When it comes to conversational AI, most people think of the big players: Amazon (NASDAQ:AMZN) Alexa, Google (NASDAQ:GOOGL) (NASDAQ:GOOG) (NASDAQ:GOOGL) Assistant, Apple (NASDAQ:AAPL) Siri, among others. Amid a competitive landscape, SoundHound AI (NASDAQ:SOUN) has carved out a distinct niche. While Big Tech focuses on consumer ecosystems, SoundHound is building solutions tailored for enterprises.

In this article, I will explore what sets SoundHound apart, the substantial barriers to entry in its field, and why I believe it's a first mover with disruptive potential in the Voice AI industry.

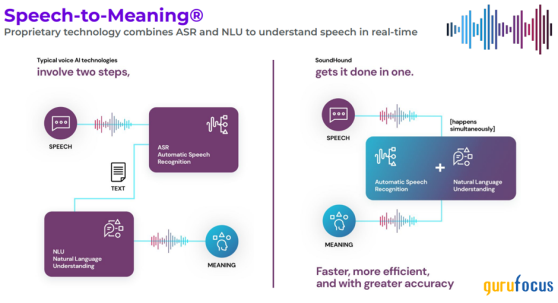

SoundHound's Competitive EdgeSoundHound is a leader in conversational intelligence, with the mission to voice-enable the world with conversational intelligence through an independent AI platform that enables humans to interact with products and services as they interact with each other. What makes SoundHound unique is its ability to deliver high-quality conversational experiences across industries like automotive, IoT, and customer service. At its core lies Speech-to-Meaning technology, which bypasses the traditional step of converting speech into text. Instead, it derives meaning directly from audio input, enabling faster, more accurate responses. Imagine asking, Show me Italian restaurants near the Space Needle that are open past 9 PM, have parking, and allow pets, and receiving an instant, precise answer. It's this level of speed and precision that sets SoundHound apart from its competitors.

While Big Tech players such as Apple, Google, and Amazon (NASDAQ:AMZN) have advanced voice recognition systems, relying on entrenched speech-to-text architectures, which involve converting speech into text, and then parsing the text for meaning. Transitioning to a Speech-to-Meaning system would demand substantial re-engineering and access to annotated datasets that map raw speech directly to meaning. These datasets are scarce, especially for complex, multi-intent queries. In contrast, SoundHound's years of R&D and expertise have built a robust system capable of handling nuanced commands seamlessly.

Source: SoundHound Investor Presentation

This specialization explains why SoundHound excels in industry-specific applications. From voice-activated car controls to dynamic restaurant ordering systems, its technology is tailored to practical, real-world tasks. Users consistently find it faster and more reliable for precise, layered queries compared to general-purpose systems offered by Big Tech.

Perhaps the most striking difference is SoundHound's business model. While Big Tech builds voice assistants to reinforce their ecosystems, often limiting customization, SoundHound offers white-label solutions. This approach allows businesses to fully control branding, user data, and voice assistant functionality, a crucial differentiator for enterprises wary of sharing sensitive information.

Barriers to Entry and SoundHound's Competitive MoatSoundHound's technology and patents create substantial barriers to entry that many competitors simply cannot replicate. Speech-to-text architectures are deeply entrenched in Big Tech's systems. Transitioning to speech-to-meaning would involve re-engineering these pipelines from scratch, which is resource-intensive. Training a speech-to-meaning system requires annotated datasets where raw speech is directly mapped to intended meanings, skipping the text transcription layer. While Big Tech companies possess massive datasets for speech-to-text, they often lack the speech-to-meaning datasets required for handling complex, multi-intent commands.

This is where SoundHound's competitive advantages come into play. SoundHound's AI models, including its foundational Polaris (TSX:PIF) engine, were trained on billions of conversations and over a million hours of audio. This sheer volume of data spans dozens of languages, enabling the system to handle everything from casual queries to highly domain-specific commands.

Another key factor is SoundHound's globalization efforts. Supporting over 25 languages while understanding nuanced cultural contexts cannot be engineered overnight. It requires precise localization and linguistic adaptability, which SoundHound has been refining for over a decade. This gives it an edge in international markets along with over 155 granted patents and 115 more pending, the company has built a protective wall around its innovations in speech recognition, natural language processing, and conversational monetization.

Switching costs further strengthen SoundHound's moat. SoundHound positions itself as platform-agnostic, serving businesses that want branded and customizable voice AI without relying on a specific ecosystem while Big Tech companies remain heavily consumer-focused. Shifting to business-to-business enterprise markets would require changes in business models, marketing, and go-to-market strategies. SoundHound's strength lies in its white-label solutions that allow businesses to own and brand their voice assistants. For example, once a bespoke voice assistant is embedded into a vehicle's operating system, replacing it requires redesigning core components, a costly and time-consuming process for automakers. This deep integration solidifies SoundHound remains an indispensable partner for its clients, creating long-term partnerships between SoundHound and its customers.

Another aspect of SoundHound's competitive edge is its ability to provide customizability and data privacy. Unlike Big Tech, which uses voice assistants to lock users into their ecosystems, SoundHound offers white-label solutions that empower businesses to retain control over branding and user data. This independence is a crucial factor for enterprises that need to maintain privacy while delivering a branded experience to their customers.

SoundHound as a First Mover and Industry DisruptorAs an early leader in key vertical markets, SoundHound continues to expand its presence by collaborating with renowned brands while maintaining operational independence. While Amazon and Google focus on creating consumer-facing ecosystems, SoundHound is forming AI agent solution partnerships with prominent players in sectors such as healthcare, insurance, telecommunications, and banking, alongside securing government and military contracts in the US.

One of the company's standout achievements lies in the restaurant industry, where it has significantly optimized drive-through phone ordering systems. Additionally, there has been a notable increase in agreements with EV manufacturers globally, aiming to embed advanced conversational AI capabilities into modern vehicles.

Source: SoundHound Investor Presentation

Take, for instance, its work in the automotive sector with partnerships with global leaders like Hyundai and Mercedes-Benz. SoundHound's voice AI doesn't just handle basic commands; it enables drivers to ask complex, vehicle-specific questions like, How do I activate the fog lights? or What's the recommended tire pressure for this car? By combining generative AI with its proprietary Speech-to-Meaning and Deep Meaning Understanding technologies, SoundHound has created a hands-free assistant that goes far beyond what traditional systems offer.

Similarly, in the hospitality industry, SoundHound's solutions, such as Smart Ordering, are restructuring the way restaurants handle customer interactions. Smart Ordering streamline restaurant operations by allowing customers to place voice orders efficiently. Meanwhile, Dynamic Interaction combines voice and touchscreen inputs for a multimodal approach, making it ideal for drive-thru scenarios.

SoundHound's capacity to address these specific use cases solidifies its position as a leader. While Big Tech often pursues one-size-fits-all solutions designed to serve the broadest audience possible, SoundHound's approach, on the other hand, is tailored, allowing enterprises to offer voice solutions that align with their brand identity and operational needs.

In addition to adding multiple high-profile customers, SoundHound has partnered with Nvidia (NASDAQ:NVDA) to enhance in-vehicle voice assistants. This partnership integrates SoundHound's Chat AI platform with NVIDIA's DRIVE platform, facilitating advanced in-vehicle voice assistants capable of operating without cloud connectivity. This advancement allows drivers to access information directly from the car manual and other data sources using natural speech, enhancing the in-car experience.

Additionally, NVIDIA (NASDAQ:NVDA) holds an investment stake in SoundHound AI, owning over 1.73 million shares. This partnership underscores NVIDIA's confidence in SoundHound's voice AI technology and its potential applications across diverse industries.

Generative AI and the Expanding Role of PolarisSoundHound has embraced the generative AI revolution by integrating tools like OpenAI's ChatGPT and Perplexity through its Generative AI Connector. This feature augments its proprietary technologies by enabling richer, more conversational interactions. While Polaris remains the core engine powering SoundHound's precise and efficient task handling, the addition of generative AI enhances its ability to tackle open-ended and creative queries.

For example, when a user speaks a query (e.g., "Find me a restaurant nearby that's open now and has vegetarian options"), SoundHound's directly converts the speech into meaning. The platform uses its proprietary natural language understanding (NLU) engine to fully comprehend the intent of the query, including contextual nuances and specific business data integration. It could pull real-time data from a restaurant's availability system or vehicle's settings for accurate responses.

After extracting the query's meaning, SoundHound taps into generative AI models, via the Generative AI Connector, for open-ended questions: If the query goes beyond structured data, such as "What are the benefits of a vegetarian diet?" or creative responses: For queries needing elaboration or a conversational touch, like storytelling or general knowledge.

Large language models such as ChatGPT and Perplexity deliver richer and more conversational responses in these scenarios.

The hybrid approach is effective in industries requiring both domain-specific accuracy and conversational flexibility. For example, in automotive use cases, Polaris ensures the assistant can handle technical commands accurately, while generative AI allows for more natural interactions, such as discussing travel plans or suggesting nearby attractions.

The Market Opportunity (SO:FTCE11B) and Scaling Challenges

The AI voice generator market is experiencing a fast expansion, estimated to increase in market value from around $3.0 billion in 2024 to $20.4 billion by 2030, a 38% CAGR. The global voice and speech recognition market size was estimated at USD 20.25 billion in 2023 and is anticipated to grow at a CAGR of 14.6% from 2024 to 2030. The market is anticipated to be driven by technological advancements and rising adoption of advanced electronic devices.Source: Grand View Research

SoundHound has been focusing on a combination of three types of revenue generation, comprising royalties, subscriptions, and transaction monetization. As more industries and consumers adopt voice technology, SoundHound's average revenue per customer will tend to increase.

However, scaling sustainably remains a challenge. While revenue growth has been impressive, with a projected $83.5 million for 2024, the company's negative free cash flow and reliance on equity financing highlight the need for disciplined financial management. Operating expenses, though growing slower than revenue, still reflect the high costs of R&D and market expansion. Achieving profitability while maintaining its competitive edge will be crucial for SoundHound to solidify its position in the market.

FinancialsSoundHound's recent financial performance reflects a company in high-growth mode, with impressive scalability metrics but ongoing challenges in profitability. Revenue has grown consistently, exceeding 50% growth over the last four quarters. In Q3 2024, revenue reached $25 million, marking an 89% year-over-year (YoY) increase. Full-year revenue is expected to reach $83.5 million, representing an 82% YoY growth rate, with an updated 2025 outlook projecting $155-$175 million, nearly doubling YoY.

Despite this robust growth, operating expenses remain a concern due to substantial investments in R&D and market expansion. Encouragingly, expenses have grown at a slower pace than revenue, signaling improving operational efficiency.

On the balance sheet, SoundHound holds $136 million in cash and cash equivalents, with only $40 million in current debt. While the company continues to report negative free cash flow due to net losses and operational expenditures, its cash reserves provide a runway of approximately 4 to 6 quarters, assuming no additional debt or equity raises. However, its reliance on equity financing has led to significant shareholder dilution. Stock-based compensation also accounts for a considerable portion of operating expenses.

SoundHound has also made significant progress in addressing its historical customer concentration risks. As of December 2023, the top three customers accounted for 87% of accounts receivable. Today, no single customer exceeds 10% of accounts receivable, a significant achievement in diversifying its revenue base and mitigating investor risk. From a revenue perspective, the improvement is equally outstanding. Last year, the largest customer contributed 72% of total revenue, whereas now, the top five customers collectively account for less than a third.

This diversification not only stabilizes SoundHound's financial position but also underscores its ability to attract a broader range of clients across industries, reducing its dependency on a few key accounts while building a more resilient business foundation.

Valuation and Final TakeThe company's current valuation raises significant concerns. Following its Q3 2024 earnings report, the stock soared over 190% in just 35 days. While this reflects market enthusiasm for its scalability and diversified customer base, it has also driven its price-to-sales (P/S) ratio to an astonishing 99x, with a forward P/S of 53x. Given the projected revenue growth, such valuations are hard to justify for a company still facing profitability challenges and reporting negative free cash flow in my opinion.

Adding to these concerns is the pace of insider selling. Last month alone, insiders sold over $2 million in shares, likely capitalizing on the inflated stock price. While insider selling isn't always a negative signal, the aggressive pace here suggests insiders may share concerns about the stock's long-term sustainability at these valuations. To me, this activity reinforces the notion that the stock is currently overpriced.

That said, I believe SoundHound has the potential to become a major player in this sector, and its long-term prospects remain compelling. As a founder-led company, it has demonstrated its ability to secure high-profile partnerships, reduce customer concentration risks, and drive innovation in the voice AI market. Its voice AI assistant has been integrated into vehicles from prominent brands like Peugeot, Opel, Vauxhall, Alfa Romeo, Citroen, and Lancia. It has also partnered with Kia to deliver the "Hey Kia" voice AI experience in India, reflecting its ability to penetrate diverse global markets. Beyond automotive, SoundHound has expanded its AI agent customer service offerings to hundreds of additional brands, signaling strong demand across multiple sectors.

Despite the vast total addressable market (TAM) for voice AI and SoundHound's position as a first mover, growing revenue over 80% YoY, I believe the market is irrationally pricing the stock at 100x its P/S ratio. While markets can remain irrational for extended periods, these valuations warrant extreme caution.

For now, I'll continue to monitor SoundHound closely. If the valuation improves without a deterioration in its fundamentals, I would consider becoming a shareholder.

This content was originally published on Gurufocus.com

Which stock to consider in your next trade?

AI computing powers are changing the Canadian stock market. Investing.com’s ProPicks AI are winning stock portfolios chosen by our advanced AI for Canada, the US, and other exciting markets around the globe. Our top strategy, Tech Titans, nearly doubled the S&P 500 in 2024 - one of the most bullish years in history. And Beat the TSX, designed for broad market exposure, is showing +878% gains with 10 years’ back-tested performance. Which Canadian stock will be the next to soar?

Unlock ProPicks AI