During a mixed day trading session yesterday, I was unable to gain traction on my positional calls, resulting in a small net loss. This showed up as a narrow range doji for both the Nasdaq and S&P 500 on the technical charts.

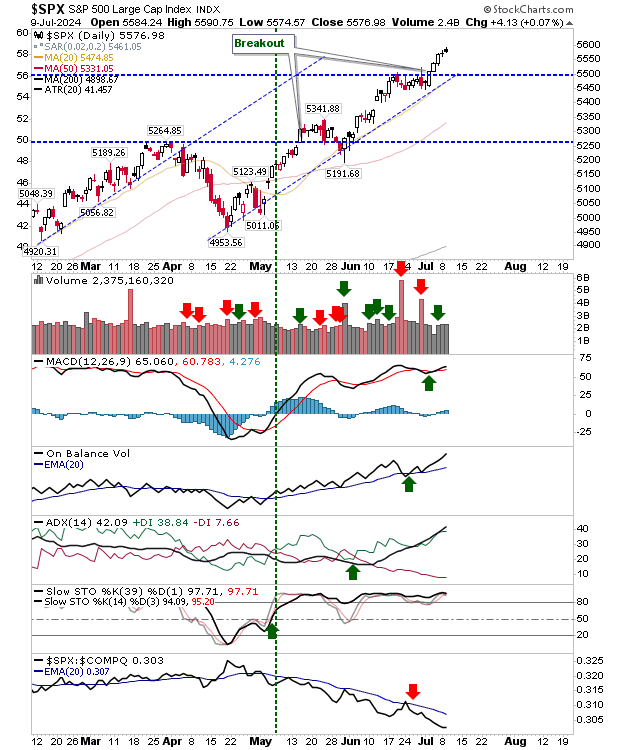

For the S&P 500, there was a fresh 'buy' signal in the MACD as part of the 5,500 breakout. Volume edged a little higher, counting as registered accumulation. The slowdown in the rally opens up for a reversal and test of breakout support.

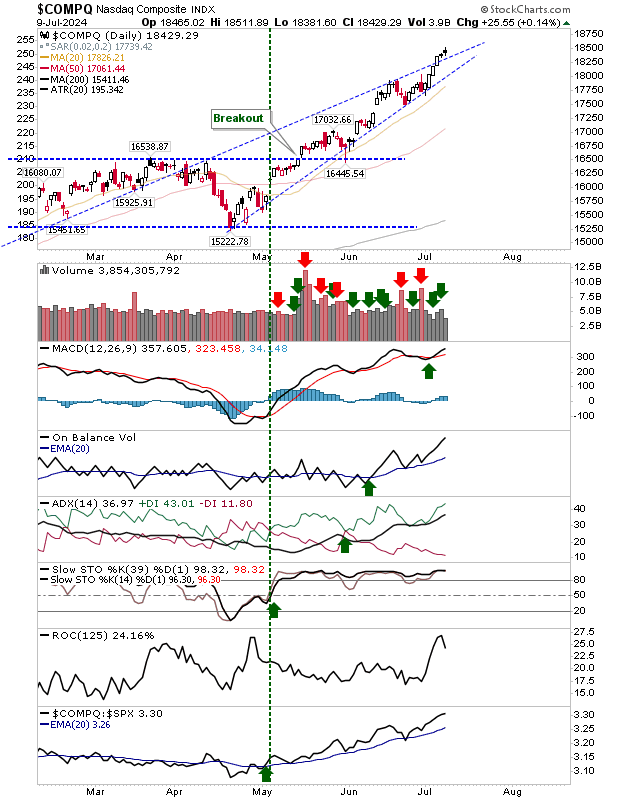

The Nasdaq edged over bearish wedge resistance, also on the back of a new MACD trigger 'buy'. The index is more vulnerable to a reversal as a cut below wedge support would likely deliver a greater loss than a similar breach in S&P 500 support.

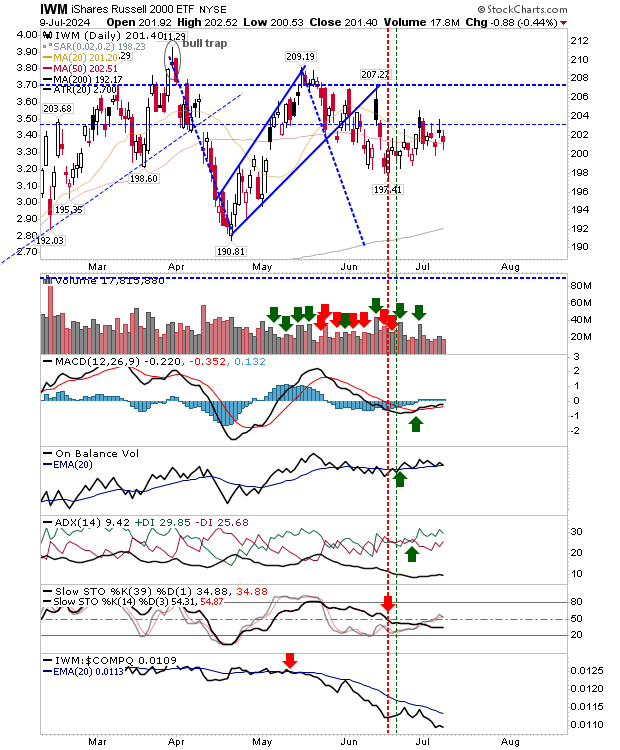

The Russell 2000 (IWM) experienced a scrappy day. The 20-day and 50-day MAs have both converged, but neither can play as consistent support.

I think this needs a larger move to the 200-day MA before buyers can work something. Slow stochastics continue to drift lower below the bullish mid-line.

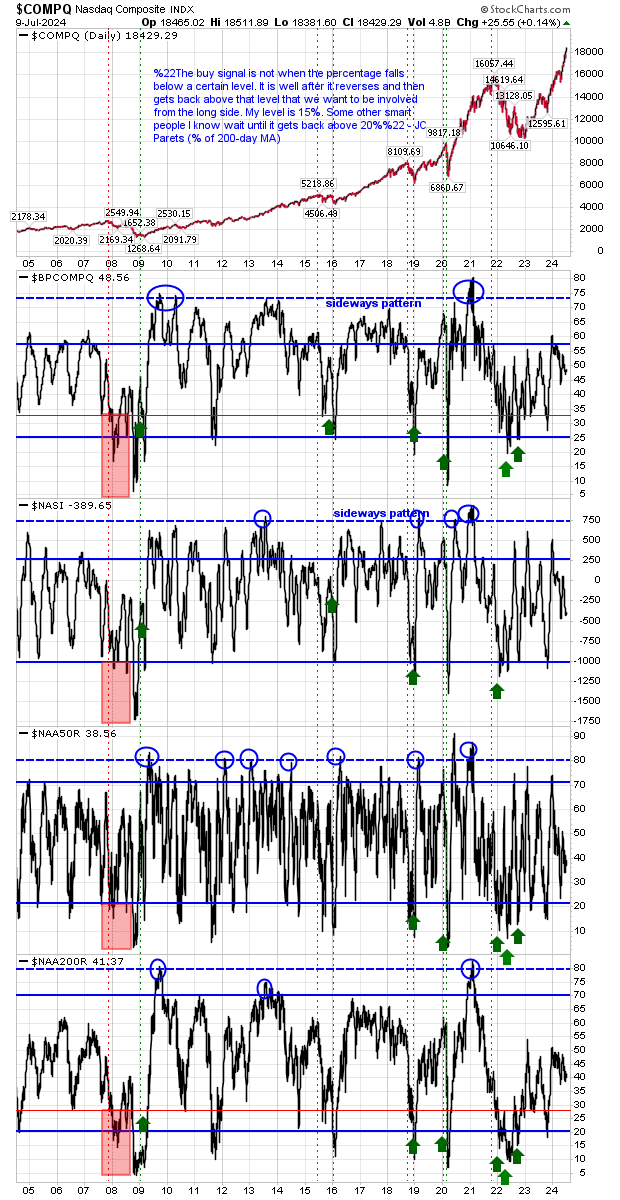

I will be watching Nasdaq breadth metrics closely. There may be one more leg up before the inevitable downswing emerges.

We do have a new secular bull market as long as the Nasdaq stays above 16,500, but even a drop below this would only slow the advance. Should the latter happen, then I would be looking for oversold breadth metrics to signal a bottom.

For today, I will be looking for pre-market downside for a probable gap down in the S&P 500 and Nasdaq.

If pre-market holds, then buyers will have the opportunity to create an opening gap to new highs, although it does seem like sellers have the edge. The Russell 2000 ($IWM) remains a mess and I don't expect much from it in either direction.