It was a bit of an off day. The gap down had all the makings of a substantial sell-off (one I tried to short), but in the end, it was longs who came out on top.

The question for today is if yesterday's action can deliver a challenge on the day before yesterday's highs, and get past them on a way to challenge all-time highs.

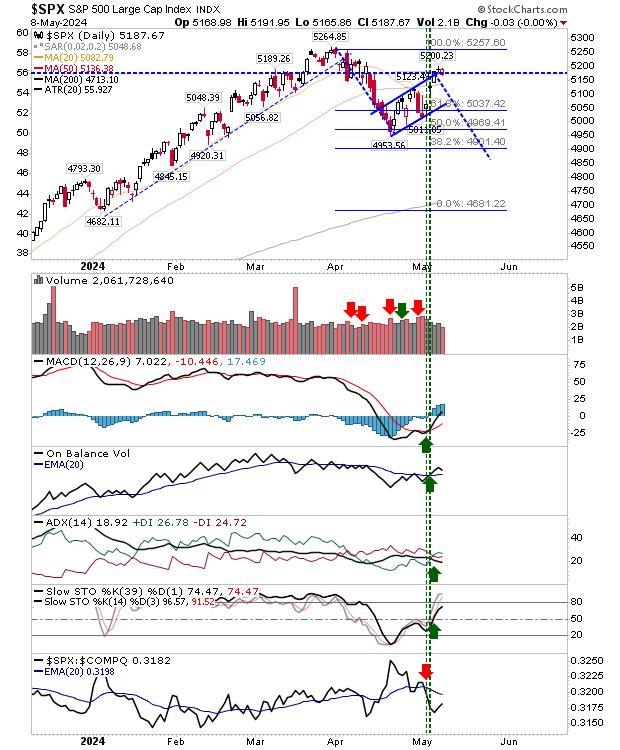

The S&P 500 is the best of the indexes. The day finished flat, but yesterday's action remained close to yesterday's doji. It's the index most likely to follow through today.

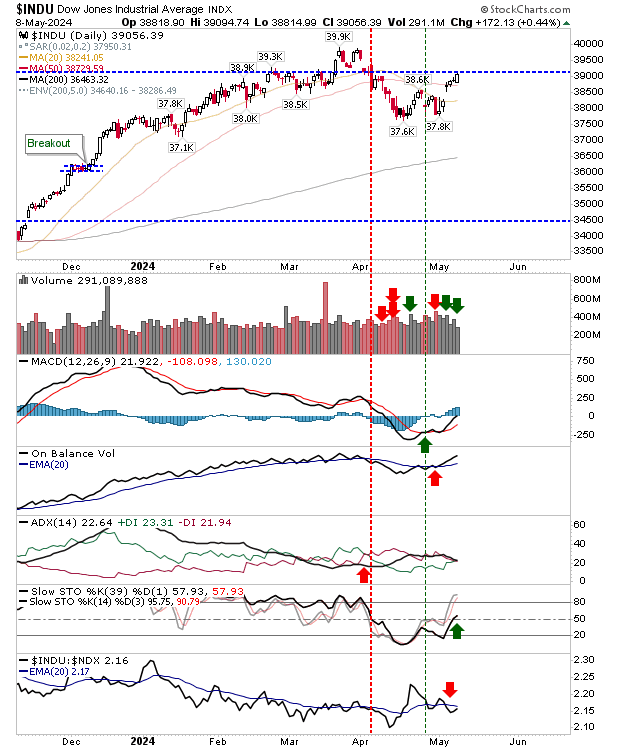

On the subject of Large Cap indexes, the Dow Jones Industrial Average actually pushed beyond yesterday's candlestick, although it's up against another resistance level.

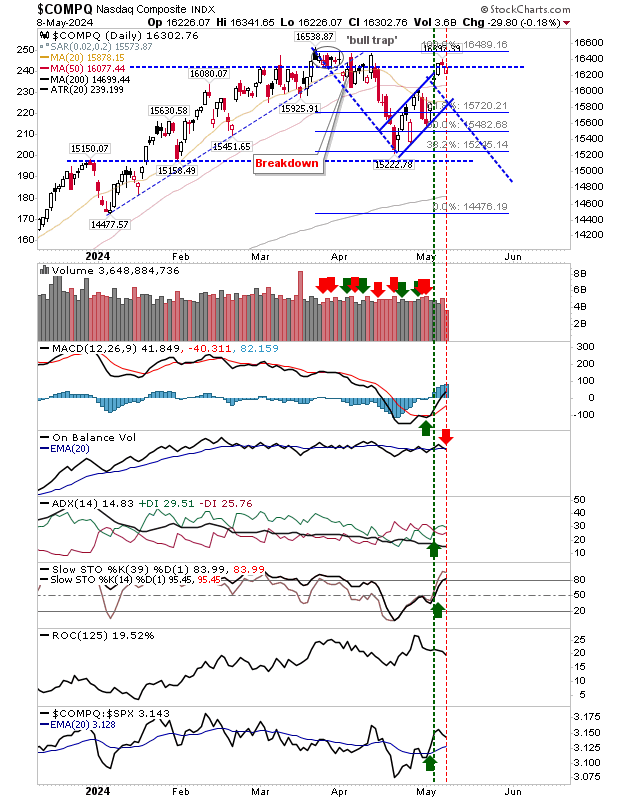

The Nasdaq is next in line, although we could be looking at a bearish 'evening star' despite yesterday's gain. Yesterday's gain wasn't enough to prevent a new 'sell' trigger in On-Balance-Volume.

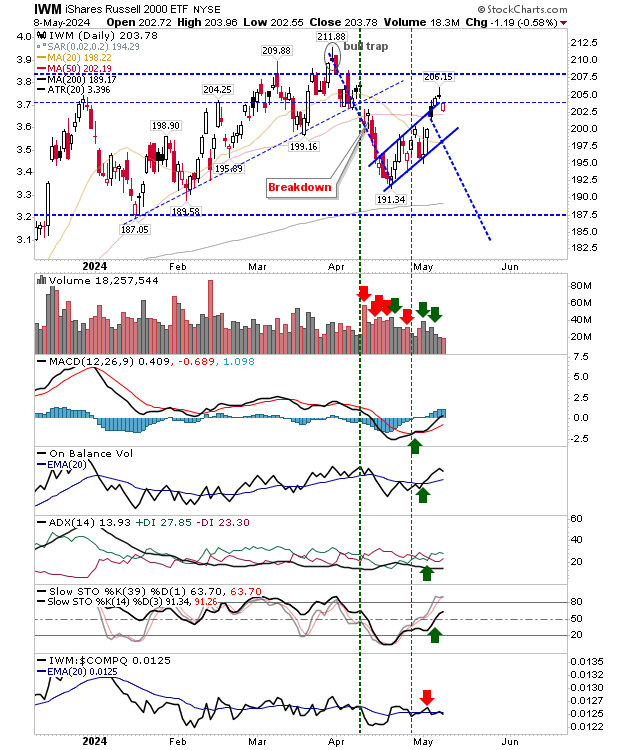

While the Russell 2000 (IWM) has the most well-defined bearish 'evening star', although the pattern typically requires a standard red candlestick as the third candlestick for the pattern (not the one delivered).

It was interesting to see volume drop across the pattern, typical for a "bear flag", so I would not be surprised to see yesterday's gains reversed. Technicals are net positive, so there is work to do if this is a bearish scenario.

Heading into today, watch the Dow Industrial and S&P 500 indexes for leads. If bullish momentum is maintained and the aforementioned indexes post gains, then I would expect the Russell 2000 to push higher.