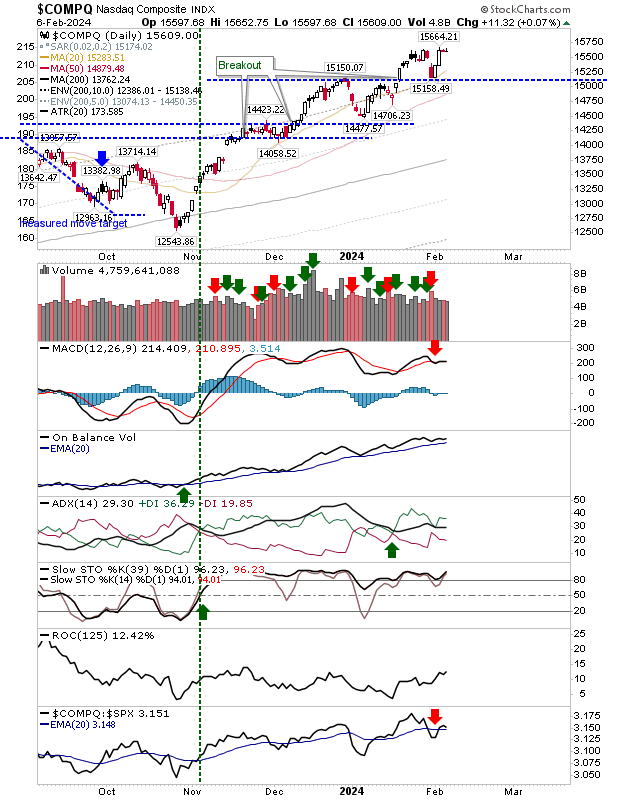

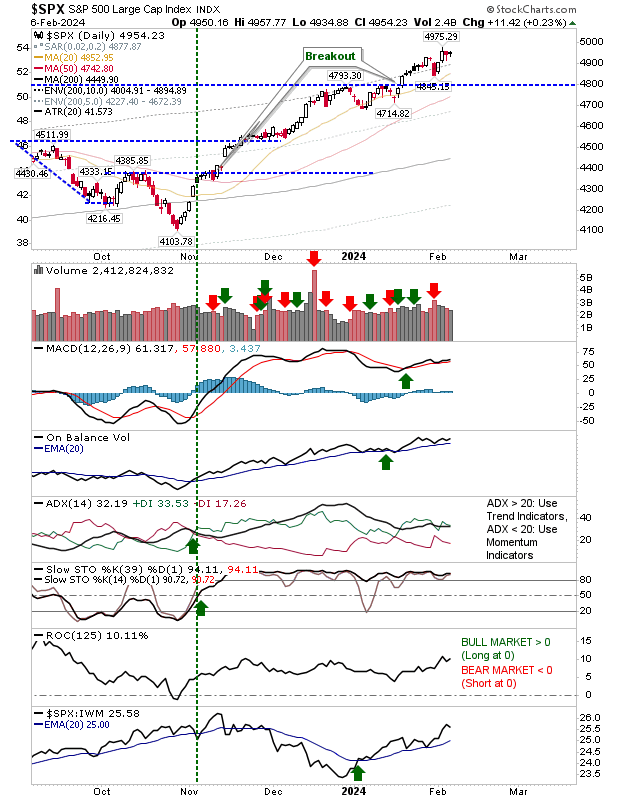

A bit of a non-event for the S&P 500 and Nasdaq as both indexes closed with tight doji near their highs. There isn't a whole lot more to add for these indexes.

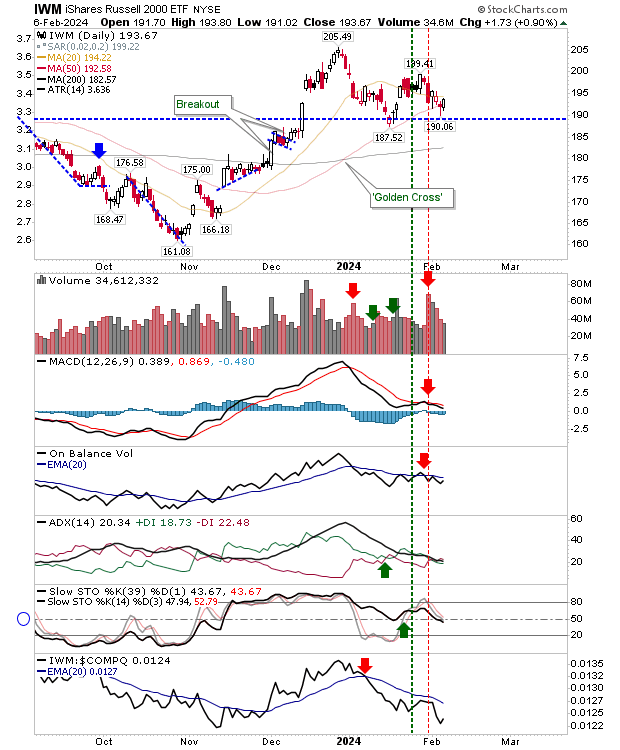

The Russell 2000 (IWM managed to deliver a little more upside with a successful test of its 50-day MA. However, the volume was well down on what I would like to see for a successful support test.

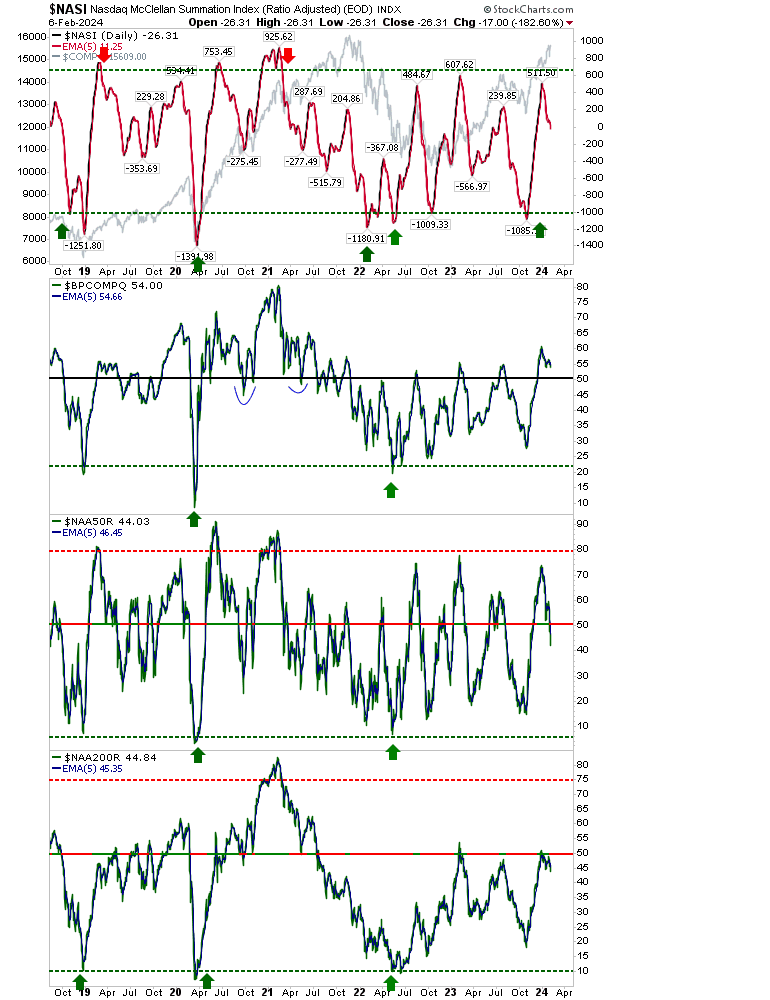

I follow J.C. Parets and he has noted the breadth weakness in this rally.

This is apparent in the Percentage of (Nasdaq) Stocks above the 50-day MA, 200-day MA, Bullish Percents Index, and Summation Index, all of which are showing a bearish divergence.

Given the breadth picture (in the Nasdaq), the expectation is that tight trading will eventually give way to selling, or catch bulls off guard with a 'bull trap'. I would expect this selling to spill across indexes, but let's see what the market brings.

Which stock to consider in your next trade?

AI computing powers are changing the Canadian stock market. Investing.com’s ProPicks AI are winning stock portfolios chosen by our advanced AI for Canada, the US, and other exciting markets around the globe. Our top strategy, Tech Titans, nearly doubled the S&P 500 in 2024 - one of the most bullish years in history. And Beat the TSX, designed for broad market exposure, is showing +878% gains with 10 years’ back-tested performance. Which Canadian stock will be the next to soar?

Unlock ProPicks AI