Stryker Corporation (NYSE:SYK) is one of the largest global medical device companies with a focus on MedSurg, Neurotechnology, and Orthopaedics markets. The company has been a compounding machine for many decades and experienced strong growth in 2024, with organic sales growth of 10.2% for both the fourth quarter and the full year. Stryker is well positioned for sustained future growth due to its strong moat. However, at the current price, the company is modestly overvalued.

Company introduction and operational analysis

Stryker was founded in 1941 by orthopedic surgeon Dr. Homer Stryker in Kalamazoo, Michigan. The company pioneered portable hospital beds in the 1940s and has since evolved into a diversified global medical device giant through both R&D efforts and strategic acquisitions. Two milestone acquisitions for Stryker are the acquisition of Mako Surgical in 2013 and Wright Medical (TASE:BLWV) in 2020. The Mako acquisition is critical for Stryker’s currently super-successful robotic platform. The Wright Medical acquisition reinforced Stryker’s lead in orthopedics.Stryker operates across two core segments: Orthopaedics and MedSurg & Neurotechnology. The Orthopaedics segment includes sales of joint replacements, trauma, and sports medicine products. The MedSurg & Neurotechnology sells surgical instruments, endoscopy, neurovascular devices, spinal implants, and navigation systems. For 2024, Stryker’s MedSurg and Neurotechnology segment contributed 59.7% of total revenue, while the Orthopaedics segment contributed 40.3%.

In the orthopaedics market, Stryker competes mostly against Johnson & Johnson (JNJ), Zimmer Biomet (ZBH), and Smith and Nephew (SNN). Stryker’s competitive advantages include its broad product portfolio, strong sales culture and leadership in the Mako robotics platform.

In the MedSurg & Neurotechnology segment, Stryker competes against various big players in different niche markets. For instance, in endoscopy, Stryker mainly competes against Karl Storz and Olympus Optical, while in surgical instruments, Stryker’s main competitors include Baxter International (NYSE:BAX), Zoll Medical Corporation, and Medline Industries. Compared to its rivals, Stryker’s competitive advantage is the ability to cross-sell across different product categories, making it a one-stop shop for hospitals and healthcare facilities.

Key to Stryker’s long-term growth is its acquisition strategy. Stryker targets high-growth markets and innovative technologies to expand its portfolio offering. After the acquisition, Stryker can seamlessly integrate the acquired technologies into its existing product lines. With each acquisition, the company adds more to its already broad product offering and expands cross-selling opportunities.

Financial and valuation analysis

Stryker has demonstrated strong financial performance, with consistent growth and a stable margin trend.For 2024, Stryker reported net sales of $22.6 billion, an increase of 10.2% year-over-year. The MedSurg and Neurotechnology segment contributed 59.7% of total revenue, while the Orthopaedics segment contributed 40.3%. Net sales for the MedSurg and Neurotechnology segment reached $13.5 billion, which grew 11.1% year-over-year. Net sales for the Orthopaedics segment were $9.1 billion, representing an 8.9% increase year-over-year. For FY2025, Stryker’s management team expects organic net sales to grow from 8.0% to 9.0%.

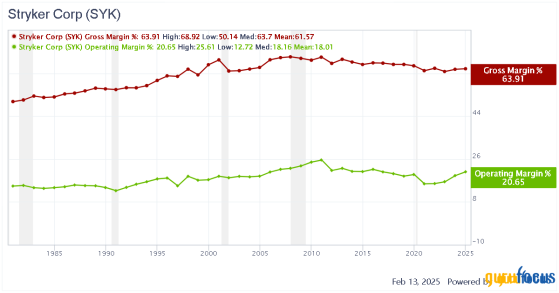

Over the past 15 years, Stryker’s gross margin and operating margin declined between 2011 and 2020 due to product mix shifts and pricing pressure. Since 2021, the gross margin has been stabilized while the operating margin started to expand again. The gross profit margin increased to 63.9% in 2024 from 63.7% in 2023 and 62.8% in 2022. This improvement was driven by higher pricing and volume increases.

As Stryker has the highest predictability and generates consistent free cash flows, the DCF model is an appropriate model to use for valuation. If we use a 10% discount rate and assume that Stryker can grow its free cash flow at 12.9% over the next 10 years and 4% afterward, the implied current intrinsic value per share is $192. At the current price of $386, Stryker’s stock price is modestly overvalued and has no margin of safety at all. Using the reverse DCF tool, Stryker would need to grow its FCF per share at 23% a year to justify its current valuation. Given the size of the company, this is almost impossible.

Risk Analysis

Stryker faces various risks in its operations. Firstly, the regulatory environment in the U.S. has become more and more unfriendly to medical device companies due to reimbursement pressures. For instance, CMS reimbursement for joint replacements is proposed to be cut by 2% in 2025.Secondly, Stryker may face supply chain disruptions as the company has built a complex supply chain across different regions. Stryker relies on some Chinese suppliers for its products. To mitigate this risk, Stryker has worked with its Chinese suppliers to move some production facilities outside of China.

Thirdly, Stryker is vulnerable to foreign exchange fluctuations because almost 40% of the company’s revenue is generated outside of the U.S.

Conclusion

Stryker’s is well-positioned for consistent long term growth as a result of the company’s competitive advantages. In the near term, risks around U.S. healthcare policy may impact the company’s financial performance. Meanwhile, Stryker’s current valuation has priced in unrealistic growth potentials and offers no margin of safety. Value investors should stand on the sideline.This content was originally published on Gurufocus.com