- Long-term optimism prevails despite short-term challenges in market sentiment.

- Meanwhile, the bullish sentiment in S&P 500 continues a historic streak.

- This begs the question: how long can this streak continue?

- Looking for actionable trade ideas to navigate the current market volatility? Unlock access to InvestingPro’s AI-selected stock winners for under $9 a month!

I am a firm believer in long-term thinking and maintaining an optimistic outlook on the future. If I am being understated, I’d say I naturally see "the glass half full." Given the choice, I'd be a lifelong permabull rather than a permabear.

Staying optimistic can be tough, even with a long-term perspective. We inevitably face decades peppered with recessions, three or four bear markets, some deeper crashes, financial and geopolitical crises, wars, political upheavals, and those completely unexpected events that catch us by surprise.

But here's the key: I am aware these challenges might occur in the short term, yet I remain bullish on the S&P 500 over the long run.

If you think about it, we’re all permabulls in a sense. Our history as a species is a mix of critical moments, setbacks, and conflicts, yet we rise each morning with a resolve to improve our circumstances. When you look closely, you’ll find our collective story brimming with determination, progress, innovation, and growth.

I could pull up a chart of the S&P 500 to show its enduring upward trend, but today, let’s explore current investor sentiment using data from the American Association of Individual Investors (AAII).

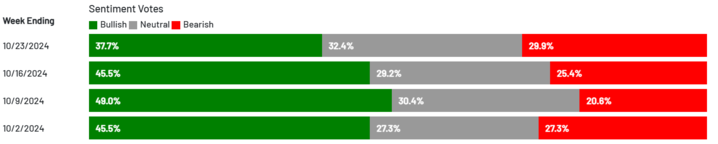

Last week's stall in the S&P 500 (-0.93% at the time of writing) coincided with a dip in sentiment. According to the AAII survey, only 37.7% of respondents felt bullish this week, down from 45.5% the previous week and over 50% a month prior. Bullish sentiment is currently at its lowest in six months.

As expected, the decline in bullish sentiment translated to increased bearishness, with 29.9% of investors expressing negative sentiment—up 9.3% over the past two weeks from a recent low of 20.6%.

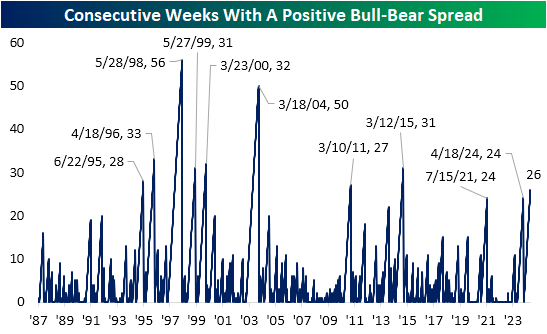

But let's look at the data as a whole: Bullish sentiment still outpaces bearish by 7.8%. This might seem minor, but it isn't when you consider we've seen 26 consecutive weeks of prevailing positive sentiment.

This string marks a historically long period, surpassing the 24-week series in July 2021 and April 2024. It’s the longest since 2015, and since then, sentiment has been markedly bullish for more than six months only seven other times.

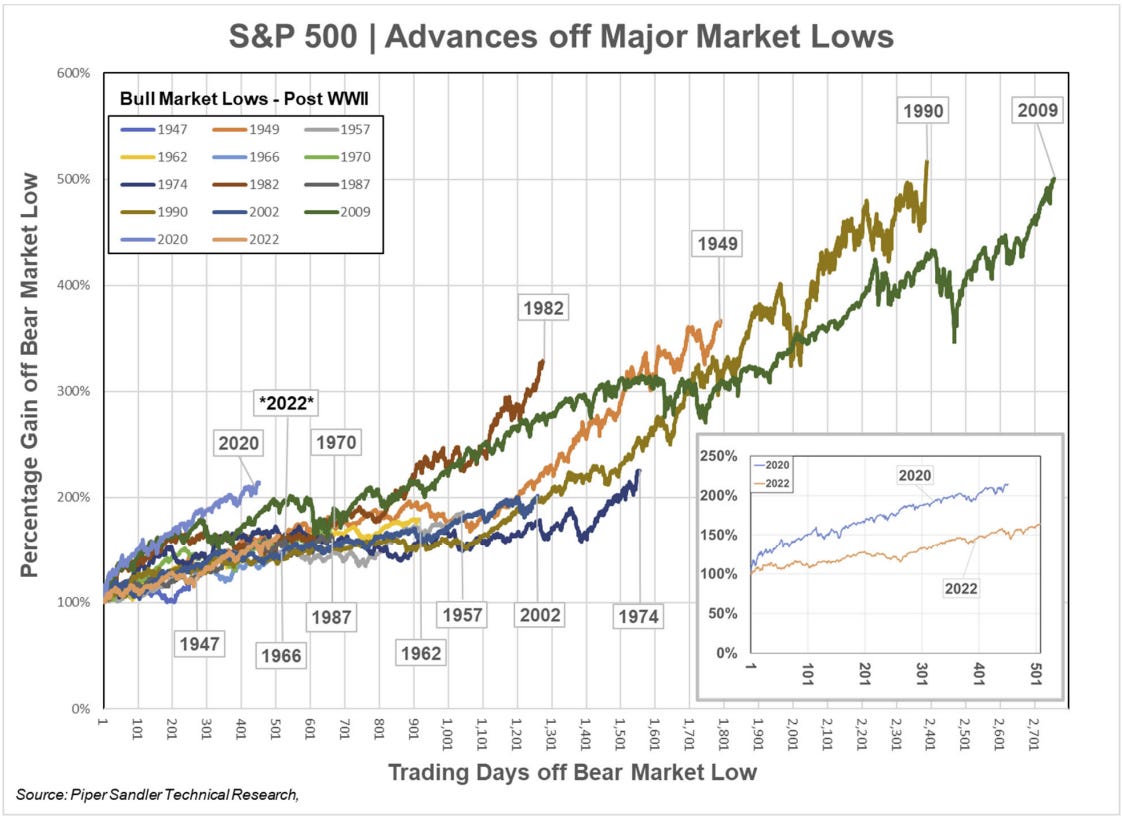

Moreover, we’re in the third year of a bull market following the October 2022 lows. Historically, uptrends from market lows last about 1,147 days on average. We're currently only at day 507, not even halfway through.

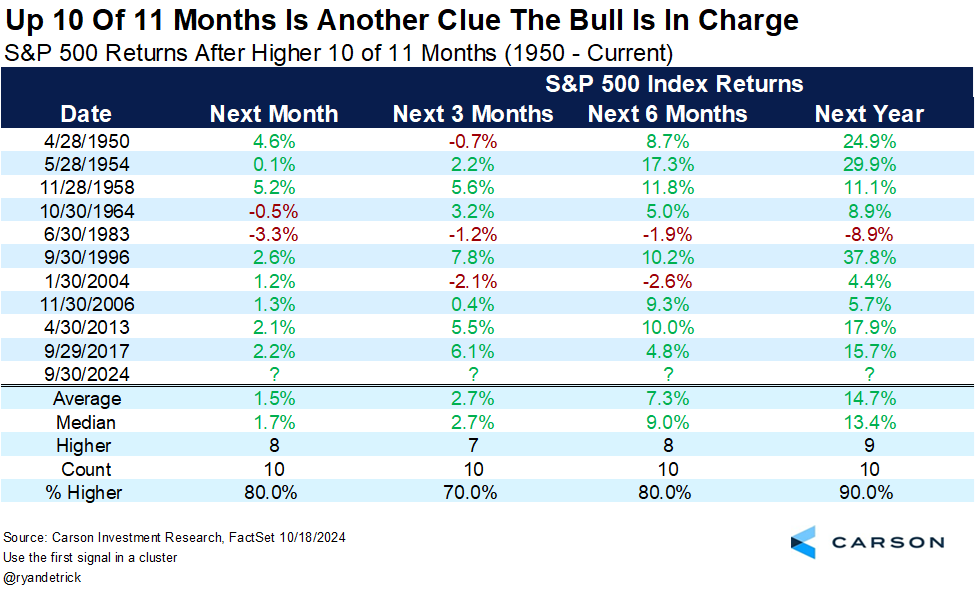

The strong track record of a bullish market extending up to 10 months suggests this could continue over the next 6 to 12 months.

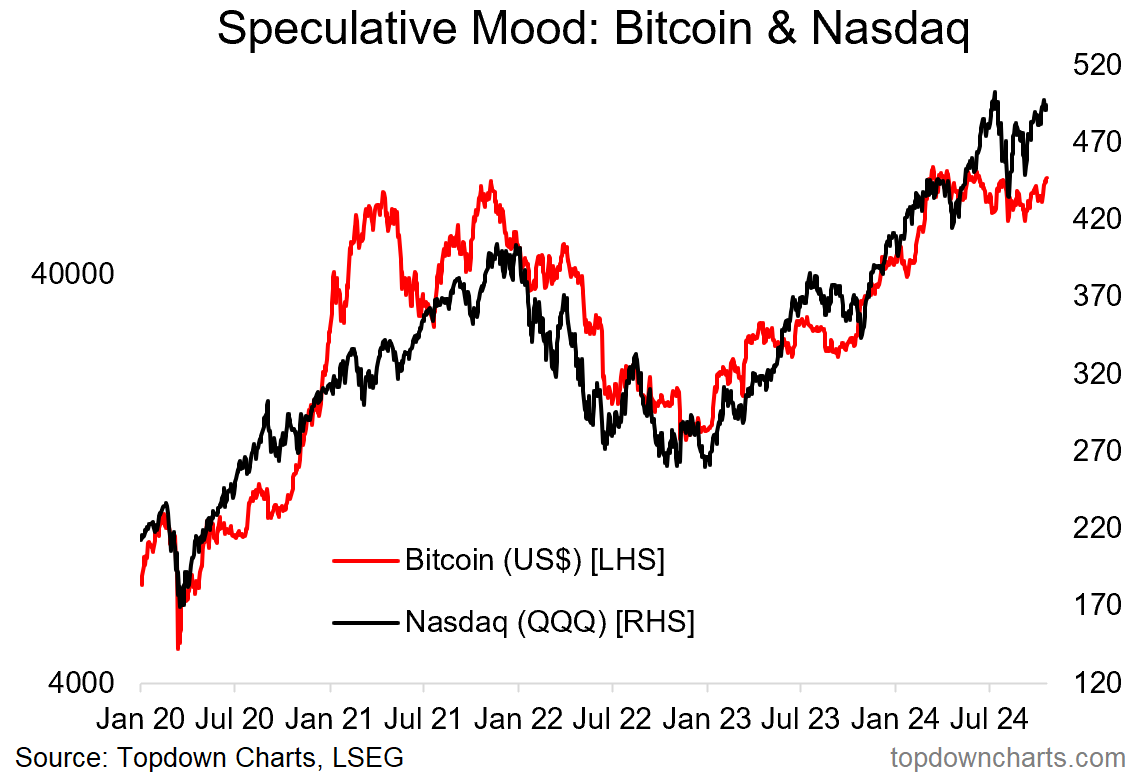

When we shift focus to Bitcoin, which often mirrors Nasdaq's movements, we observe a significant positive sentiment shift. Optimism may stem from potential election outcomes, an absence of bad news, or anticipated Fed rate cuts.

This sentiment is likely lifting Bitcoin’s trends alongside, after what many described as a lateral market phase for the cryptocurrency.

Until next time!

***

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, counsel or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. I would like to remind you that any type of asset, is evaluated from multiple perspectives and is highly risky and therefore, any investment decision and the associated risk remains with the investor.