One of the few reliable strategies that ETF investors can employ to bolster their long-term net returns is ensuring they pay minimal expense ratios. Over time, these expenses compound, and when all variables remain constant, a lower fee translates directly to enhanced returns.

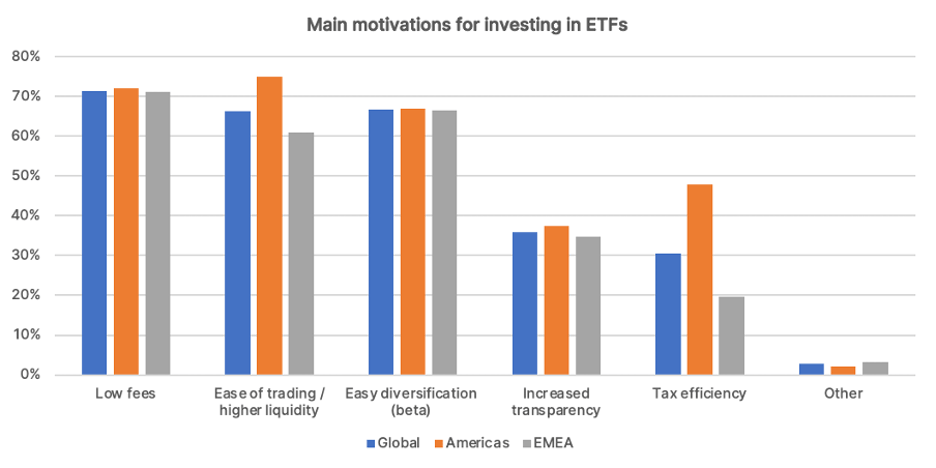

Investors have clearly taken note of this consideration. According to the 2023 Trackinsight Global ETF Survey, an overwhelming majority of respondents from all regions agreed that low fees were the primary reason for investing in ETFs, beating out other considerations like liquidity, diversification, and transparency.

It's evident that ETF managers have not only recognized this but are also making it a pivotal aspect of their strategy in the competitive landscape of ETFs. On August 1, 2023, State Street Global Advisors, the investment arm of State Street Corporation (NYSE:STT) unveiled a cut in expense ratios for 10 ETFs within their low-cost SPDR Portfolio lineup.

"We continuously evaluate our product lineup and pricing structure in order to offer investors attractive solutions to help them meet their goals," says Deborah Heindel, Vice President, Public Relations for SPDR ETFs North America. "These expense ratio reductions are a result of that process, as we believe low-cost ETFs allow buy-and-hold investors to limit the impact of fees on a portfolio’s long-term performance."

Here's a look at the impacted ETFs and the wider implications it holds for the entire ETF industry.

The affected ETFs

The recent modifications prominently impact the SPDR Portfolio ETFs. Originally introduced to serve as low-cost foundational elements for portfolio construction, these SPDR funds are directly positioned to rival offerings such as the iShares Core ETF lineup.

- SPDR Portfolio S&P 500 ETF (SPLG): Previous ER 0.03% → New ER 0.02%

- SPDR Portfolio S&P 400 Mid Cap ETF (SPMD): Previous ER 0.05% → New ER 0.03%

- SPDR Portfolio S&P 600 Small Cap ETF (SPSM): Previous ER 0.05% → New ER 0.03%

- SPDR Portfolio Developed World ex-US ETF (SPDW): Previous ER 0.04% → New ER 0.03%

- SPDR Portfolio Europe ETF (SPEU): Previous ER 0.09% → New ER 0.07%

- SPDR Portfolio Emerging Markets ETF (SPEM): Previous ER 0.11% → New ER 0.07%

- SPDR Portfolio Short Term Treasury ETF (SPTS): Previous ER 0.06% → New ER 0.03%

- SPDR Portfolio Intermediate Term Treasury ETF (SPTI): Previous ER 0.06% → New ER 0.03%

- SPDR Portfolio Long Term Treasury ETF (SPTL): Previous ER 0.06% → New ER 0.03%

- SPDR Portfolio High Yield Bond ETF (SPHY): Previous ER 0.10% → New ER 0.05%

"These expense reductions are a win for investors because presumably, a core portfolio is built for the long term," Heindel says. "Minimizing fees on long term investments is important particularly if they are the largest part of an investor’s portfolio, allowing them to keep more of what they earn."

Competitive implications

The cuts may seem small from a relative perspective, but it's crucial to frame it in the context of the ETF industry's competitive landscape.

When you glance across the ETF market, you'll find that many of the SPDR offerings have their counterparts managed by giants like iShares, Vanguard, Schwab, and Invesco. These competing ETFs often have similar objectives, historical performances, and benchmarks.

For the average investor trying to sift through these options, the process can be akin to navigating a maze. Overwhelmed with choices, many resort to easily digestible, transparent, and objective metrics to make their decision, chief among which are fees.

The recent fee cuts to the SPDR ETF Portfolio lineup are absolutely leveraging this investor mindset. By trimming down the fees, even by small amounts, they are placing their ETFs at the forefront of a cost-conscious investor's radar.

Take for instance SPLG. Now, with an expense ratio of 0.02%, it proudly wears the crown of the most economical S&P 500 ETF option in the market. This undercuts the long-reigning champions, the iShares Core S&P 500 ETF (IVV) and the Vanguard S&P 500 ETF (VOO), both of which carry a 0.03% fee.

Furthermore, this strategic positioning by SPDR reinforces its stronghold in the ETF domain. Now, the company not only boasts of the largest, most liquid S&P 500 ETF with the SPDR S&P 500 ETF (SPY (NYSE:SPY)), but it also now offers the most cost-effective option with SPLG.

Another compelling case is the international segment, where SPDW, now charging 0.03%, surpasses popular options like the Vanguard FTSE Developed Markets ETF (VEA) and the iShares Core MSCI EAFE ETF (IEFA), which charge 0.05% and 0.07% respectively.

In the emerging markets category, SPEM at 0.07%, has a slight edge, undercutting the Vanguard FTSE Emerging Markets ETF (TSX:VEE) (VWO) at 0.08% and the iShares Core MSCI Emerging Markets ETF (NYSE:IEMG) at 0.09% respectively.

Finally, the revised expense ratios for their treasury bond ETFs not only beat Vanguard's lineup, which hovers at 0.04%, but also significantly undercut popular funds such as the iShares 20+ Year Treasury Bond ETF (NASDAQ:TLT), the iShares 7-10 Year Treasury Bond ETF (NYSE:IEF), and the iShares Short Treasury Bond ETF (SHV), all of which charge a heftier 0.15%.

In conclusion, the recent fee reductions by SPDR might be minuscule in isolation, but in the fiercely competitive landscape of ETFs, they can potentially sway billions of dollars in AUM over time.

This content was originally published by our partners at ETF Central.