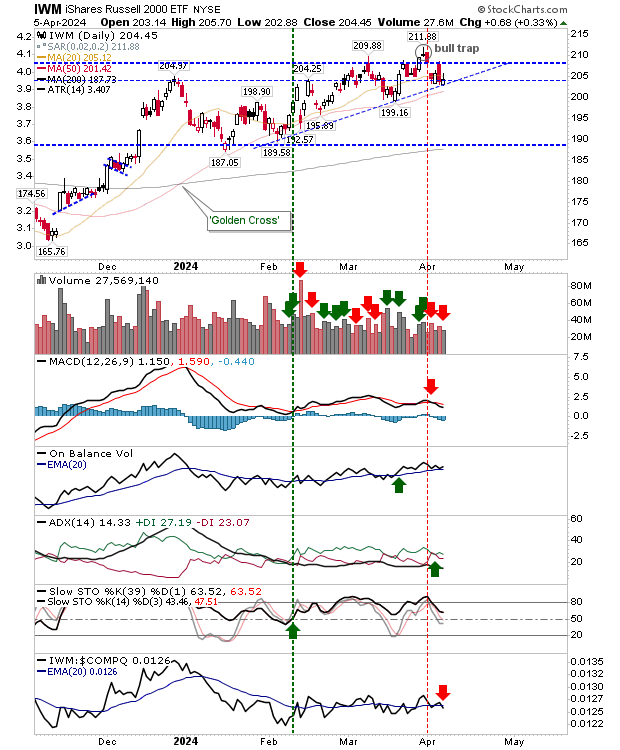

There wasn't much volume to Friday's trading, but there was enough to determine that buyers have stepped in at the trendline support in the Russell 2000 (IWM). There was no technical change to the index with only a whipsaw signal in relative performance against the Nasdaq, although the MACD remains on a prior 'sell' signal.

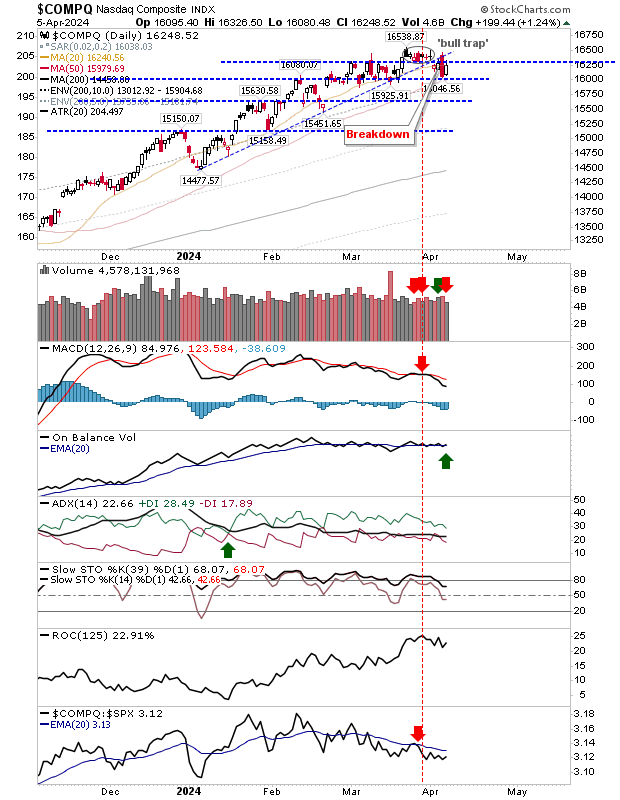

The Nasdaq recovered some of Friday's losses but remains a long way from challenging the 'bull trap' and is below breakout support. The index continues to underperform the S&P 500. On-Balance-Volume has flatlined against the signal line, although has moved back to a 'buy' signal.

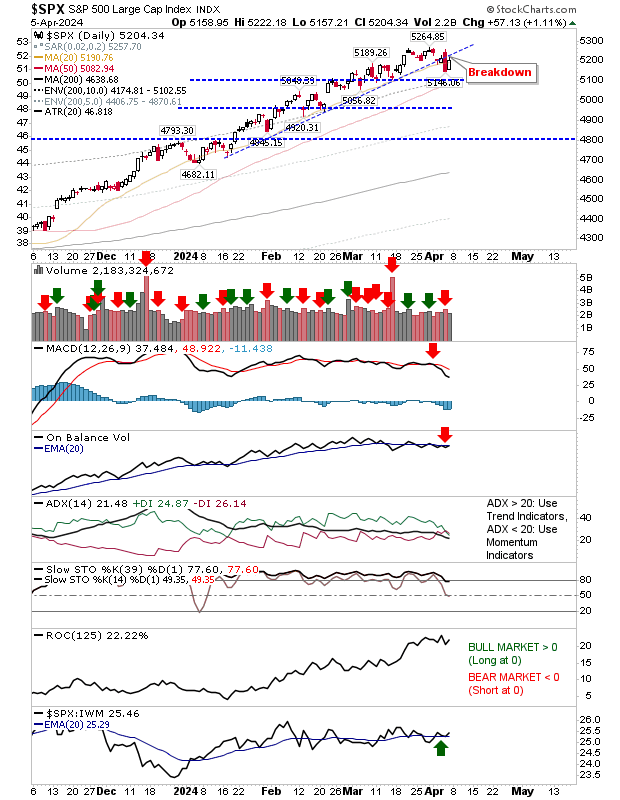

The S&P 500 similarly remains below trendline support when Friday's gain failed to recover this support. The index is outperforming relative to the S&P 500 but both On-Balance-Volume and MACD are holding to earlier 'sell' signals.

Today's lead will be the Russell 2000 ($IWM) continuing its move-off support. But, if this fails after the first half-hour of trading, then look to the Nasdaq ($COMPQ) and S&P 500 ($SPX) for a short opportunity, particularly if these indexes make it to trendline resistance (former support).