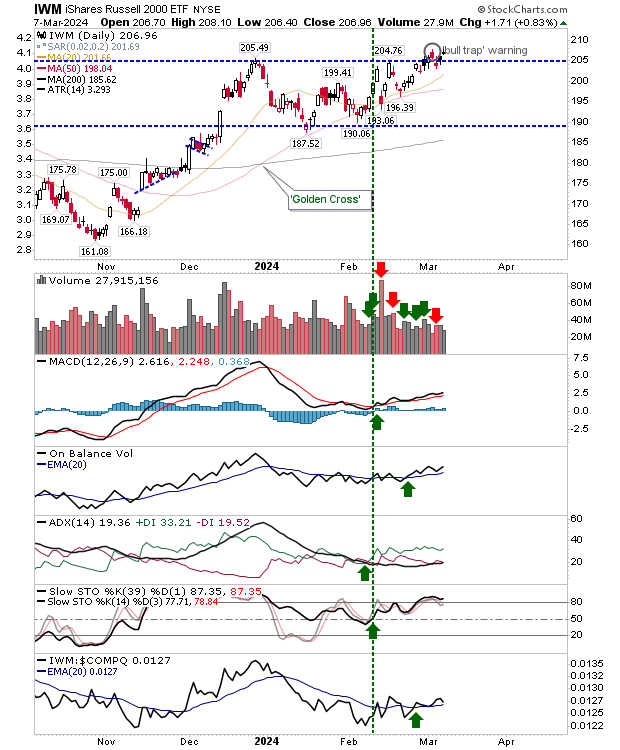

Yesterday was a bit of a mixed bag with all recording gains (good), but the Russell 2000 (IWM) finished with a 'black' candlestick (close less than open price) that leaves bulls pressured and vulnerable to additional losses.

In the case of the Russell 2000 ($IWM), the losses were not huge and selling volume was light and below the previous day's buying volume. Technicals remained net positive. The 'bull trap' is still the favored outcome following today's action.

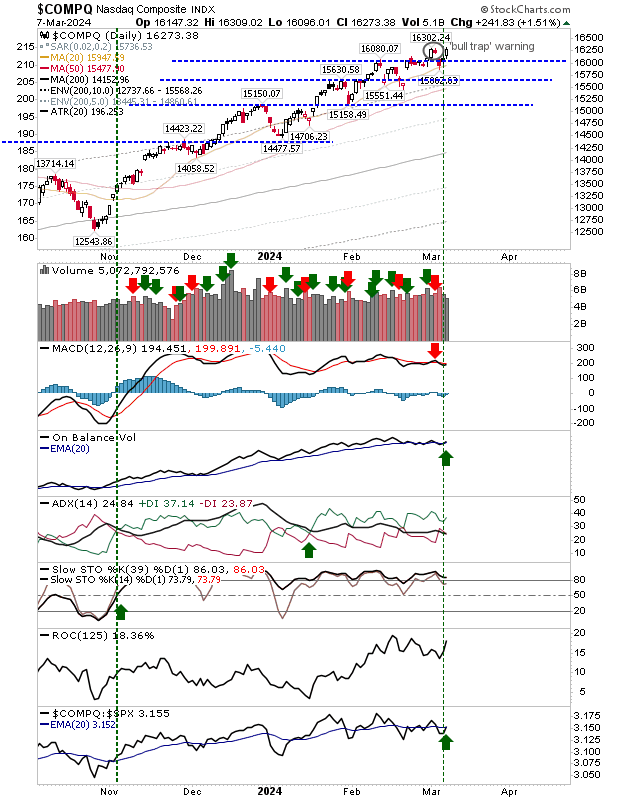

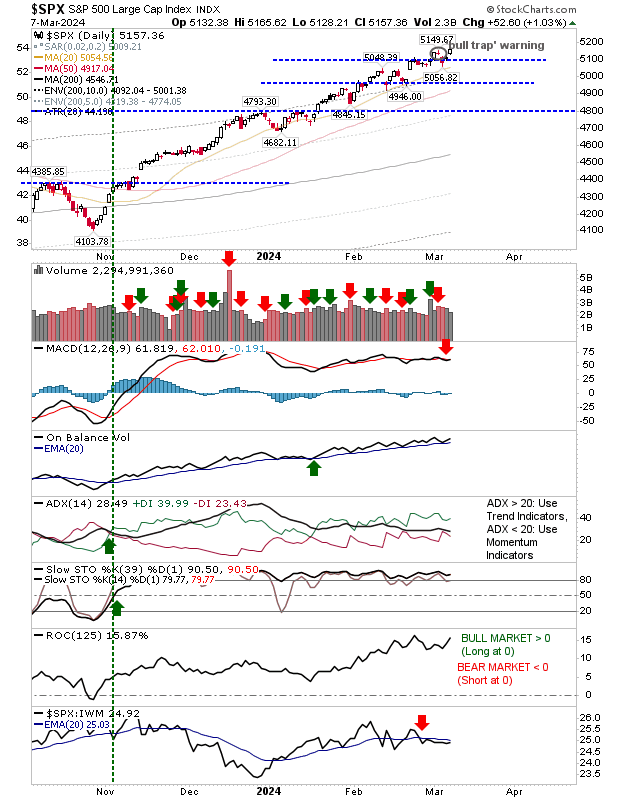

Things are more bullish for the S&P and Nasdaq. Both indices had registered potential 'bull traps', but both were able to post gains to challenge - and possibly negate - these traps. In the case of the Nasdaq, gains were enough to return a 'buy' trigger for On-Balance-Volume.

The worst of the "bull traps" are behind these indices, but it will take a close above the 'bull trap' high to negate the bearishness of this pattern.

The S&P 'bull trap' is holding to a flatlined 'sell' trigger in its MACD but has otherwise bullish technicals.

The index is underperforming relative to the Russell 2000 ($IWM) although this relationship too has flat-lined.

The likelihood is that all indices will continue their rallies and that the bearishness exhibited in the Russell 2000 will be negated by the more bullish setups in the Nasdaq and S&P.

None of the indices are signaling blow-out tops, where I would expect the angle of ascent to sharpen beyond the steady 45 degrees we are seeing now.