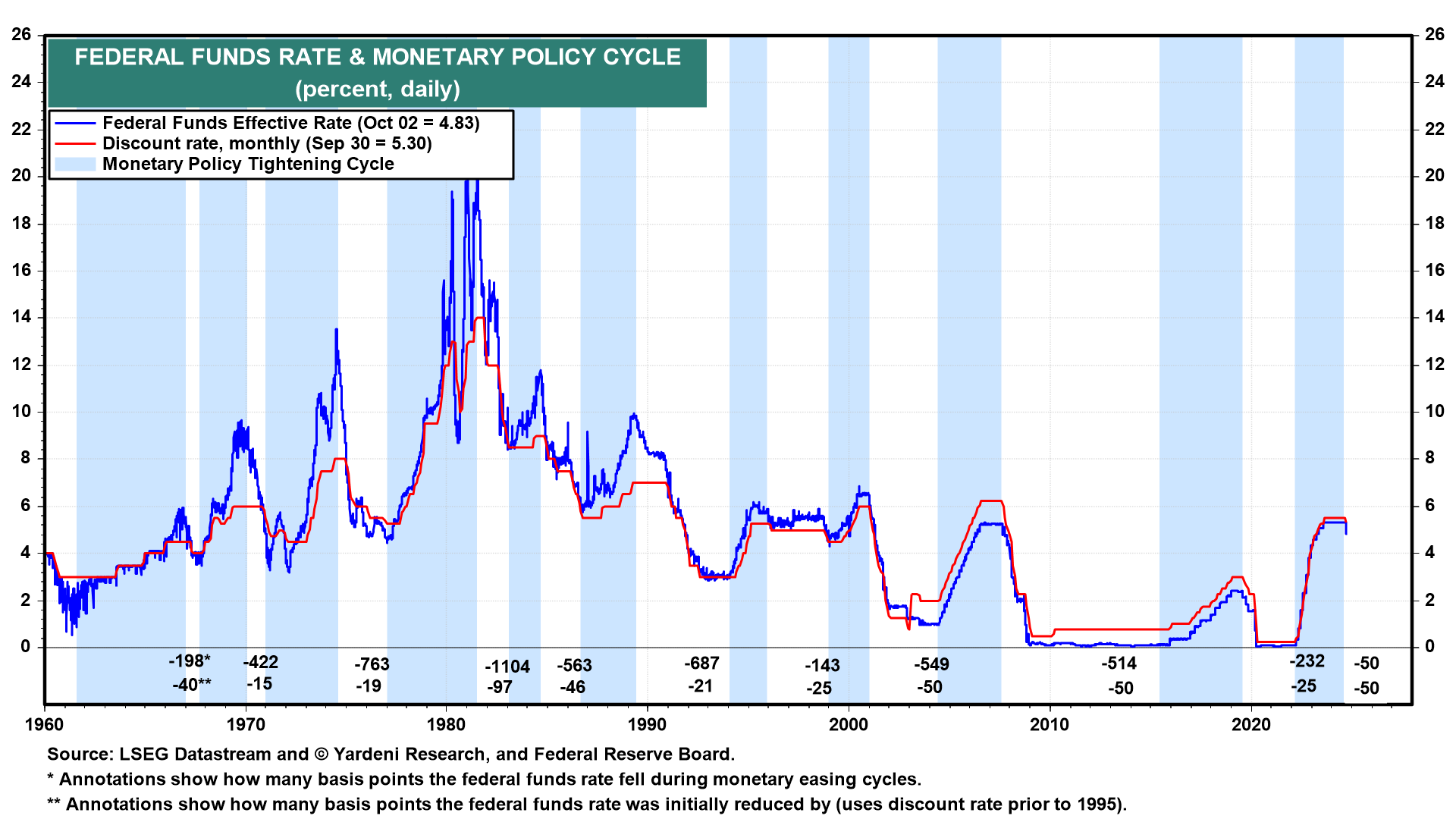

Remember the "higher for longer" mantra about the outlook for the federal funds rate (FFR) during the spring? It turned into "lower and sooner" this summer in response to the economy's soft patch.

After Friday's strong employment report, the consensus might pivot to "no rush to ease further" during the fall. We can't rule out "higher for longer" making a comeback this winter. We are in the none-and-done camp for the rest of this year.

In the past, once the Fed started cutting the FFR, it was followed by a quick succession of additional rate cuts (chart). So far, the difference this time is that there's no credit crisis, credit crunch, or recession.

Instead, the economy continues to grow at a solid pace around 3.0% on a y/y basis. So there's no rush for the Fed to ease, especially if the economy continues performing well.

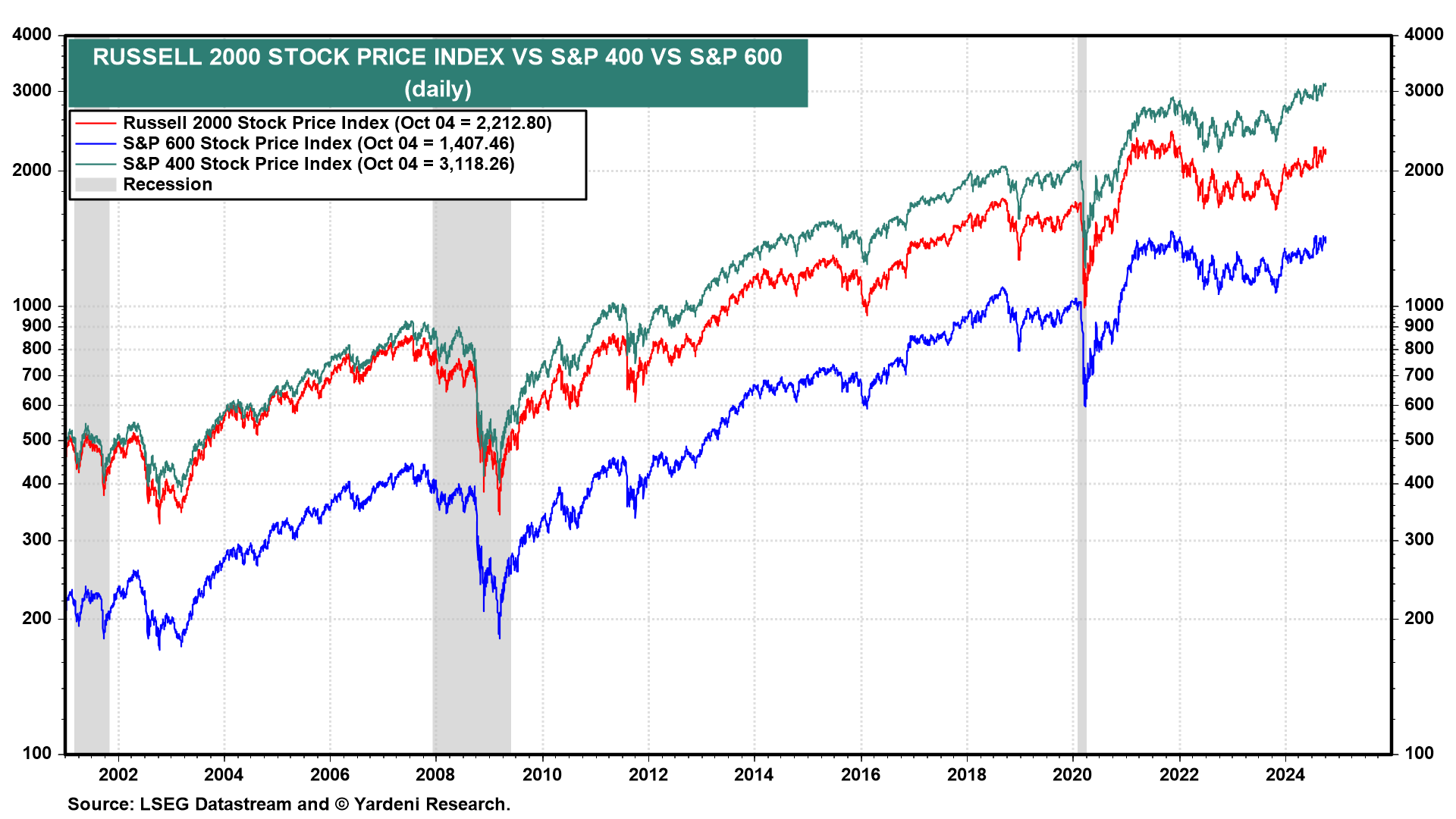

In recent weeks, everyone agreed that lower interest rates should be bullish for smaller companies with floating-rate debt.

The Russell 2000, S&P 400 MidCaps, and the S&P 600 SmallCaps have been rallying this year on expectations of Fed easing (chart). So have the S&P 500 Utilities and Real Estate sectors.

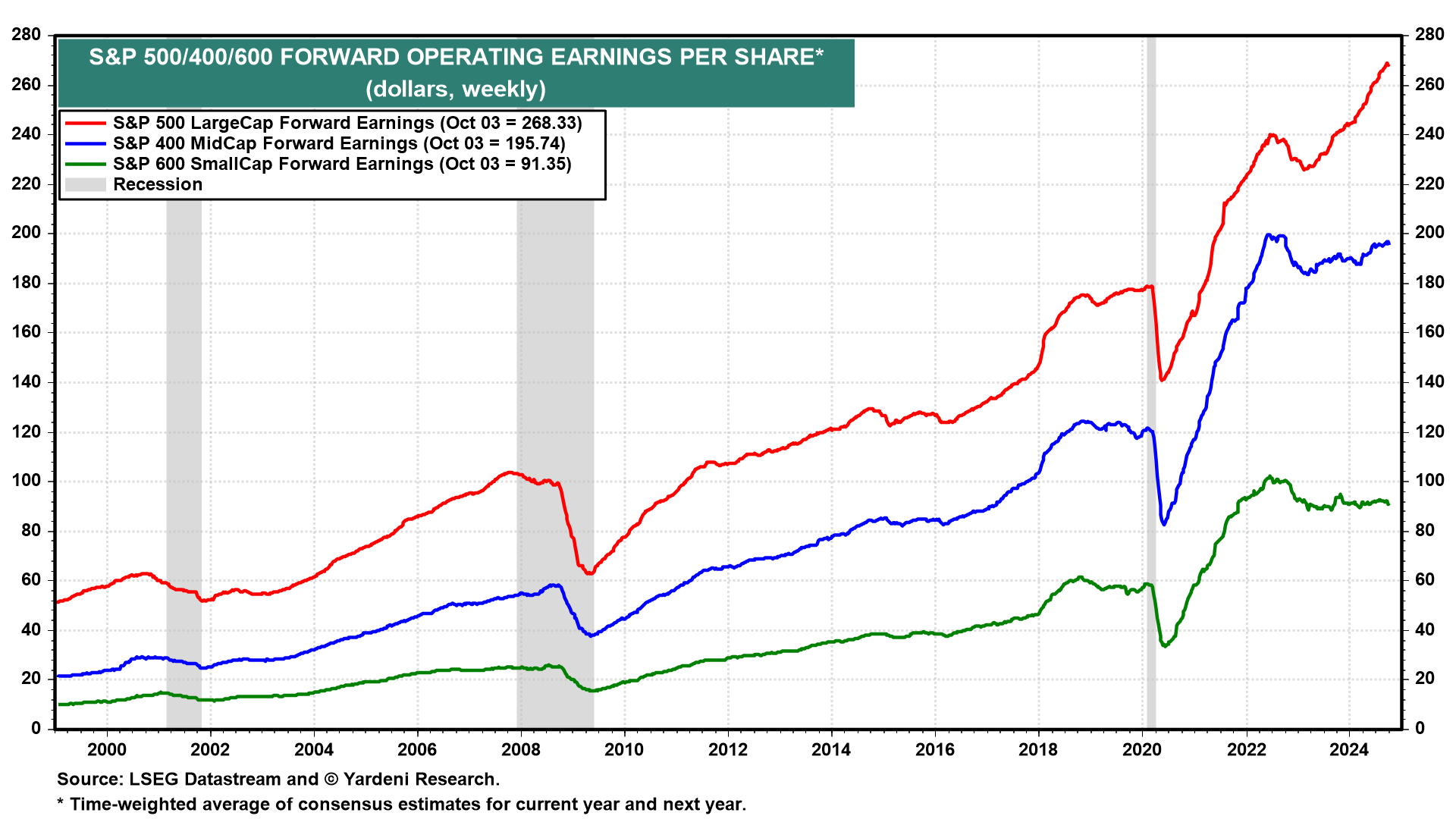

If the new consensus narrative shifts back toward higher-for-longer interest rates, that will be because the economy continues to perform better than expected, and so will earnings.

If so, that shift should favor the S&P 500 relative to the Midcaps because the former's forward earnings is benefiting more from a better economy than the latter for several reasons we have previously discussed (chart).

We still expect that the bull market in stocks will continue to broaden, but it is more likely to broaden from the Magnificent-7 to the S&P 493 than to the S&P 400/600 SMidCaps.

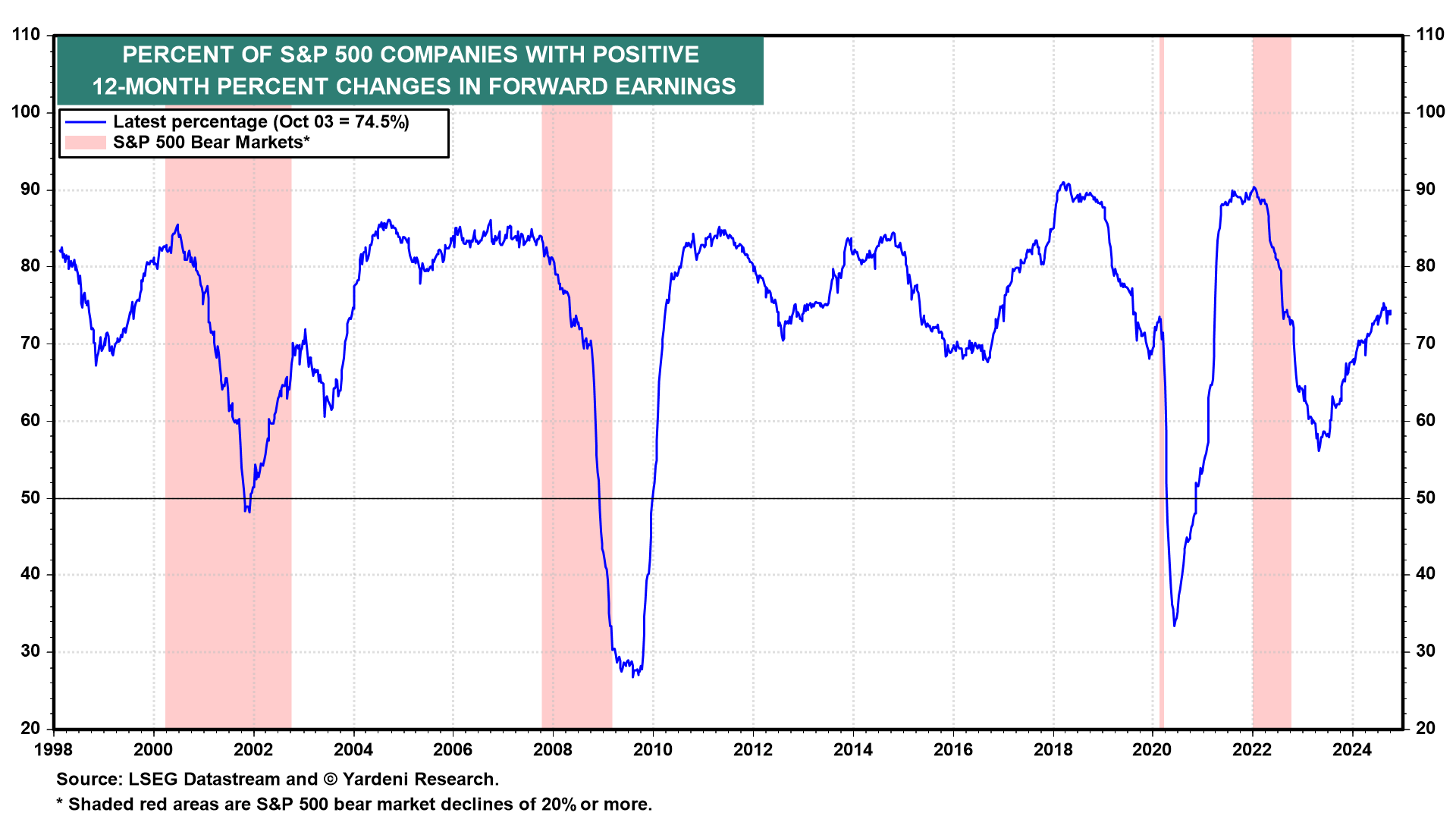

As the economy continues to expand, more of the S&P 500 companies are showing positive y/y comps for forward earnings (chart).

We asked Michael Brush for an update on insider trading:

"Insiders overall remain neutral as the market hits new highs. But there were targeted, large and actionable insider purchases last week in tech, biotech, the airline sector, fintech, and commercial real estate."