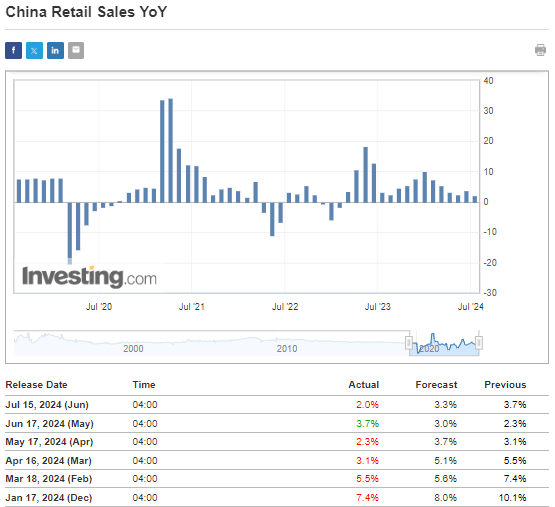

One area of concern is retail sales, which have once again disappointed, indicating a lack of sustainable upward momentum.

A major challenge confronting Beijing is the ongoing crisis in the real estate market, historically a powerhouse of the local economy. Simultaneously, there's a noticeable downturn in domestic consumption, intended to drive future growth as per previous government announcements. Insights into the economy's future trajectory amidst these risks may emerge during the upcoming party congress.

China's significance in global markets, particularly for silver, cannot be overstated. The country's automotive industry alone manufactures 60% of the world's electric vehicles and hosts 95% of global photovoltaic capacity, according to the International Energy Agency. Both sectors heavily rely on silver, underscoring China's pivotal role in global demand dynamics.

Weakening US Dollar Could Boost Silver

The US dollar's decline continues, fueled by a near-certain expectation of September rate cut (priced at over 93% probability at writing). A weaker dollar historically benefits precious metals, and this is evident in gold's recent surge to new highs.

The key question for silver investors: will a weaker dollar translate to medium and long-term gains? The answer hinges on the Fed's strategy. Will they initiate a series of cuts, or will it be a single cut followed by steady rates?

Technical View: Breakout Above Consolidation Range Is Critical for Bulls

Silver prices have been consolidating between $30.60 and $32 per ounce for the past fortnight. A decisive breach above the upper boundary could pave the way for a challenge of this year's highs just shy of $33.

Such a breakout would signify renewed bullish momentum, potentially amplifying demand dynamics in the market.

Conversely, breaching the key support level at $30.60 might trigger a deeper decline, potentially testing support around $29 per ounce.

This breakout from consolidation will be pivotal in determining the next significant movements in silver prices, guided by market sentiment and economic indicators in the coming weeks.

***

This summer, get exclusive discounts on our subscriptions, including annual plans for less than $8 a month!

Are you tired of watching the big players rake in profits while you're left on the sidelines?

InvestingPro's revolutionary AI tool, ProPicks, puts the power of Wall Street's secret weapon - AI-powered stock selection - at YOUR fingertips!

Don't miss this limited-time offer.

Subscribe to InvestingPro today and take your investing game to the next level!

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, counsel or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. I would like to remind you that any type of asset, is evaluated from multiple perspectives and is highly risky and therefore, any investment decision and the associated risk remains with the investor.