Animal spirits are reviving after US shares rallied for a third straight week, fueled by renewed speculation that the Federal Reserve’s rate hikes are done and cuts are near.

The S&P 500 Index rose 2.2% last week, closing at its highest level since Sep. 1. Traders are watching to see if the market can decisively move higher and take out the summer peak, a gain that will suggest that the rally off of last year’s October low, which faded in recent months, is reviving. If July’s high gives way, the next hurdle is the January 2022 peak, the market’s all-time record.

“The dovish Fed narrative remains in place,” says Win Thin, global head of currency strategy at Brown Brothers Harriman & Co. “There is likely to be ongoing downward pressure on US yields and the dollar.”

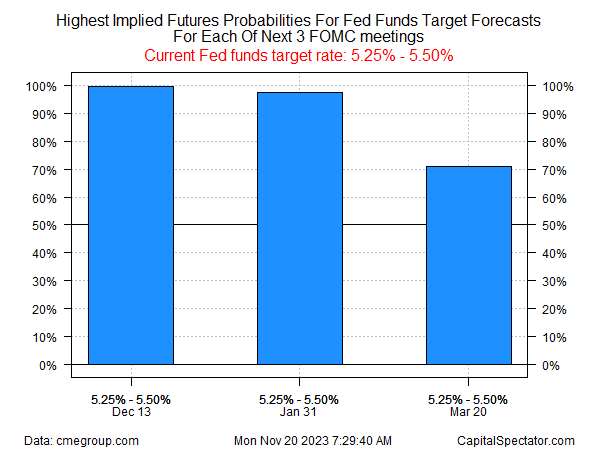

Fed funds futures are pricing in high odds that the central bank will leave its target rate unchanged at the next three meetings, but sentiment in this corner is still on the fence about the prospects for a rate cut in the near term.

Expectations for a cut start to emerge further out, beginning with the May policy meeting, which currently reflects a roughly 60% estimated probability via futures.

“Markets will move to price things in, but they don’t always get it perfectly right,” reminds Josh Jamner, an investment strategy analyst at ClearBridge Investments.

He advises that the case for a rate cut in 2024 is still “debatable,” noting that “Nobody has a crystal ball. Nobody knows how the data is going to unfold. There could well be another patch of unfavorable data that comes out and causes the market to reprice.”

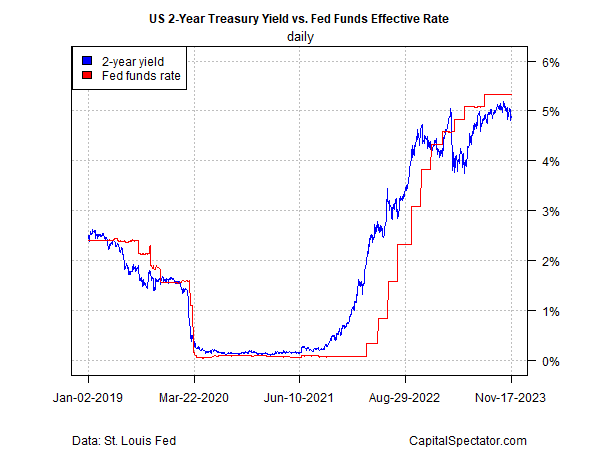

Meanwhile, the policy-sensitive 2-year yield seems to be flirting with somewhat higher odds of a rate cut lately.

This maturity, a closely watched proxy for rate expectations, has pulled back from its cyclical high in recent weeks, closing on Friday at 4.88%, modestly below its Oct. 17 peak of 5.19%.

Notably, it remains below the current 5.25%-to-5.50% Fed funds target, suggesting that momentum in favor of rate cuts is building.

To the extent the crowd continues to buy 2-year Treasuries, which will reduce its yield, market sentiment will strengthen for anticipating a cut, perhaps sooner than generally assumed.

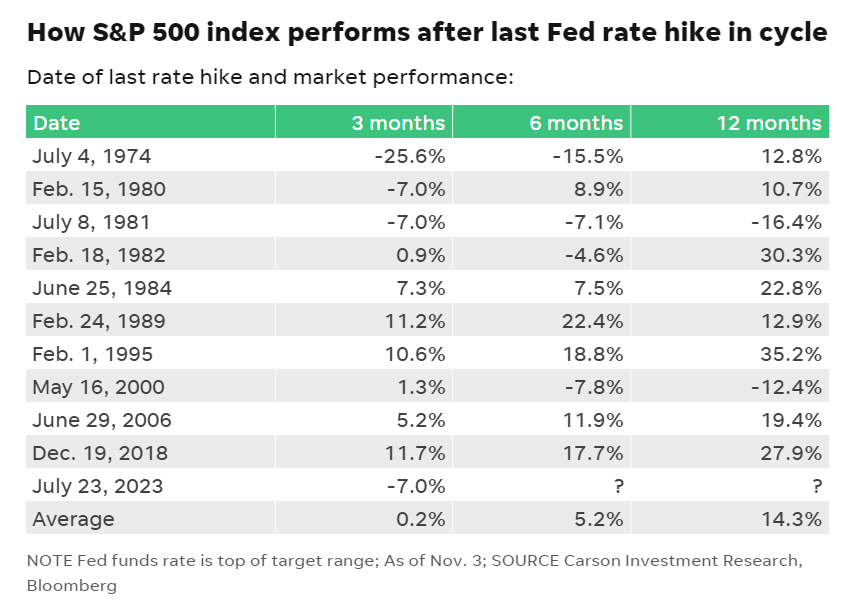

“If July was the last hike, which we think it was, stocks historically do quite well a year after that final hike,” says Ryan Detrick, chief market strategist at Carson Group.

The operative word, of course, is “if.” Considering that it’s a shortened holiday trading week in the US, combined with a light schedule for economic reports, suggests that markets in the immediate future will struggle to find clearer signs that rate cuts are near, or not.