- Echoing historical election-year trends, the S&P 500 has surged in 2024 and looks poised for more gains.

- Amid this bull trend, Investors shouldn't chase unpredictable signals like inflation and interest rate cuts, which even experts can't accurately forecast.

- Instead of relying on speculative predictions, investors must focus on a solid, long-term investment strategy to navigate market fluctuations.

- Invest like the big funds for under $9/month with our AI-powered ProPicks stock selection tool. Learn more here>>

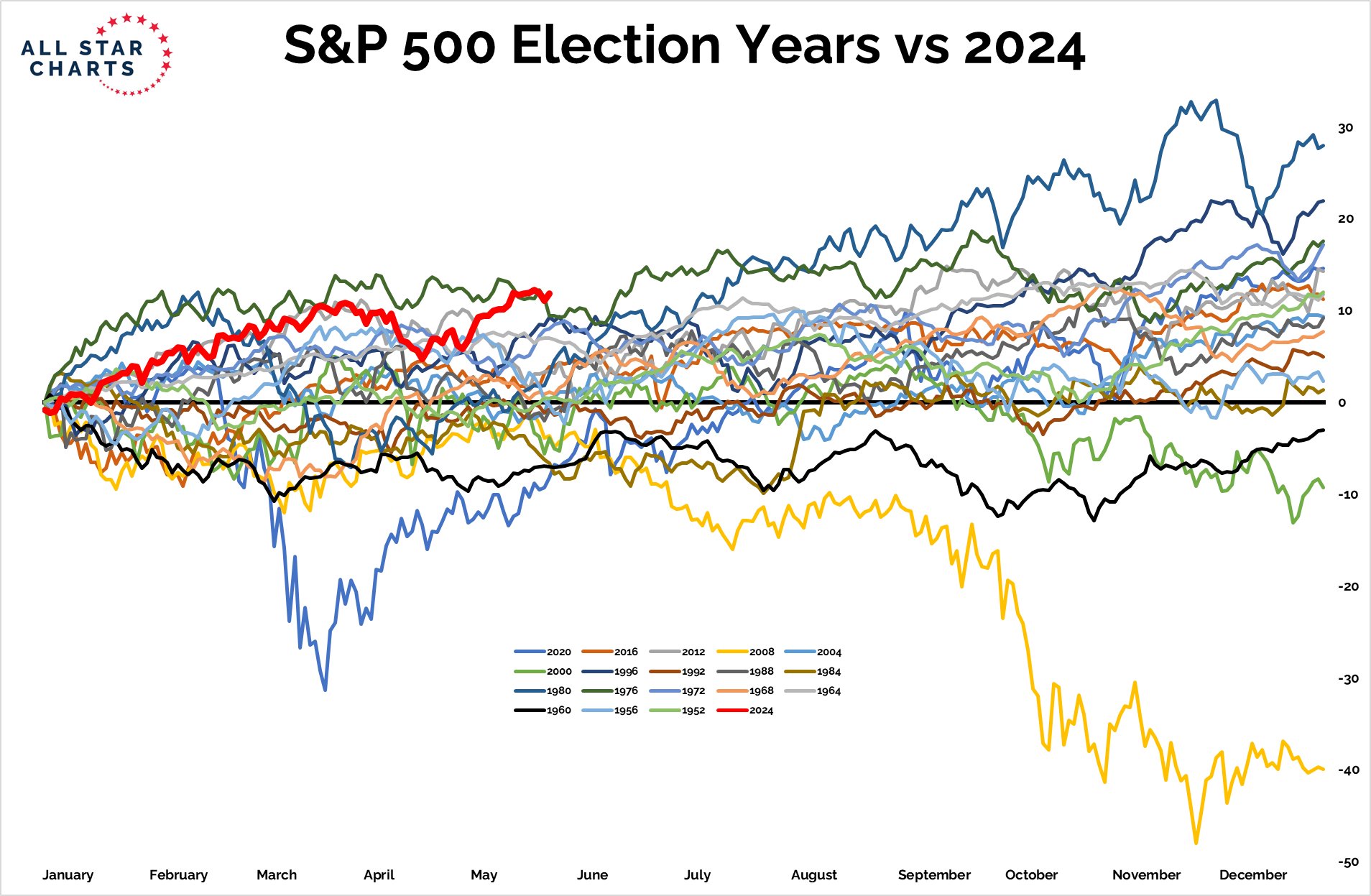

The historical data is looking eerily familiar. As predicted in this analysis back in 2023, the S&P 500 is thriving in the final year of the presidential election cycle, following a bear market in 2022 and a strong close to 2023.

How Is This Election Year Shaping Up So Far?

The red line in the image below charts the S&P 500's performance for the first five months of 2024. The index has already gained 11.21% year-to-date, even reaching new all-time highs. This current trend closely mirrors historical performance in similar economic conditions.

The Market Doesn't Care About Predictions

While some might argue that exceptional events like the 2008 subprime mortgage crisis, the 2000 dot-com bubble, and the 2020 COVID pandemic can disrupt even the "beat earnings, see stock price rise" statistic, here's the real problem: investors often chase the wrong signals.

They base their decisions on impossible-to-predict factors like:

- Where inflation will be in 2024

- When the Fed will cut rates in 2024

Think about it – not even Jerome Powell, the Fed Chair, can definitively say when or if there will be rate cuts in 2024. So, how can you claim to know for sure?

Yet, countless investors gamble their money on these very assumptions. This is often because the financial industry itself thrives on creating an illusion of certainty that simply doesn't exist.

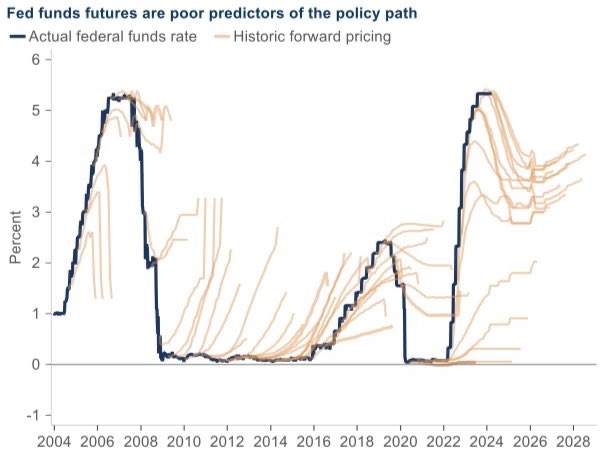

Here's a perfect example: look at historical forecasts for interest rates compared to their actual movements. This chart is worth a thousand words and demonstrates the futility of relying on predictions.

The 2.5-year bear market, stretching from 2022 to today, offers valuable lessons. What are the key takeaways?

The classic mantras – buy low, sell high, be fearful when others are greedy, and prioritize time in the market over market timing – still hold, even if they seem unexciting.

Predicting the next rate cut and jumping in and out of the market are tempting options. But these strategies involve a lot of random guesswork.

Here's a more effective approach: develop a well-defined investment strategy at the outset, monitor it regularly, and trust the market process. Accept that downturns are inevitable, and have a plan to manage through them.

Chasing the market is a recipe for disappointment. Sticking to a sound long-term strategy is the path to success.

In simpler terms, forget the get-rich-quick schemes. Focus on building wealth steadily over time.

***

Become a Pro: Sign up now! CLICK HERE to join the PRO Community with a significant discount.

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, counsel or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. I would like to remind you that any type of asset, is evaluated from multiple perspectives and is highly risky and therefore, any investment decision and the associated risk remains with the investor.