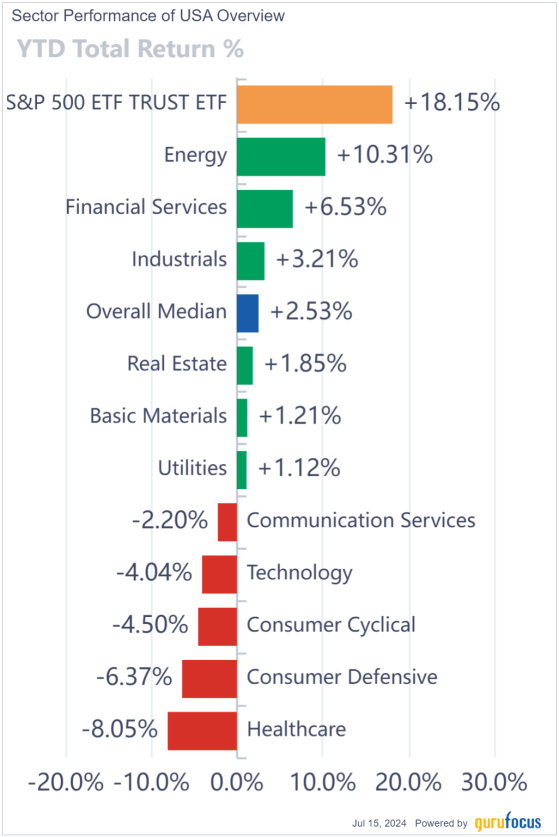

As a result of continued uncertainty regarding inflation, interest rates, supply chains and a potential recession, consumer defensive stocks appear to be performing poorly year to date as the sector has lost around 6.37%.

However, companies in this sector often continue to perform well despite the conditions of the overall economy since their products are considered necessities. As such, investors may be interested in finding opportunities among securities that have predictable performances and strong revenue growth.

The Predictable Growth Screener, a Premium GuruFocus feature, looks for companies with 10-year revenue growth of over 8% and predictability ranks of at least four out of five stars.

Based on these criteria, a handful of stocks in the consumer defensive space qualified for the screener as of July 15. One of them was Sprouts Farmers Market Inc. (NASDAQ:SFM).

Business structure and expansionThe Phoenix-based supermarket chain was founded in 2002, offering a wide selection of natural and organic foods, including produce, baked goods, dairy and meat products, bulk foods, vitamins and supplements, packaged groceries and much more.

The company's operations are split into two segments, perishables and non-perishables. As of 2023, the perishables business brought in slightly more annual revenue at 57.30%.

While Sprouts currently operates 414 stores in 23 states, it continues to open new locations across the U.S. In the first quarter of 2024 alone, it established seven new stores. For the full year, it projects opening a total of 35 new locations.

Financial reviewThe grocer revealed its first-quarter earnings results on May 1. For the three months ended March 31, it posted revenue of $1.9 billion, net income of $114 million, or earnings of $1.12 per share, and Ebitda of $217 million. All three figures were up from the prior-year period.

Its same-store sales also recorded an increase of 4%.

In a statement, CEO Jack Sinclair commented on Sprouts' impressive financial results, which also saw strength in its traffic and e-commerce numbers.

These outcomes highlight the effectiveness of our strategy and the exceptional execution by our team members across the country, he said. We are reinforcing our position as a leading specialty food retailer as we build new stores in line with our growth plans.

Looking ahead, Sprouts expects comparable store sales growth of 3% to 4% for the second quarter, along with adjusted earnings of 75 cents to 79 cents per share.

For the full year, the company guided for net sales growth of 7% to 8%, same-store sales growth of 2.50% to 3.50% and adjusted earnings of $3.05 to $3.13.

On the balance sheet, the company has $312 million in cash and $1.70 billion in long-term debt. As such, its cash-to-debt ratio of 0.18 indicates the retailer is unable to pay off its debt using cash on hand.

Sprouts is scheduled to report its second-quarter results on July 29.

ValuationSprouts Farmers Market has an $8.41 billion market cap; the stock traded around $83.67 on Monday with a price-earnings ratio of 28.85, a price-book ratio of 6.97 and a price-sales ratio of 1.24.

The GF Value Line suggests the stock is significantly overvalued currently based on its historical ratios, past financial performance and analysts' future earnings projections.

Further, the GF Score of 84 out of 100 indicates the company has good outperformance potential. While it received strong ratings for profitability, growth, momentum and financial strength, the value rank is low.

The discounted cash flow model, however, indicates the stock has a 4.67% margin of safety. This means it finds the stock is in fair value territory.

GuruFocus also found the company has a robust Altman Z-Score of 4.81 and a high Piotroski F-Score of 8 out of 9, meanings its operations are healthy. Backed by expanding operating margins and consistent revenue per share growth, Sprouts has a predictability rank of 4.5 stars. According to GuruFocus research, companies with this rank return an average of 10.60% annually over a 10-year period.

Guru and insider interestAlong with its strong performance, several gurus own the stock. According to 13F filings for the first quarter, Lee Ainslie (Trades, Portfolio) entered a new position, while two other gurus added to their holdings. Others, like the late Jim Simons' Renaissance Technologies (Trades, Portfolio) and Steven Cohen (Trades, Portfolio), curbed their investments. Overall, sentiment toward the stock appears to have been bearish over the past several quarters.

As for insider activity, only sells have been recorded in 2024. The most recent transaction, on July 3, consisted of 11,428 shares sold by Sinclair. The last buying activity recorded was in May of 2022.

The more bearish activity among insiders may not be too much of a concern, however, as they may simply be taking advantage of the 70% gain the stock has had this year.

Final thoughtsOverall, Sprouts Farmers Market has a sound business that produces predictable performance over time. Despite the high debt load in relation to available cash, its continuous expansion should continue to support revenue growth.

However, the stock may not be the best value at current levels due to the gains it has recorded year to date. As such, investors may want to hold off for now.

This content was originally published on Gurufocus.com