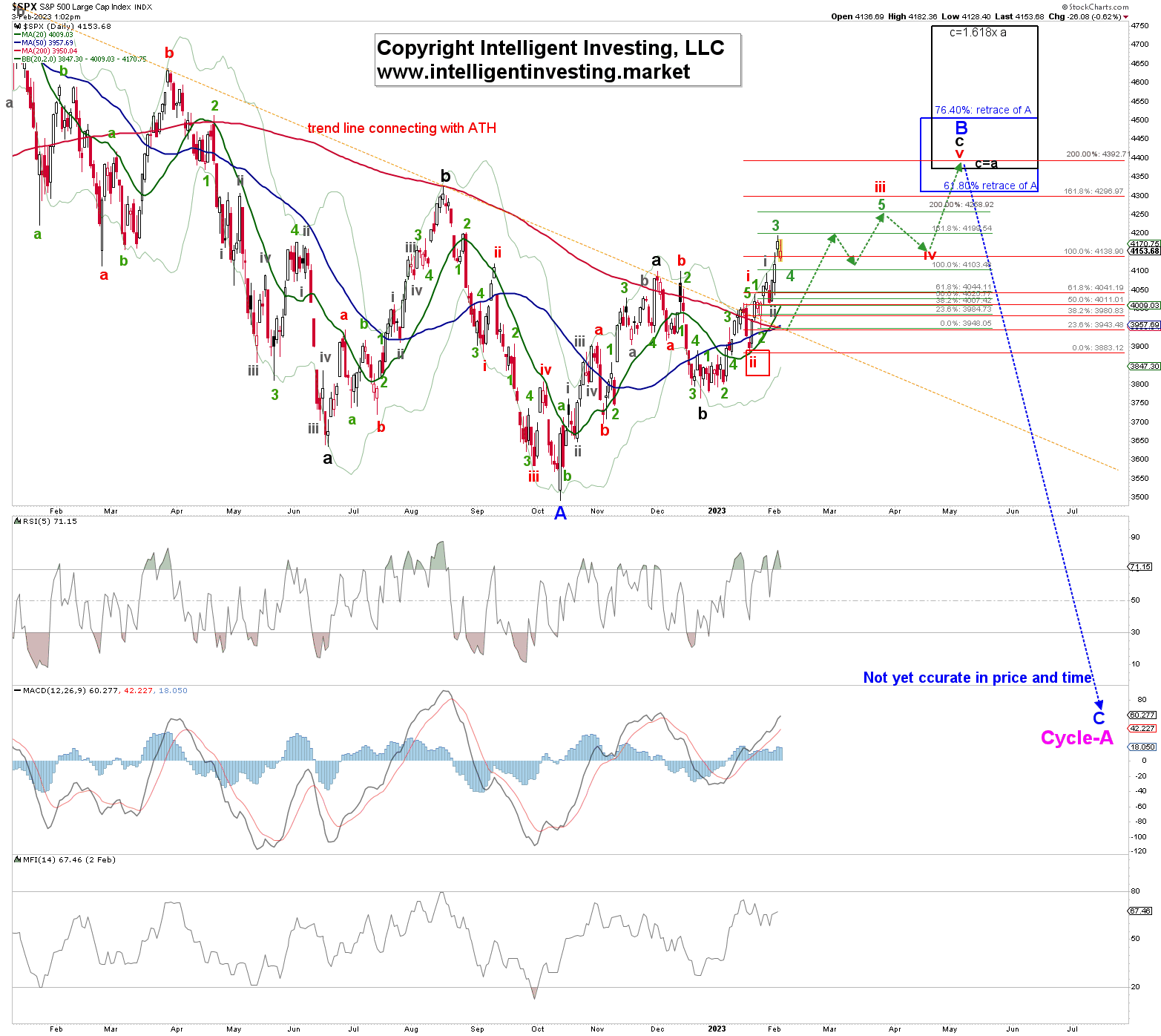

Albeit many keep fighting the current rally, the S&P 500 (SPX) continues to move along our primary expectation based on the Elliott Wave Principle (EWP): an impulsive move higher to the $4400 region. We have had this target since mid-October last year, see here and all subsequent articles since, and we continue to see no reason it will not get there. Namely, last week, see here, we determined:

"Currently, the index should be in grey W-ii of green W-3 of red-W-iii of black W-c of blue W-B."

We were off by two days, as the slight dip on the 26th was not W-ii of W-3, but only a 4th wave of W-i of W-3. See Figure 1 below. Monday's decline was the actual W-ii, and the index is now wrapping up all of green W-3. But we do not get bogged down by the smallest of waves, as we knew from last week that

"… SPX4300-4400 should be our primary focus [, as] the index makes higher highs and lower lows."

Figure 1.

The ideal Fibonacci-based upside target for green W-3 is the 161.80% extension of green W-1, measured from green W-2, at $4199. Yesterday the index reached $4195, which is close enough, and today's decline could be the start of green W-4 down to ideally $4105+/-5. Today's decline may be only a minor 4th wave of W-3 (W-iv), but there are now enough scribbles to consider W-3 complete. Thus, in the short term, expect some choppiness and downside before the next rally, green W-5, kicks in to ideally $4260+/-10.

From a more technical perspective, we can see the index trade almost entirely outside the light-green Bollinger Bands yesterday. It means the upside move has strength, classic for a 3rd of a 3rd wave, but it also went too fast, and the index needs to move back inside the bands. 4th waves often do that. The current setup is similar to that of late July last year. Besides, the SPX is holding the breakout above the orange downtrend line, and it is above the rising 20-day Simple Moving Average (20d SMA), which is above the increasing 50d SMA, which in turn is now also above the 200d SMA. That is a Bullish setup, and the Bullish EWP count is our primary expectation.

Lastly, please remember the EWP follows price only. Price is the aggregate of every trader and investor's opinion at any given time. Most of them have far larger pockets than any of us; thus, their opinion matters much more. Besides, one's single opinion matters little in a sea of millions. There is, therefore, no need to have an opinion about the stock market. It will cloud one's judgment. Follow the index's price and its limited set of well-document patterns via the EWP, and you will know most of the time what the stock market will do next. The fact that we were already anticipating this rally when the index had just bottomed in October proves the tremendous foresight one can have using the EWP.

Bottom Line

Our focus is now on the $4100 region for a smaller 4th wave bottom to ideally allow the index to rally to $4260+/-10. A multi-week correction should ensue from there before moving higher again to the $4400+ region. Moreover, please focus on the forest, not the trees.

Follow the index's price and well-documented EWP patterns, not the emotional hype du jour or some assumed narrative regarding what the market should or should not do, and you will be on the right side most of the time. The index will have to break below Monday's low at $4015 with a first warning at $4039 to tell us the Bullish path is in jeopardy.