Yesterday was a boring day, and given the amount of overload we will be getting starting today morning, you can’t blame the market for holding in place and trading sideways since Thursday. The S&P 500 topped out last Thursday at 5,490 and has tested that level four times.

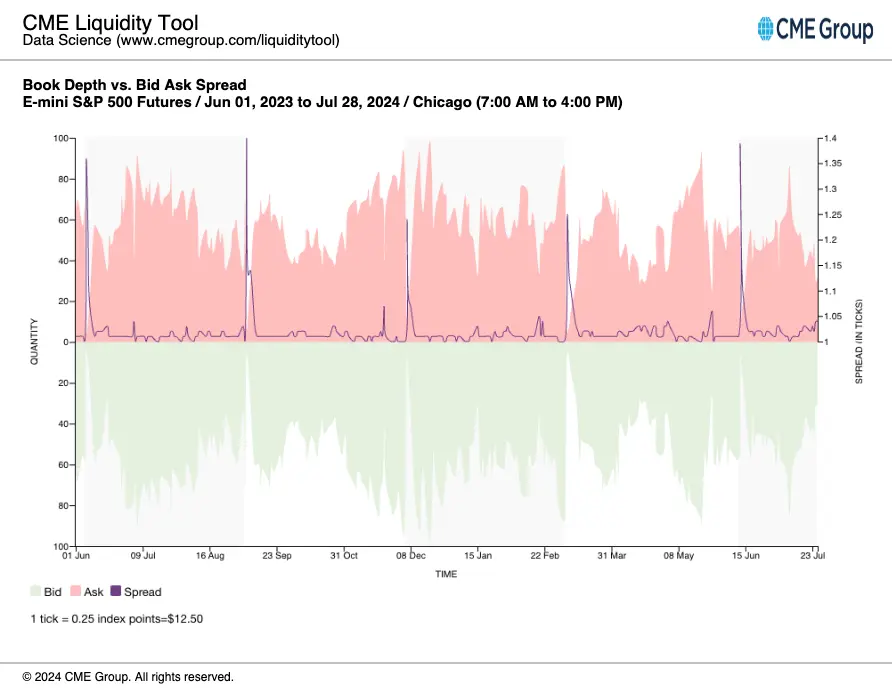

With the zero gamma level around the 5,520 region and liquidity thinning out, these conditions make it hard to predict what could happen next. The S&P 500 could just as easily rip to the 5,550 level as it could drop to the 5,400 level.

Neither of those spots is out of reach. It doesn’t take much to get this market moving, which makes the fact that it hasn’t been able to get above 5,490 interesting. The conditions for the index breaking out and up seem more favorable, given the negative gamma regime and lack of liquidity than for it to break down because it wouldn’t take much for someone to try to sweep the top of the book to move the market.

That is pretty much what it seems like has been happening in the future on Sunday night, but at least yesterday, that didn’t pan out very well.

If I use some of my artistic drawing skills, I could almost make a case that the pattern formed in the S&P 500 over the past few days is an inverse cup and handle pattern.

Nasdaq 100 in a Pennant Pattern

Meanwhile, the pattern in the NASDAQ seems a little bit less questionable than that of the S&P 500. The NASDAQ appears to be forming a pennant pattern.

Anyway, today starts the data dump and a significant earnings parade, so there’s no point in going on today about a non-event day.