President Joe Biden on Wednesday signed an executive order that will block and regulate high-tech US investments going toward China.

The move specifically targets certain sectors, including semiconductors, microelectronics, quantum information technologies, and artificial intelligence systems. This development adversely impacted tech companies such as Nvidia, with the chipmaker fighting to keep its $1 trillion valuation after its shares dropped by 8.56% over the week, falling more than 14% from its 52-week peak value. Interestingly, this happened amidst reports of several Chinese internet giants planning to invest billions in Nvidia’s AI chips ahead of potential tighter US regulations, as reported by the Financial Times.

Chinese tech heavyweights Baidu (NASDAQ:BIDU), ByteDance, Tencent and Alibaba (NYSE:BABA) have reportedly placed orders worth $1 billion for close to 100,000 A800 processors, manufactured for delivery throughout the year according to industry sources. Further commitments from these Chinese firms include the acquisition of an additional $4 billion worth of graphic processing units scheduled for delivery in 2024.

The A800, which runs at 400GB/s, is a somewhat less potent variant of Nvidia's advanced A100 GPU, designed for data center operations, which functions at 600GB/s. Nvidia slashed the interconnect bandwidth from 600GB/s to 400GB/s - thus narrowing the volume of data that can be transmitted to or received from other chips - following last year’s export restrictions imposed by Washington. In an effort to curb Beijing’s technological advancements, Chinese firms are restricted to purchasing the ‘slowed down’ A800, with ensuing limitations on large-scale AI projects.

The S&P IT sector was down 2.87% for the week. Semiconductor & AI ETFs took the hit with losses spanning between -4% and -6%.

Group Data

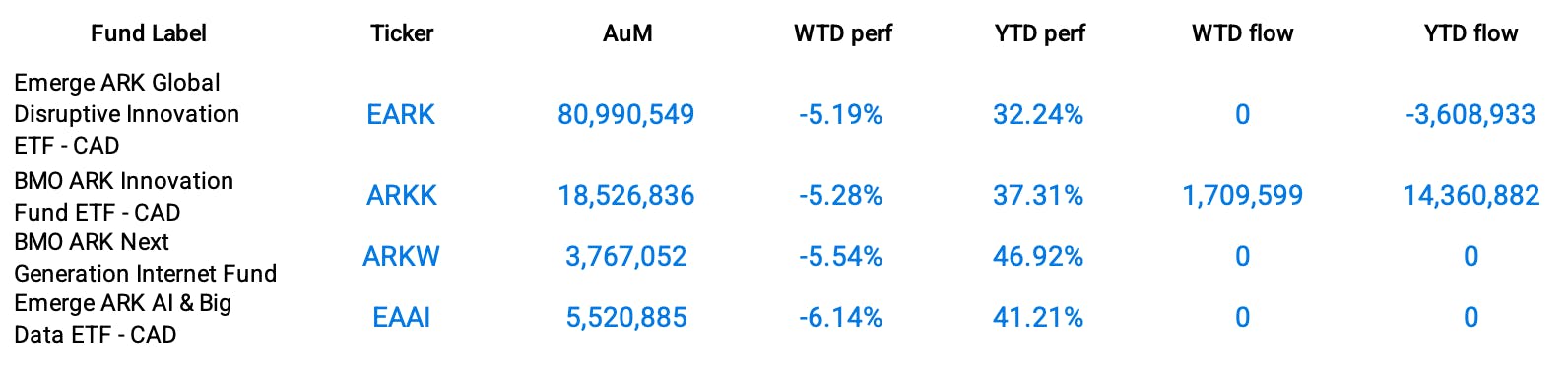

Funds Specific Data

This content was originally published by our partners at the Canadian ETF Marketplace.