Size is not a guarantee of power and bigger isn’t always better. Over the last decade, large-cap companies – mainly Big Tech – have dominated the minds of investors. But, as we enter a new economic landscape where hyper-growth-focused businesses may not thrive as they once did, smaller and nimbler companies will be showcasing the value they provide and the wealth generation they can bring to investors.

Small in Stature, Big in Impact

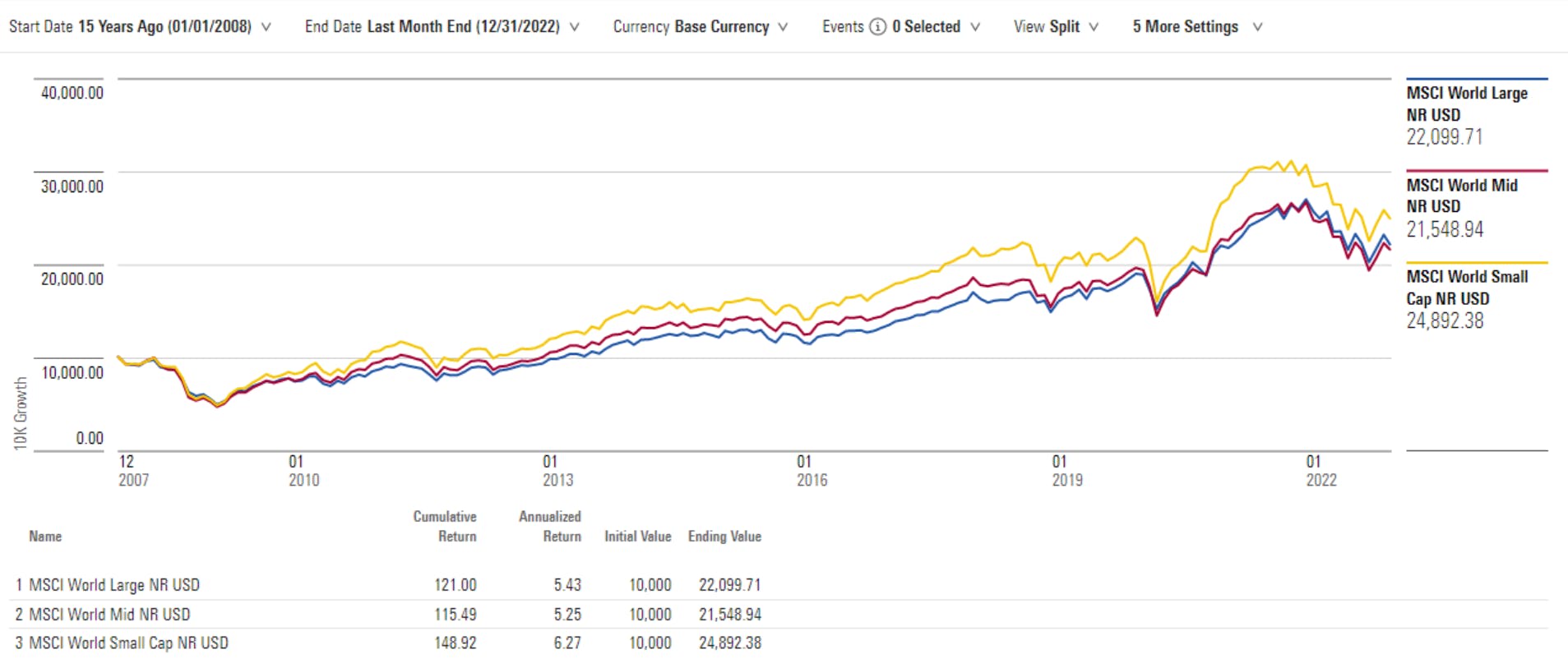

The global equities space is large in nature, but market capitalization allows for rational segmentation among companies. In observing the long-run performance of the global small-cap equities asset class (i.e., companies with a market capitalization between $300 million and $2 billion), collectively they have outperformed their mid-cap and large-cap peers, while also being a stellar source for wealth generation. This point is demonstrated when looking at the long-run performance of the MSCI World Global Small Cap equities index, in contrast to the MSCI World Large and MSCI World Mid indices.

History doesn’t repeat, but it does rhyme

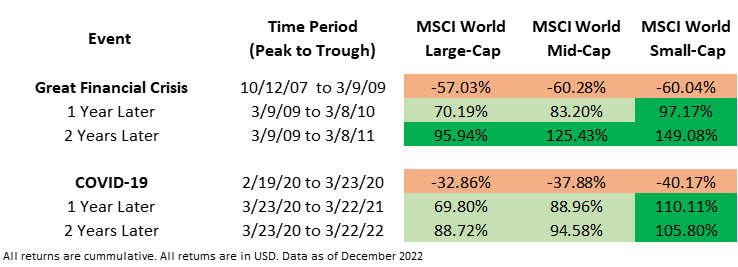

While market drawdowns affect all asset classes, the strong post-drawdown performance of global small-cap equities, relative to its mid-cap and large-cap peers, is a recurring occurrence that has been observed over time.

As evidenced by the data, during stark market downturns, the performance of all three indices is similar in nature. However, in the periods following said market drawdown, the global small-cap equities index exhibited a materially better performance in contrast to its peers.

Why consider Global Small Cap Equities now?

As global economies move into a higher interest rate environment, the previous ‘grow at any cost’ regime that was supported by below-average interest rates is no longer present. We are now at a juncture where businesses will have to make judicious decisions regarding how they operate going forward. For many small to medium size business operators, ensuring business continuity and managing in a ‘resource prudent’ manner may already be familiar functions, as such navigating the current environment may not be an entirely difficult endeavor. Conversely, larger firms that went about scaling at any cost are now entering a period of curtailment, which may involve not only cutting back on spending but also reconsidering the viability of their business model; as the market forces that helped them propel their business and assuage their stakeholders are no longer present.

As mentioned in a previous article, the market performance of 2022 was truly exceptional in nature, but it has provided an opportunity for pragmatic investors to capitalize on. With many investment offerings now available at a lower price point, now could be the opportune time for investors to gain exposure to asset classes they may not have thought of before. In the case of global small-cap equities - an asset class that has shown the ability to outperform its larger peers - adding an allocation to one’s portfolio now could prove beneficial in the years to come.

For investors interested in adding global small-cap equities exposure to their portfolio, the Vanguard FTSE All-World ex-US Small-Cap ETF (VSS) is a passively managed index solution that tracks the FTSE Global Small Cap ex US Net Tax (US RIC) Index – USD. The fund has a track record that spans over a decade, with a relatively low expense ratio (0.07%).

This content was originally published by our partners at ETF Central.