This week will be another in-focus week, with the CPI and PPI reports coming toward the week’s end.

Additionally, 3 Treasury auctions will be front and center as well. This will follow a fairly previous strong week of data, which suggests the US economy is hanging in nicely.

Currently, Bloomberg Economics GDP Nowcast is forecasting fourth-quarter growth of around 2.3%, which is slower than the roughly 5% third-quarter print but still a respectable growth rate.

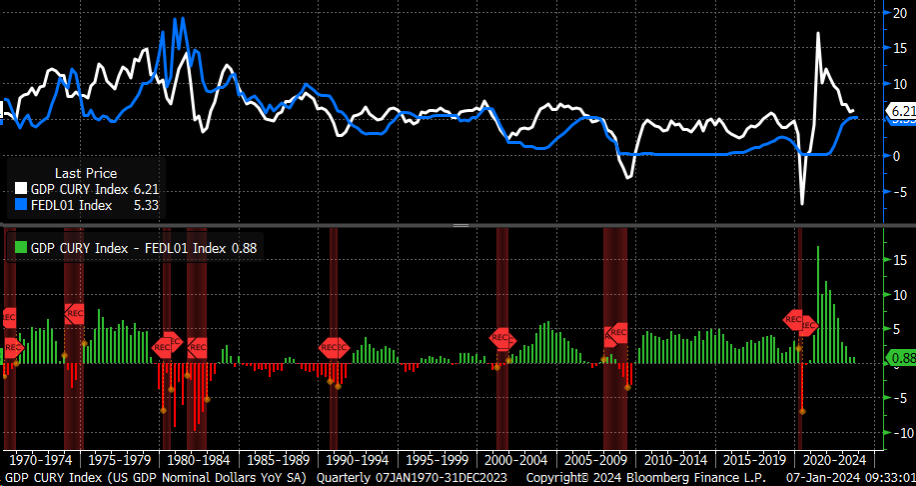

Coupled with a roughly 3% inflation rate, nominal growth is still around 5ish %. Again, it is a health level.

Given a 5% nominal growth rate, I think it will be tough to see the Fed cut rates at the moment as aggressively as the market has priced in.

As of the third quarter, Nominal GDP y/y growth was still above the Fed Funds rate, and even with a 5% nominal growth in the fourth, the Fed Funds rate and nominal growth would be almost equal.

It isn’t until the Fed funds rate is 0.5% to 1% higher than nominal growth that downward pressure is exerted on the economy, and the odds for recession seem to increase.

So I think, at the bare minimum, the Fed can continue to be patient and see what the data says, and the CPI report this week may or may not help that cause.

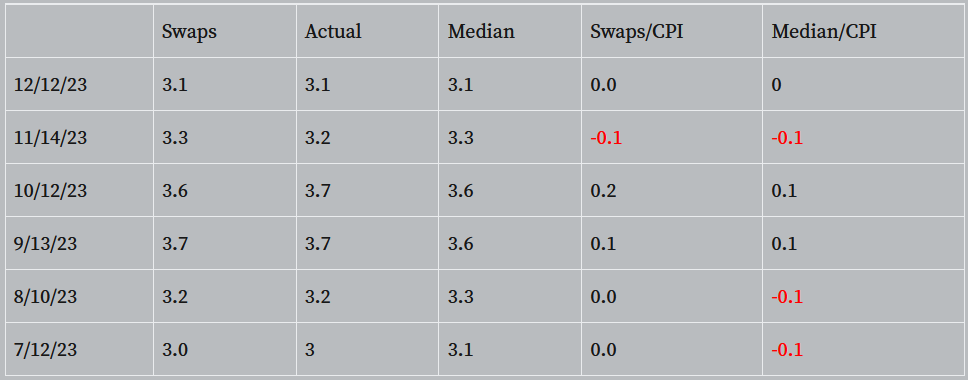

The median expectation is for an increase of 3.2% in December, while inflation swaps are priced at an increase of 3.32%.

If we look back at the data over the last few months when rounding to the nearest 0.1%, swaps have only overestimated CPI 1 time out of the last six times.

At the same time, the median has overestimated the actual CPI 3 times.

So, if we care about when the CPI has come in hotter than expected, the inflation swaps have had a better run, so one should be mindful of the risk that CPI comes in above the consensus of 3.2% this month.

If the swap data turns out to be right, given where GDP growth in nominal terms appears to be, the odds of the Fed cutting rates as aggressively as the market has priced will likely not be supported by the data.

Fed Funds policy will need to be held in place for some time longer.

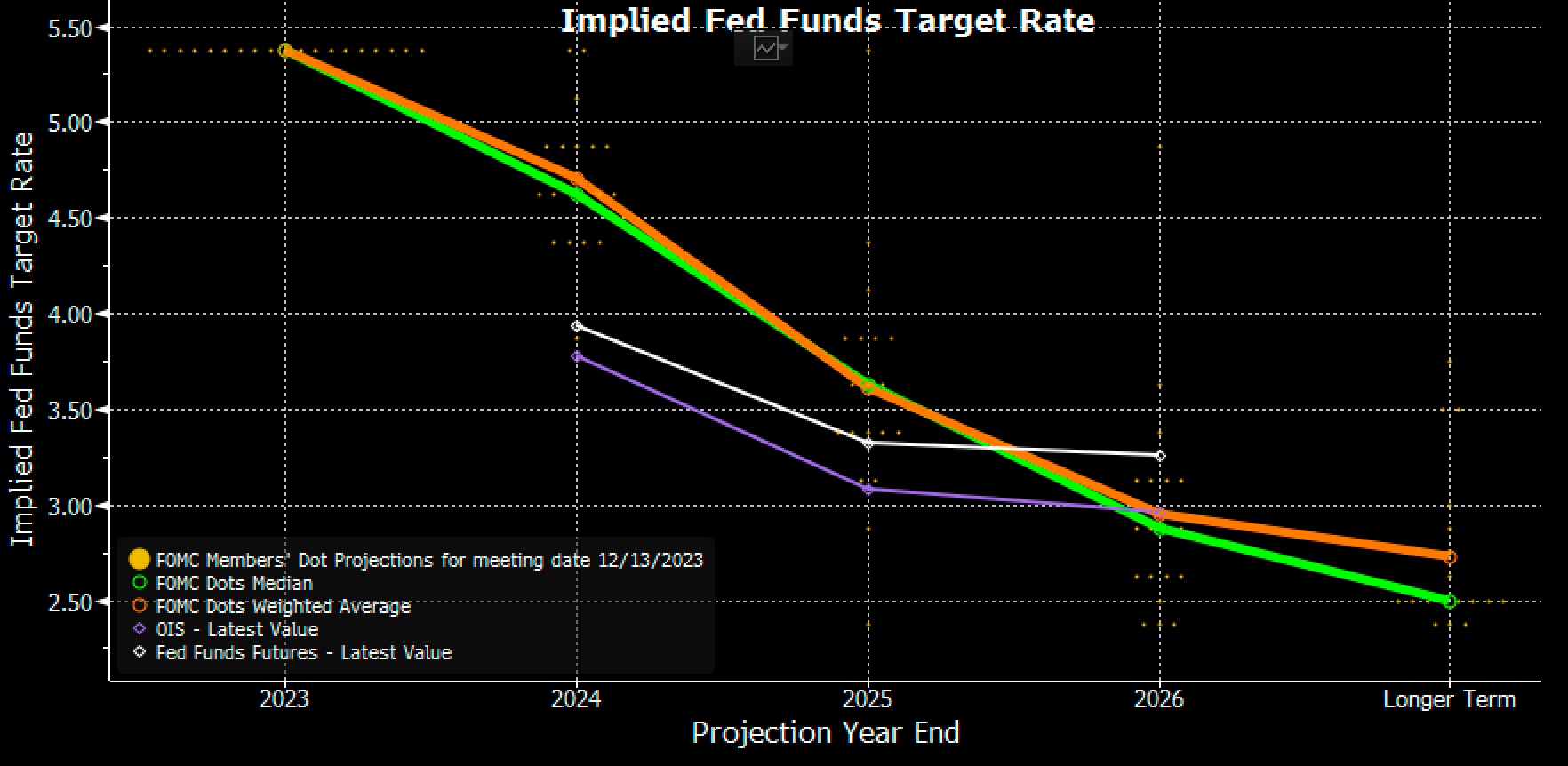

The Fed sees rates around 4.65% at the end of 2024, while swaps are trading at 3.78% and Fed Fund Futures are trading at 3.94%. The gap is too wide and will need to be closed.

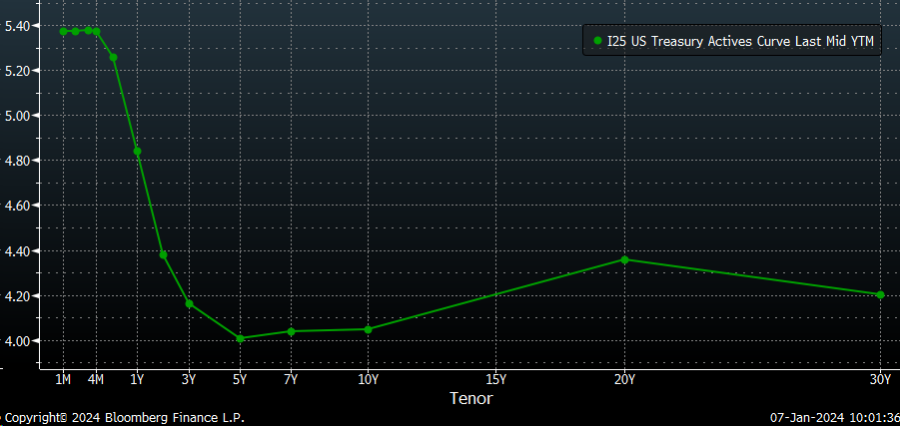

This will likely result in rates across the curve rising further because assuming a 2% inflation rate, with the 5-year trading at 4%, suggests a Fed funds rate of 2%, lower than the Fed’s longer-run rate of 2.5%.

So it would probably suggest a 50 bps upside to the 5-year from current levels and the entire curve.

While it doesn’t suggest a 10-year rate moving back to the October higher, it does suggest a 10-year rate perhaps moving back to 4.5 to 4.6%.

Given that the 10-year is showing positive and strong momentum from a break out in the relative strength index and a strong break out from a downtrend on the price chart, it won’t take much, perhaps more than a close above the 200-day moving average, to get the 10-year moving higher towards 4.25% to 4.3%.

Inflation data may only add to the breakout that already appears to be taking place.

The dollar would also likely get a boost. While the dollar isn’t as well positioned as the 10-year currently, It is getting closer to seeing a significant breakout, with an RSI trending higher overall and breaking free in several key spots.

If the DXY can clear the 102.65 region, it has room to run to around 103.50 and test horizontal resistance and the 200-day moving average.

S&P 500: Revisit to 3600 in the Cards for 2024?

The S&P 500 is also on its way lower and has recently fallen below its 10-day exponential and 20-day simple moving averages, with the lower Bollinger band around 4,580 being one potential target.

Of course, it is not uncommon that when an index hits the upper Bollinger Band, it retraces to the lower Bollinger band over time, and in that case, that would be around 4,100 on the weekly chart.

It isn’t uncommon on the monthly chart, meaning a revisit to the lows of around 3,600. Because that is what happened in mid-2022, early 2020, late 2018, and in parts of 2016.

The December 2023 rally pushed the index above the upper Bollinger band. We are now in 2024, of course. Have you noticed the trend?

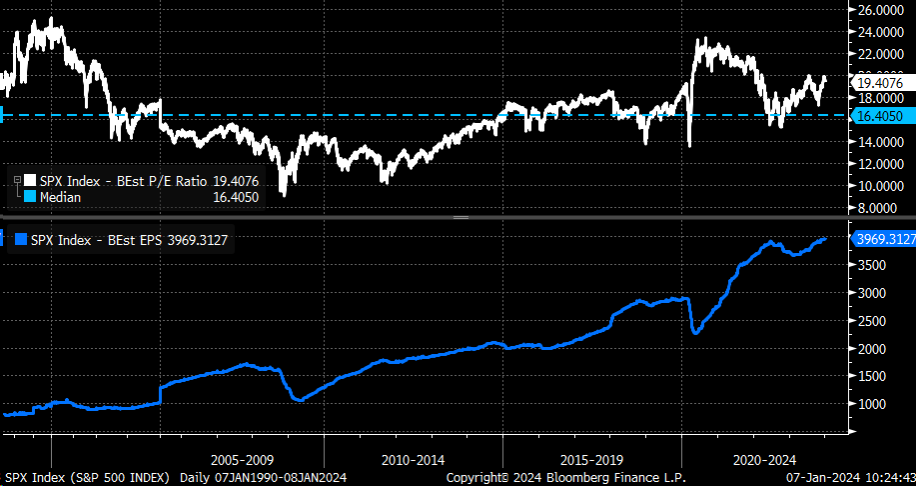

The market has been very aggressive with rate cuts, and rate cuts to the degree the market has priced doesn’t look right—also, the earnings multiple of the S&P 500 is too high at 19.4.

The median PE ratio for a 12-month forward S&P 500 is 16.4; at roughly $242 in earnings per share, the value of the S&P 500 would be around 3,960.

That is, assuming that earnings grow by 10%, should they grow by just 5%, and are instead $231 per share, the value drops to 3,790.

So, from a fundamental and technical basis, a drop back towards the lower monthly Bollinger band should not be completely ruled out or viewed as fiction.

The fundamentals and technical aspects suggest it be possible, especially if rates increase again and earnings don’t live up to the hype.

Enjoy the final week of Football. I will be watching the Bill play the Dolphins. I have been a Bills fan since 1989, and it doesn’t get bigger than the Bills at Dolphins playing for the AFC East title.

This weekend’s YouTube Video: