- The S&P 500 and Nasdaq have rallied, each achieving four consecutive sessions of record highs last week.

- Shares of Spotify have been on a steady climb too, nearing their all-time highs.

- Spotify is eyeing $1 billion in free cash flow by raising subscription prices, fueling bullish optimism.

- Invest like the big funds for under $9/month with our AI-powered ProPicks stock selection tool. Learn more here>>

The S&P 500 and Nasdaq have soared recently. Both indexes notched four consecutive sessions of record highs last week. This impressive feat extends the S&P 500's winning streak to seven out of the last eight weeks.

Statistically, the S&P 500's performance through the first 114 trading days ranks as the 17th best start to a year overall, and the absolute best during a presidential election year.

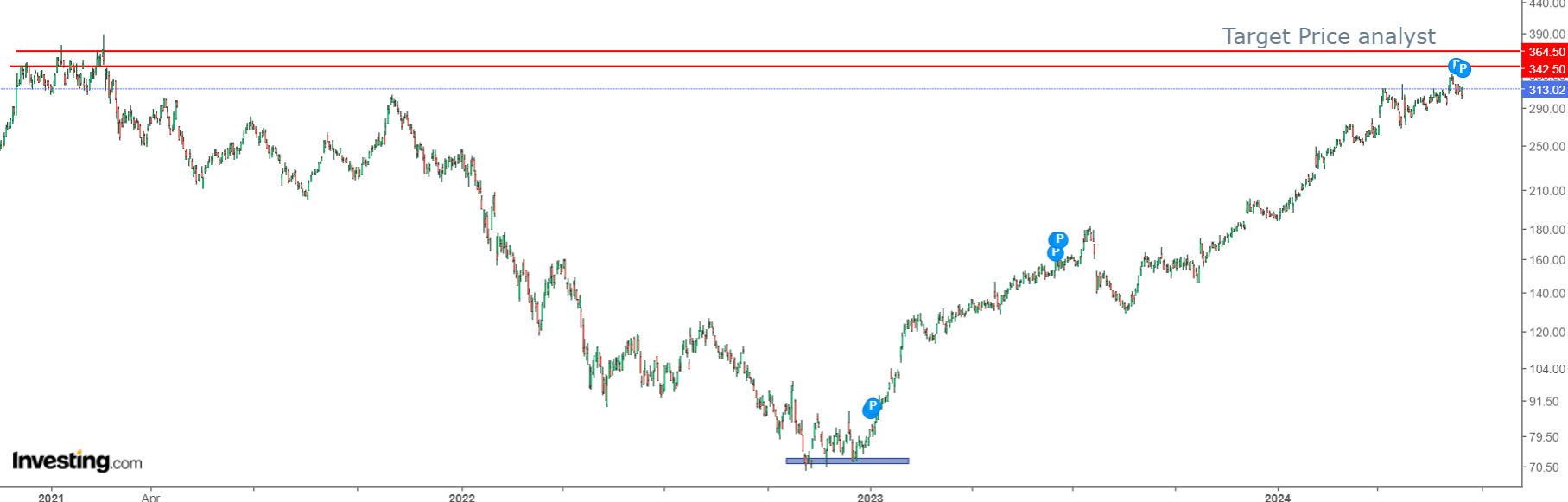

The bullish enthusiasm has spilled over to certain stocks and as a result, Spotify (NYSE:SPOT) has been on a steady climb for the past 16 months, making it a stock to watch amidst this bullish week on Wall Street.

After plummeting from the 2021 highs by more than 80% since 2023 it has been growing steadily, approaching all-time highs that are about +16% away.

Spotify: Analyst Ratings Vary, But Recent News Could Boost Stock

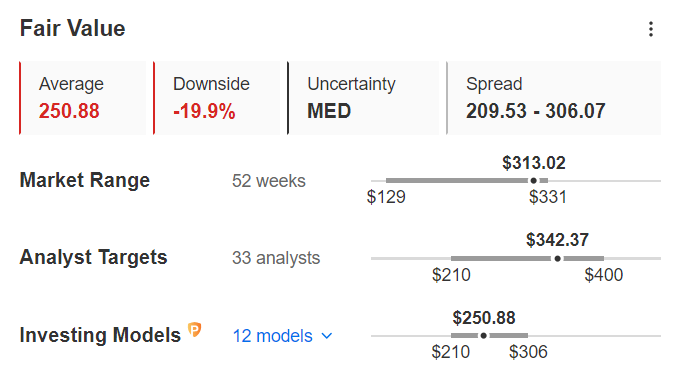

InvestingPro's analysis suggests Spotify might be overpriced. Their Fair Value estimate of $250.88 sits 19.9% below the current price.

However, analyst target prices, available to InvestingPro subscribers, remain bullish at $342.37. This indicates that analyst expectations for Spotify's future earnings are outpacing the current stock price.

Source: InvestingPro

Despite a recent complaint filed against Spotify by the National Music Publishers Association, positive developments could be on the horizon.

The company recently announced a price increase for all subscription plans, particularly in the US.

Spotify's family plan will increase from $16.99 to $19.99 per month. Duo plans, which enable two users to share an account, will go up by $2 to $16.99. Spotify Premium subscriptions will now be priced at $11.99 per month, a $1 hike.

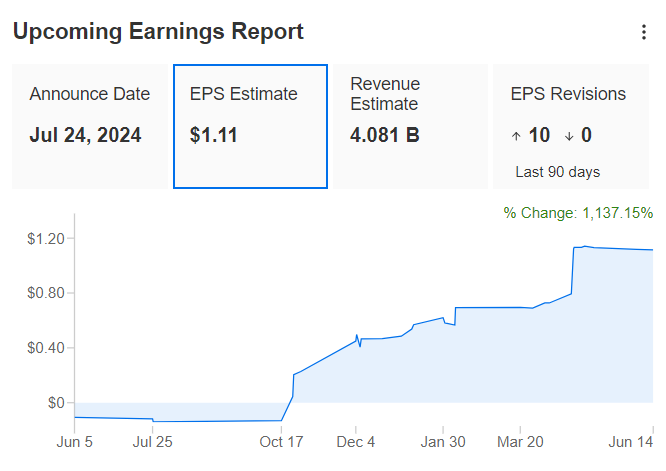

This move aims to improve profitability and cash flow, with a target of $1 billion in free cash flow by year-end. Additionally, Spotify is experiencing healthy growth in gross profit thanks to rising revenue and reduced operating costs.

Source: InvestingPro

The future holds further potential growth drivers. Spotify is focusing on advertising, video monetization, and bundling audiobooks with premium subscriptions.

This reclassification, if approved by the U.S. Copyright Royalty Board, could allow Spotify to pay songwriters less due to the bundled "book and music" licenses within the premium service.

On a positive note, Spotify's premium subscriber base grew 14% year-over-year in Q1 2024, reaching 239 million. The company also anticipates exceeding 631 million monthly active users in Q2.

Source: InvestingPro

The chart below shows how the stock price has reacted to earnings.

Source: InvestingPro

Analyst Upgrades for Spotify

Several analyst firms recently upgraded their ratings and price targets for Spotify in June:

- Evercore ISI: Reiterated "Outperform" rating and set a new price target of $340.

- Canaccord Genuity (TSX:CF): Upgraded to "Buy" with a price target of $370.

- Benchmark: Upgraded to "Buy" and raised their price target from $325 to $405.

- JPMorgan (NYSE:JPM): Maintained an "Overweight" rating but increased their price target from $365 to $375.

Source: InvestingPro

***

Become a Pro: Sign up now! CLICK HERE to join the PRO Community with a significant discount.

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, counseling or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. As a reminder, any type of asset is evaluated from multiple points of view and is highly risky therefore, any investment decision and the associated risk remains with the investor. The author owns shares in the company mentioned.