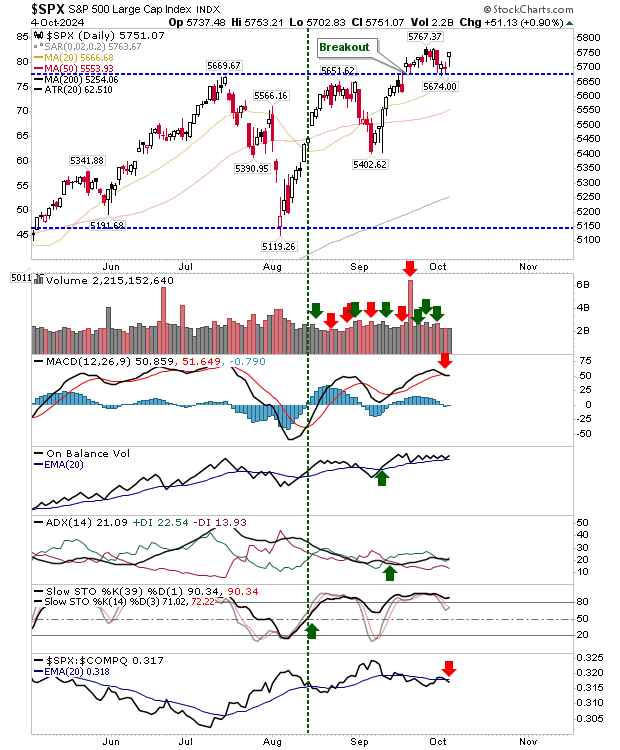

The S&P 500 saw a decisive breakout in September, and so far, it’s managed to hold onto those gains with relative ease.

While the index is lagging behind the Nasdaq, price action remains the key factor. Despite a MACD 'sell' signal, Friday's price movement suggests that this bearish signal could potentially reverse soon.

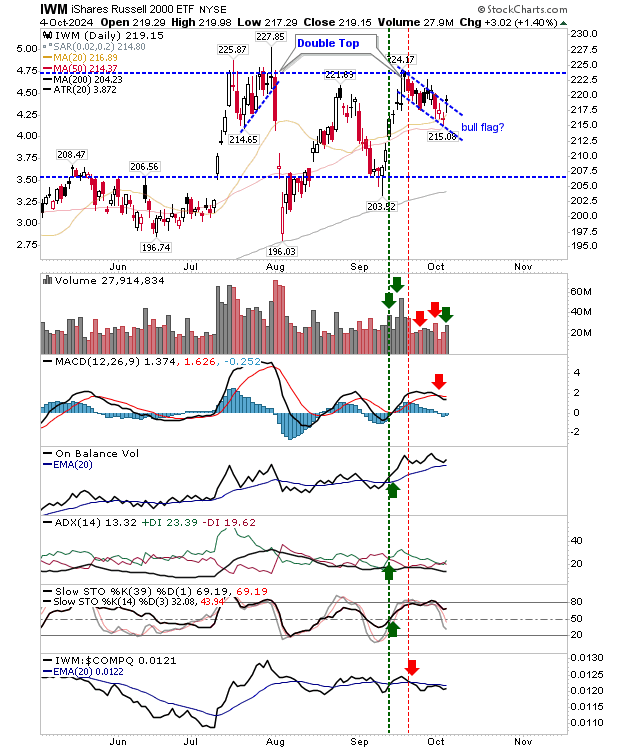

The Russell 2000 (IWM) may be playing towards a double top, but until there is a confirmation break of $206.50, the index remains range bound.

Friday saw a successful rally off nearby 20-day and 50-day MAs on higher volume accumulation.

There is still a MACD trigger 'sell' to work off, but other technicals are bullish. If there is a disappointment, Friday's 1%+ gain came with an indecisive doji, so no confirmed break from the 'bull flag'.

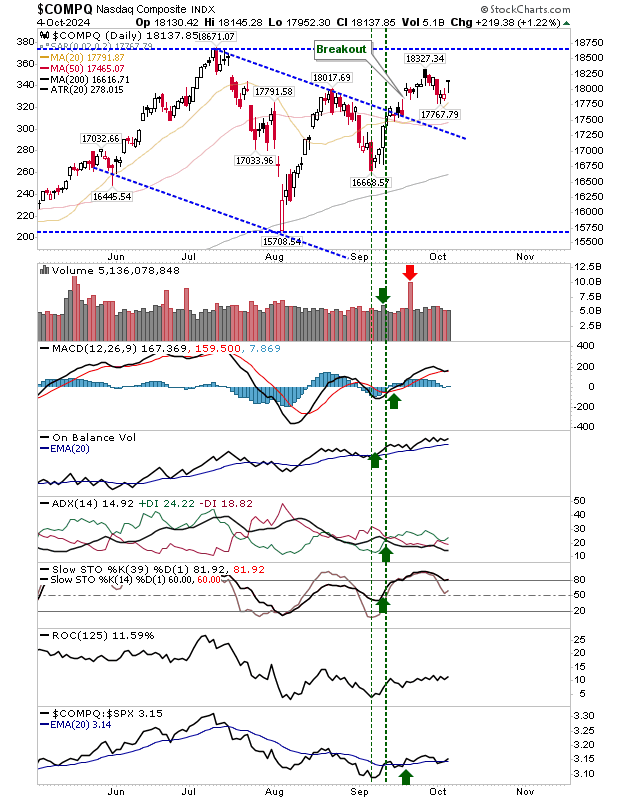

The Nasdaq is the relative index outperformer. Its chart is a hybrid of the S&P 500 and Russell 2000; it's not at highs, but it has cleared the downward channel on net bullish technicals (there is no MACD trigger 'sell').

But as with the Russell 2000, the indecisive 'doji' finish for the candlestick is not ideal.

If Friday had closed with a more bullish candlestick formation, today could have presented a clearer entry point for the bulls.

As things stand, today's open near Friday's close will be crucial to maintain momentum. Otherwise, there's a risk that Friday's gains could fade, leaving bulls on shaky ground.