Yesterday's action looked more like a Triple Witch Friday than anything you would expect to see on a Monday.

A peak of the news mentioned a Fed rate cut and positive news from Intel (NASDAQ:INTC), but I was surprised with the level of trading in the S&P 500 and Nasdaq.

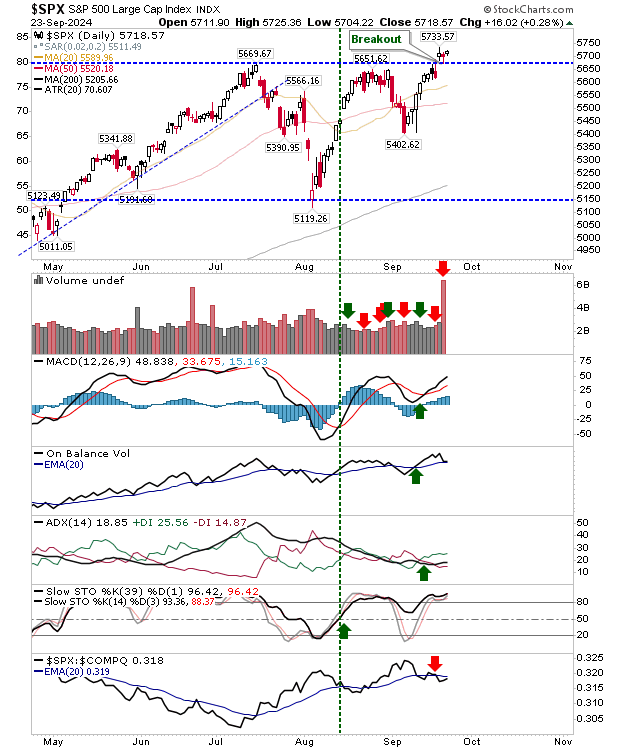

The S&P 500 has done little over the past couple of days, despite doing what is most important, and that's holding breakout support.

The big spike in volume did little to change the overall picture. There is a shift towards relative underperformance against the Nasdaq, but other technicals are bullish.

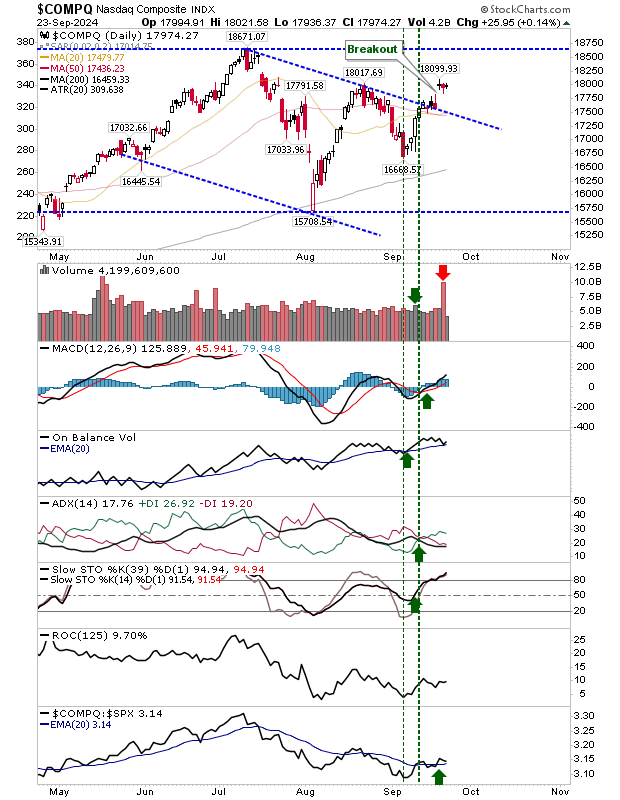

Likewise, the Nasdaq has held on to its breakout gap, although remains someway from challenging July highs. Technicals are net positive, and the index is outperforming both the S&P and Russell 2000 (IWM).

While its possible we could see a move into the breakout gap, Friday's action suggests this is done, and the next step now is a move to challenge 18,650s.

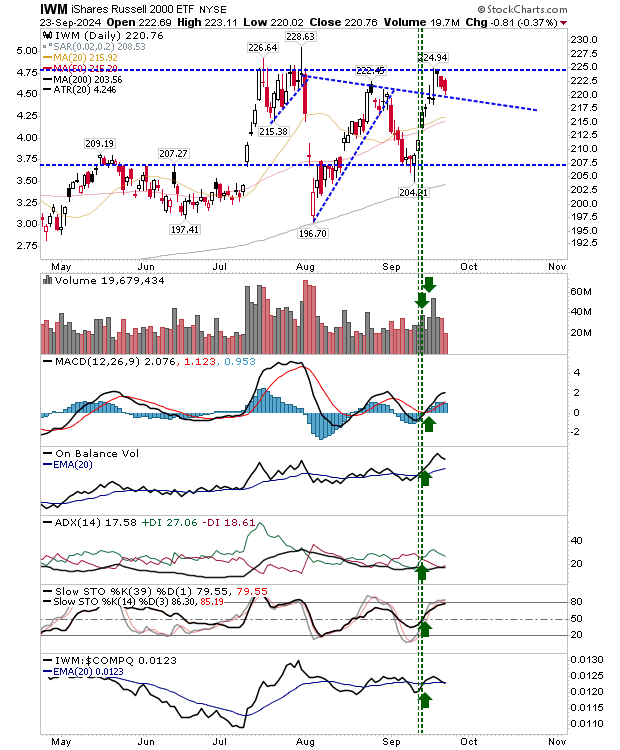

Last week I talked about the symmetry in the Russell 2000 ($IWM), but the outcomes have been very different.

The reaction we are seeing now in the index, despite the last two days of losses, is far more positive. The index is holding support of former trend resistance (even if the critical $225 level holds as resistance).

Technicals are net positive and selling volume has been well below days of buying. If you were a swing trader, I would say buying at yesterday's close could prove profitable.

For today, it might be more of the same, but at some point, I will want to see some upside follow-through as indices don't look like they want to sell off.