This week will be busy, and if you are taking time off, don’t.

The news starts Monday afternoon and runs through Friday morning, and all of it will impact where stocks and rates go from here because if you forgot what kicked off the stock market rally, it is time for a refresher.

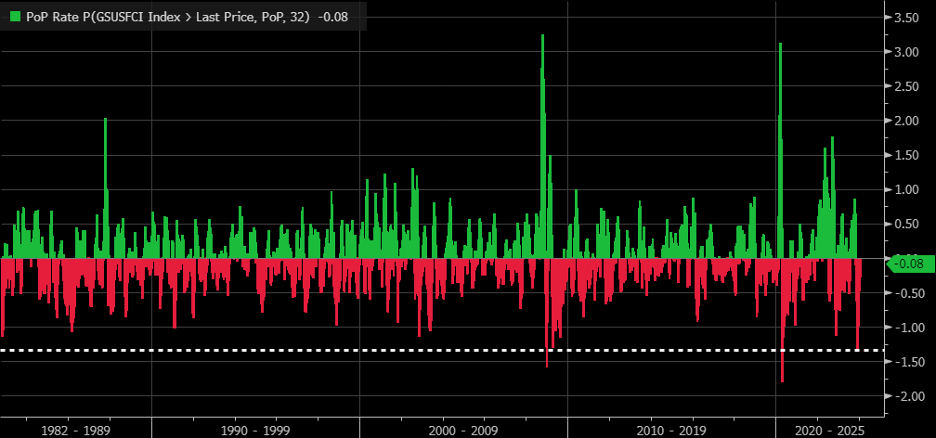

It happened three months ago when October ended and November began. The biggest reason for the rally was the massive easing of financial conditions, which was on par with the rate-cutting cycles witnessed in 2008 and 2020.

I’m not sure, but yesterday doesn’t seem as bad as those prior periods, and one could argue that the easing has been a bit extreme.

But don’t blame the easing of those conditions on Jay Powell. Blame the easing of financial conditions on Janet Yellen; you know, the former FOMC Chair who is now in charge of the US Treasury but still thinks she is in charge of the FOMC.

That is because, on October 30, the Treasury announced it would need to borrow $76 billion less than originally noted.

Then, on November 1, the Treasury decided to issue more of the government’s financial needs in Bills, shocking long-term rates lower.

This started this risk-on rally as 10-year rates plunged, sparking a stock market rally for the ages, as a negative regime sparked a short-covering rally from negative and systematic flows jolting markets higher.

This brought the volatility dispersion trade back to life, allowing all those calls in the “Troubling 3” Nvidia (NASDAQ:NVDA), Meta (NASDAQ:META), and Microsoft (NASDAQ:MSFT) to catch epic bids into January OPEX.

This may have been good for my portfolio, but certainly not for my business overall since I had been bearish on the market and correctly so, noting that the summer rally was BS until Janet decided to flip the script on the bond market.

It is really hard to get into Janet’s head and know what it is she is thinking about, but Treasury noted back in October that:

During the January – March 2024 quarter, Treasury expects to borrow $816 billion in privately-held net marketable debt, assuming an end-of-March cash balance of $750 billion.

Will that number be less or higher? I have no idea. Will issuance be directed more to bills or bonds? I have no idea.

On Monday afternoon, we start to find out when the Treasury will tell us how much needs to be borrowed.

Then, on Wednesday morning, we will find out the form of the issuances, whether it means more bills or more notes and bonds.

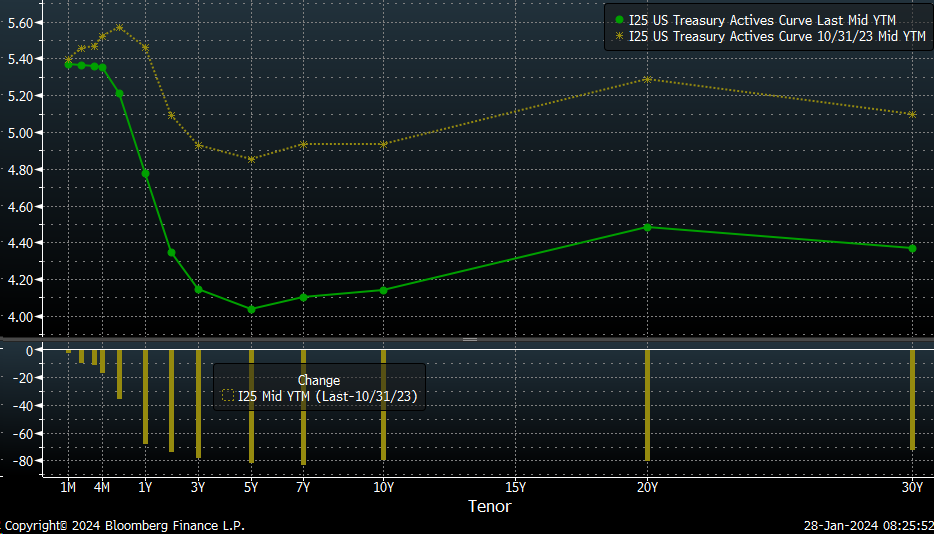

I can see pretty easily that the Treasury curve has fallen. More importantly, bill rates have also fallen, which may favor more duration being issued this time. Currently, T-bills are trading in line with the Fed’s overnight reverse repo rate.

I guess from a political standpoint, does Janet want to hold back some dry powder for later in the year, as the election nears, and do a massive easing of financial conditions over the summer months in case the economy begins to slow again and opt to tighten financial conditions now only to ease them later?

Well, suppose Janet does choose to sacrifice the present for the future.

In that case, we enter a vulnerable period then because the volatility dispersion trade is likely to go through a rough patch right now, as implied volatility for the Mag 7 will see a big dip following the earnings releases (chart above) on Tuesday and Thursday.

Once the event risk (earnings) passes, IV will fall sharply, and if IV in the Mag 7 falls, it defeats the purpose of the dispersion trade, causing it to unwind and pushing the implied correlation indexes (lower chart) higher as they did in July.

The setup yesterday looks similar to July’s from a vol dispersion perspective.

It is just a matter of the vol dispersion being large enough to kick the market back below the zero gamma level, which is currently at 4,820.

If the S&P 500 gets back below 4,820 and we can flip back into negative gamma, then the odds of triggering systematic selling flows increase, which could start around the 20-day moving average.

Unfortunately, this market is ruled by flows. It is all about the direction of those flows that matter in the short-term right now and where that starts and stops appear to be held with the direction of long-end of the Treasury curve, which leads to financial conditions tightening again, which can mean that then flows will turn unfavorable, starting the unwinding process.

The direction of flows will start to be determined as early as this afternoon and sealed by Friday morning.

The Free YouTube Video: