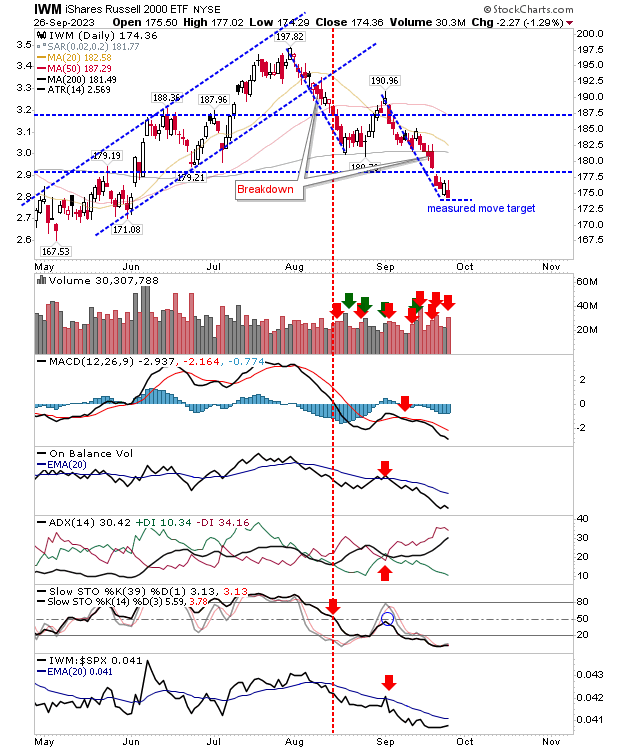

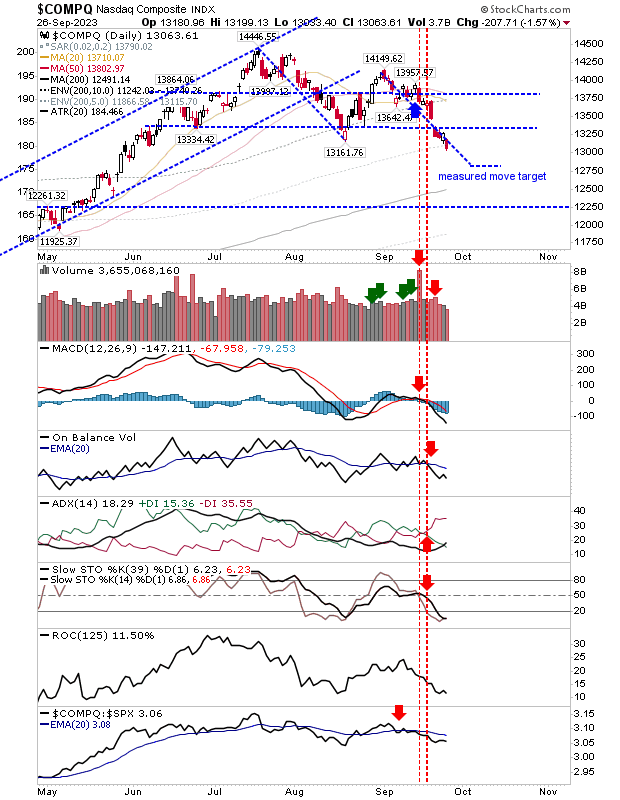

Yesterday was a slam dunk day for the bears as whatever support, such as the retention of 4,325 in the S&P 500, was sliced apart. We are now looking at measured move targets for the Russell 2000 (IWM), S&P 500, and Nasdaq, and tests of their respective 200-day MAs.

The S&P 500 is on course to reach its measured move target, with a good chance for a follow-through to its 200-day MA. Technicals are net negative, but the index is still outperforming peer indexes.

The Russell 2000 (IWM) will reach its measured move target having already pushed below its 200-day MA. Yesterday also marked confirmed distribution to go with an ugly technical picture. If we do see a bounce, I would expect it to stall out at its 200-day MA.

The Nasdaq is furthest from its measured move target and its 200-day MA. If the S&P 500 tests its measured move target, with the Russell 2000 likely to have done so by the time you read this, then the Nasdaq should do likewise.

On daily time frames (at least on a six-month lookback) there isn't a whole lot of support for this decline to lean on, particularly for the Russell 2000. The S&P 500 and Nasdaq have their 200-day MAs, but should these fail, then we will need to look again at weekly charts for targets.