Almost a month ago, see here, we asked the question if a major top was forming for the S&P500. Using the Elliott Wave Principle (EWP) we found:

"Although the index has not dropped below the critical $4458 level, we must now be mindful that either the red W-iv to ideally $4300+/-25 is underway, or the blue W-B counter-trend rally has ended, and the index is working lower to $2700-2900. Please note the upside levels have been on our radar since October last year. See here when we were looking for the index to reach SPX4350-4650."

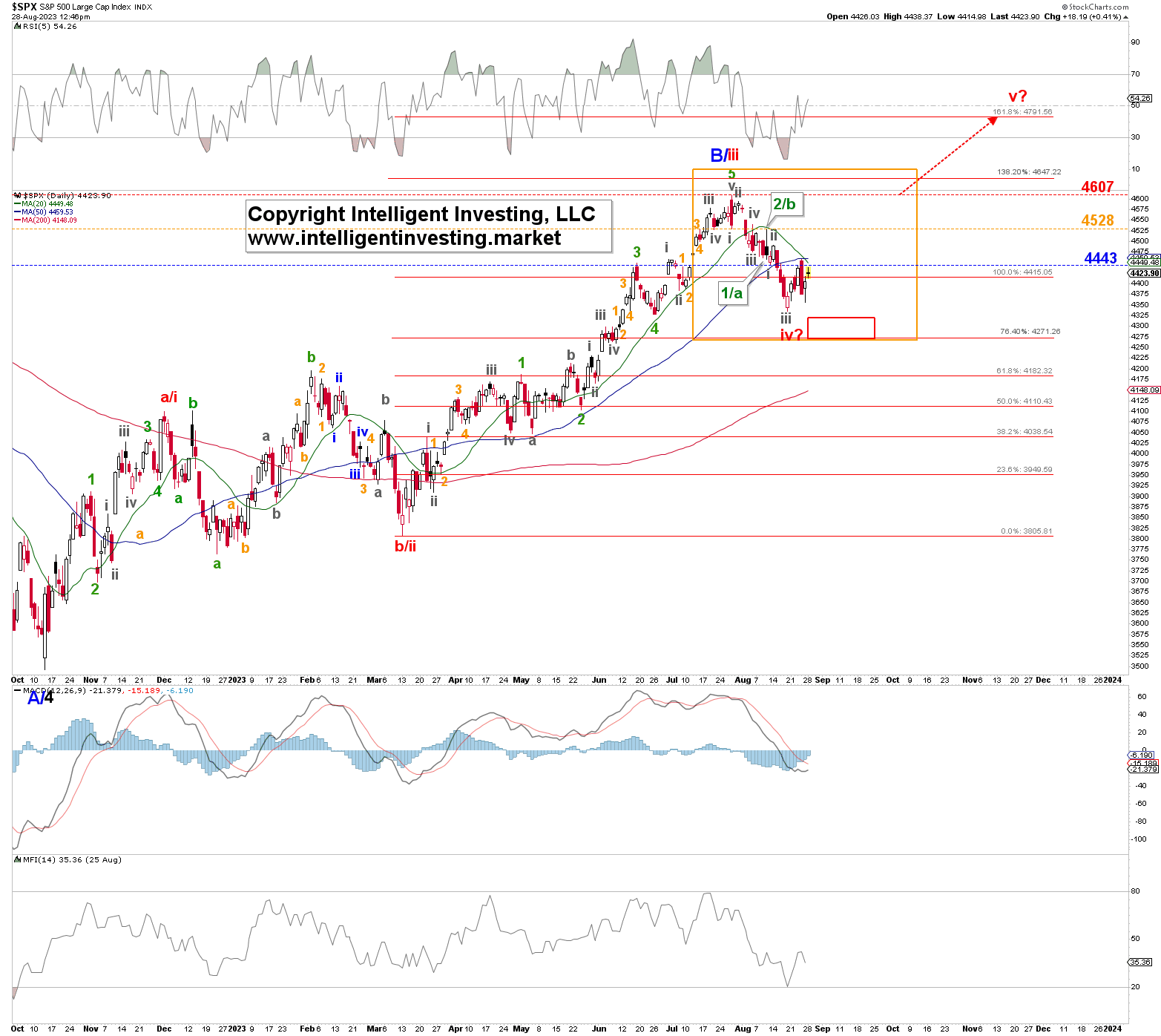

On August 18, the index bottomed out at $4335, very close to the red W-iv target zone, shown in Figure 1 below. On the daily chart, the decline since the July $4707 high counts best as "three waves down," which means that the most bullish possibility cannot yet be eliminated: the decline was a correction, red W-iv? and that correction is over. Thus, from this perspective, the Bears still need at least one more low to turn the decline into a more significant impulse down.

Figure 1. Daily SPX chart with detailed EWP count and technical indicators

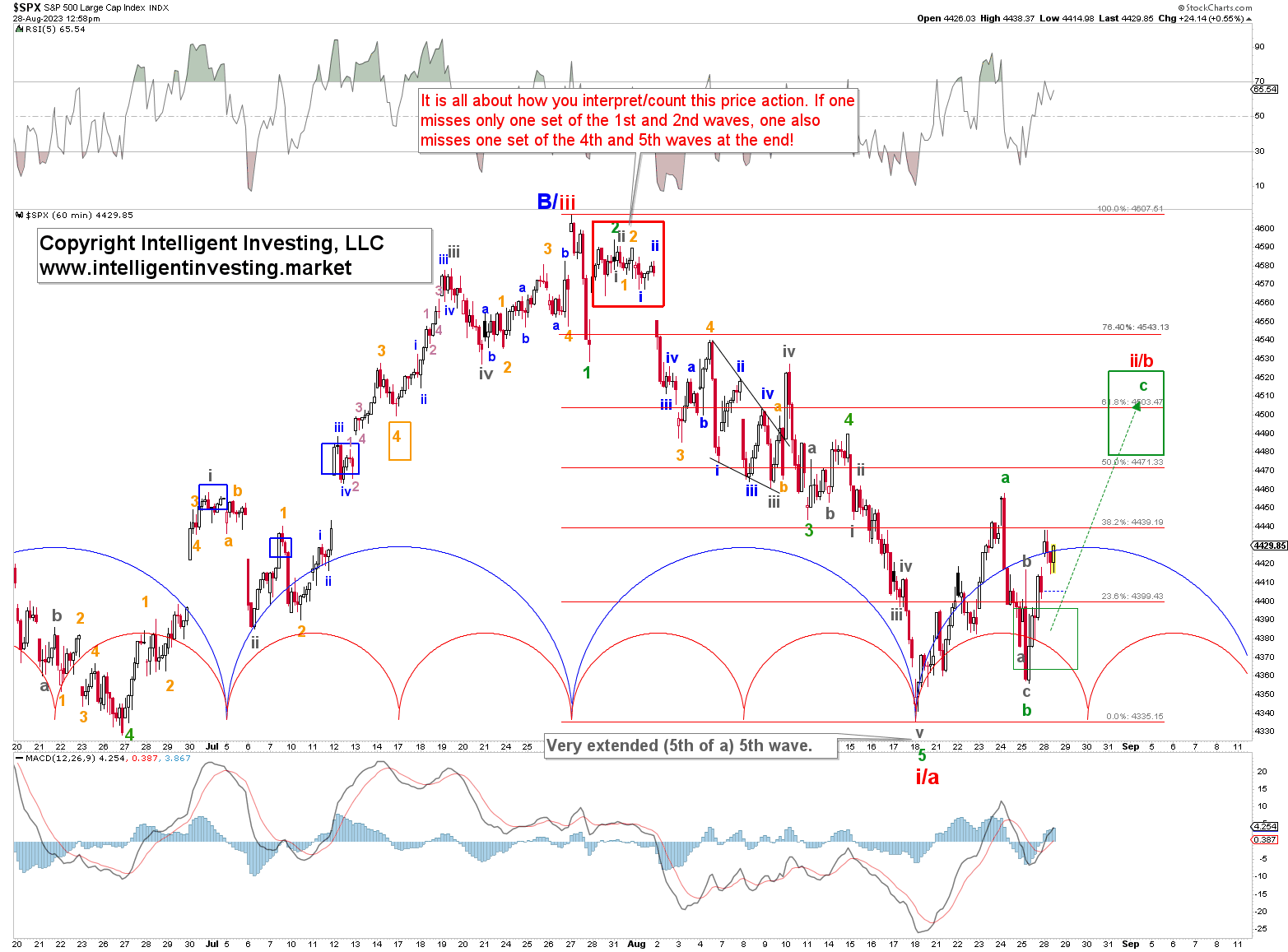

However, there's another possibility. Namely, the price action encompassed by the orange box in Figure 1 is highlighted in Figure 2 below. Using this chart, we found in our last update the SPX had to:

"rally above $4443, without dropping below today's low again, to indicate early the red W-ii/b is underway, with confirmation above $4490. If it stalls around $4425+/5 and then drops below today's low, we should expect $4370-80 before the index can retry its multi-day "dead cat bounce.

Figure 2. Hourly SPX chart with detailed EWP count and technical indicators

Fast forward, and the index stalled at $4421 that day, bottomed out at $4335 the next, and rallied by last Thursday above $4443, confirming the anticipated EWP pattern. Given that the decline lasted three weeks, a three-day bounce appears too short to allow for a more proportionate counter-trend rally. See the blue and red time cycles in Figure 2.

Thus, Thursday's $4458 high can be counted as green W-a, Friday's $4356 low as green W-b, and now the index is working on green W-c of red W-ii/b to ideally $4500+/-25. From there, the index must break first below the $4458 high, followed by the August 18 low to usher in red W-iii/c to ~$4075. If, however, the index rallies through $4525, towards the $4550-4600 region, and holds above $4458 on any pullback, then chances increase the recent month-long decline was indeed only a correction, and we should look for $4790+/-10 to be reached before the Bears have another chance.

Regardless, we can conclude, as long as Friday's $4356 low holds, we should look higher for at least $4500+/-25. Above the $4550-4600 region, and $4790+/-10 is likely next.