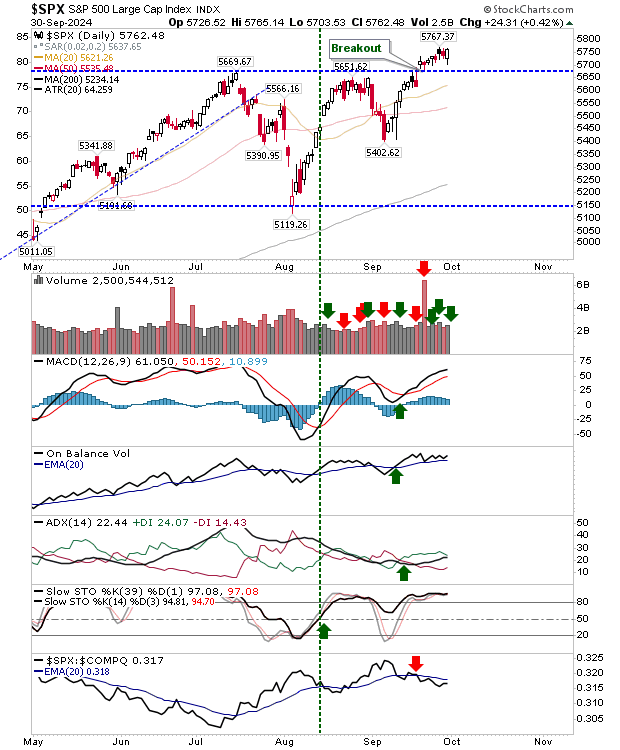

While Small Caps typically lead markets, it's currently the S&P 500 doing most of the work. Yesterday's action saw the index move towards a test of breakout support without going all the way.

The price action confirmed that there is high volume demand - marked by accumulation - and that buyers appear prepared to defend the 5,670 support level. Technicals are net bullish, another tick in the 'defend the breakout' column.

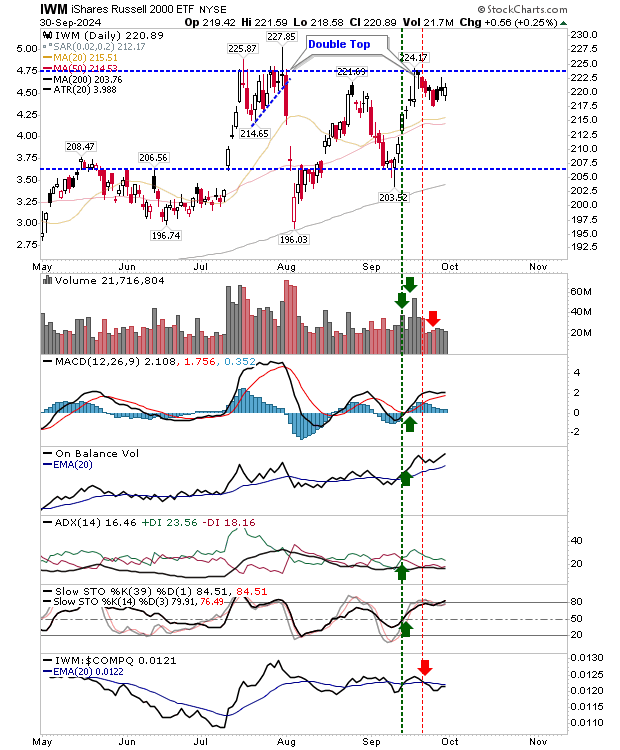

The buying in the S&P 500 has given the Russell 2000 (IWM) a chance to mount a new challenge on $225 resistance.

I had mentioned the likelihood of a double top for this index. I might have seen action favoring a double top coincide with a test of 20-day/50-day MAs, and this hasn't happened.

Instead, buyers have attempted to mount a challenge in the absence of any clear prior buyer support. If we see the current move higher tag $225 I would be very optimistic of higher prices to follow.

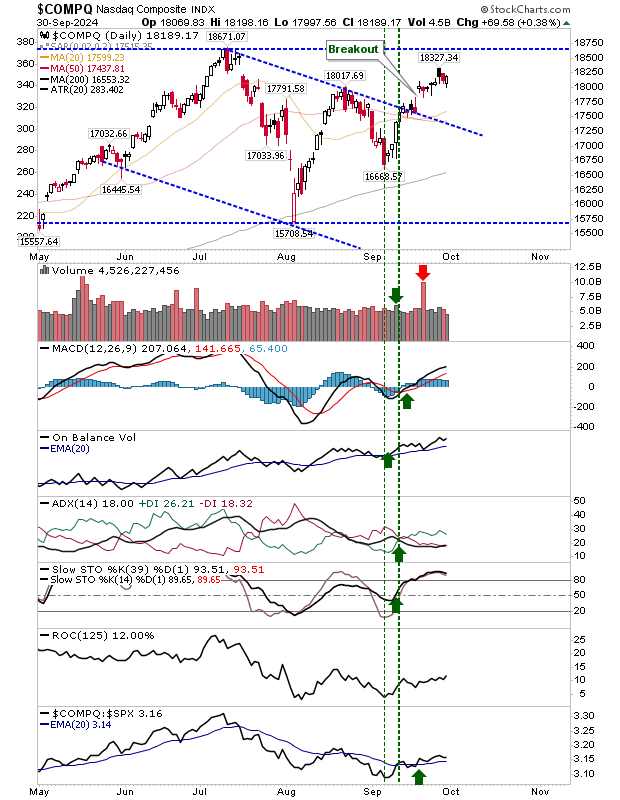

Nasdaq Breakout Remains Intact Too

The Nasdaq hasn't challenged its July high but continues to move towards 18,670 as part of the September resistance breakout. Technicals are net positive, and the bearish black candlestick from Thursday still has a chance of been negated.

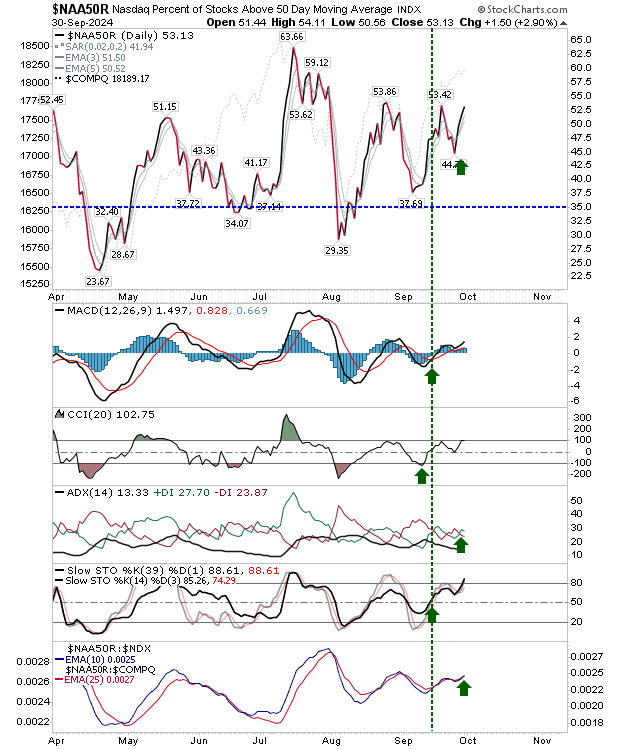

Even supporting Nasdaq bready metrics are swinging back in favor of bulls; for example, the Percentage of Nasdaq stocks making new 50-day MAs highs is close to a new high if it can climb above 54%. This will set up the parent Nasdaq for further gains.

For today, we will want to see the S&P 500 maintain its breakout so it can help the Russell 2000 ($IWM) reverse the developing double top. The Nasdaq is doing its own thing, but is likely to take a little longer to report a new all-time high as the channel breakout looks firmly intact.