Stocks finished the day higher, thanks to a buy imbalance that gave the market a lift in the final 10 minutes. Technically, not much changed yesterday, and that is because the index just churned sideways most of the day.

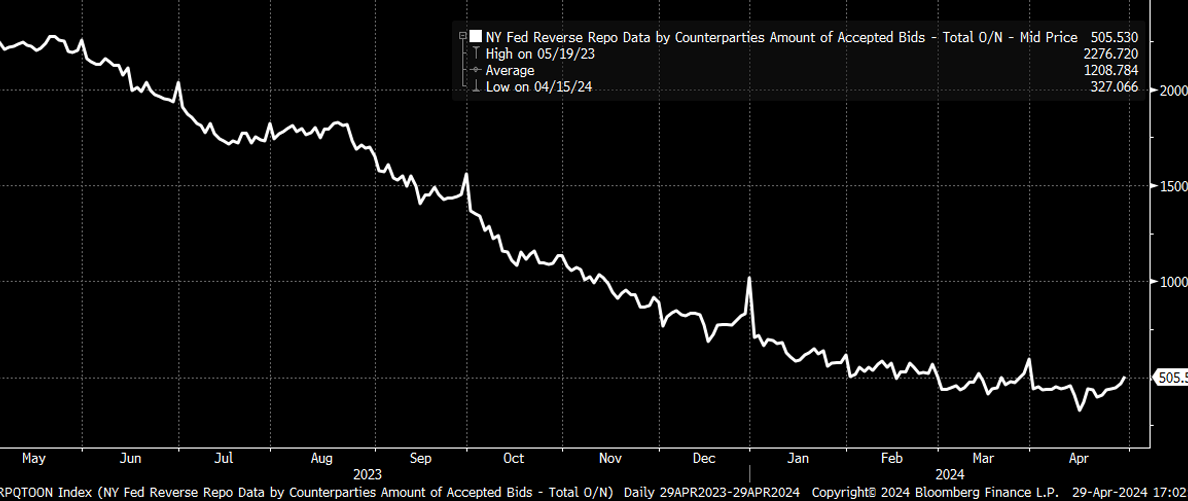

Liquidity is still dropping, with the reverse repo facility yesterday rising to $505 billion, while the TGA remained unchanged from Friday.

Some of the higher moves in the reverse repo facility could be due to the end of the month, and some of it could be because of Treasury net issuance. We won’t know until Wednesday because that is when month-end cash will exit the reverse repo facility.

Treasury to Step Up Borrowing?

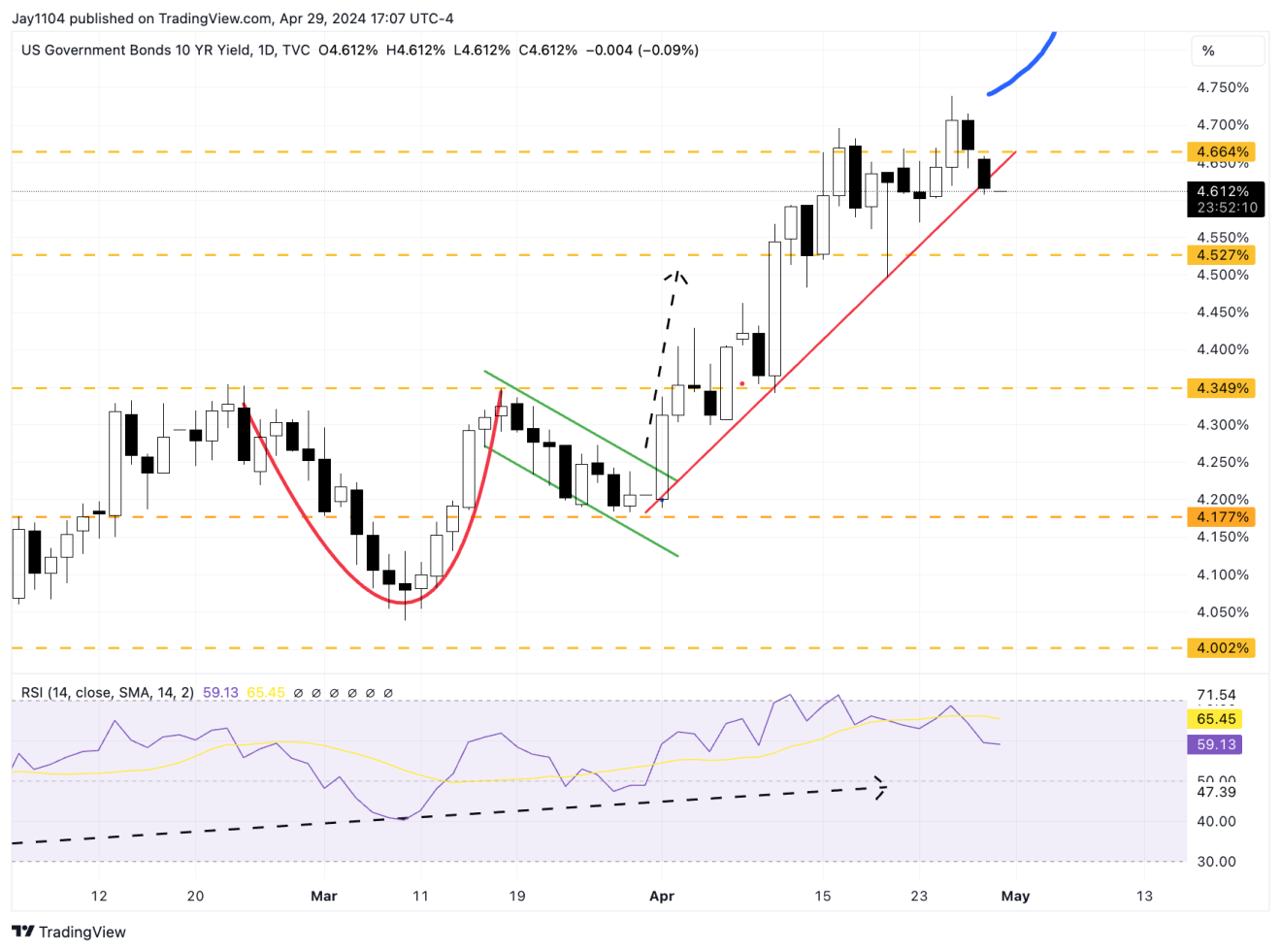

Additionally, the Treasury indicated yesterday it would increase its borrowing by $41 billion to $243 billion for the April to June quarter, which was higher than its previous guidance, and would need to borrow $847 billion in the third quarter while assuming a TGA of $850 billion.

This sounds like more than what the market expected, but at least now, the market will have to wait until Wednesday at 8:30 AM ET to find out how the Treasury plans to issue the debt. At least as of yesterday, rates haven’t moved very much. Most of what I have read suggested that there would be no change to coupon issuance, but that may have changed now.

BoJ Intervenes

When the Yen hit 160, Japan decided it had enough and intervened in the FX market. It will be interesting to see how long it takes for the market to test the 160 level again, assuming the US data supports such a move.

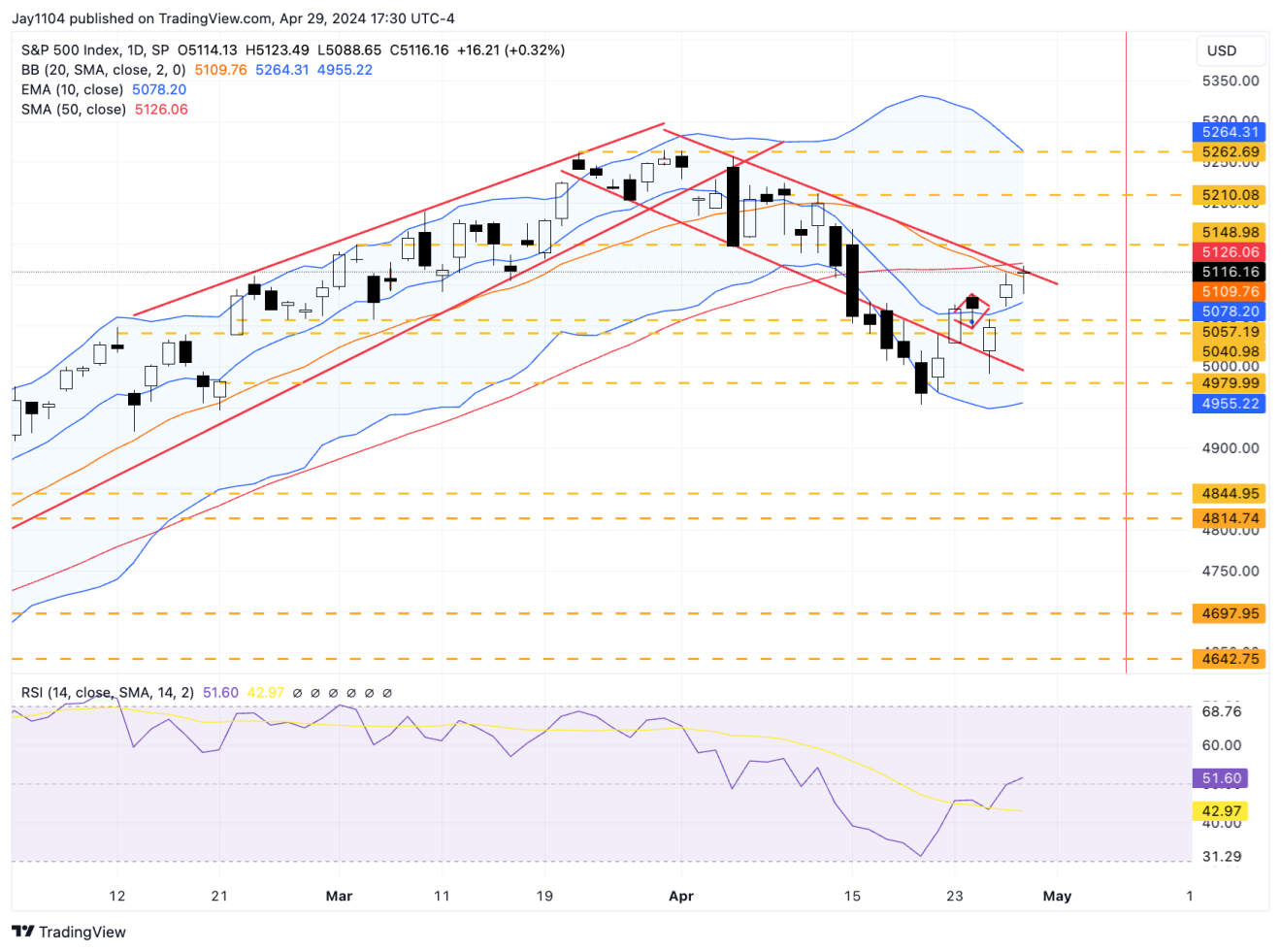

S&P 500 Stalls at a Resistance

In the meantime, the S&P 500 traded along the downtrend that was established a few weeks back. There is not much to say here as we continue to hover around the 20 and 50-day simple moving averages. This area should continue to act as resistance for another day or so.

Things will start getting more exciting today and continue through Friday, so there is no reason to make this longer than it needs to be.