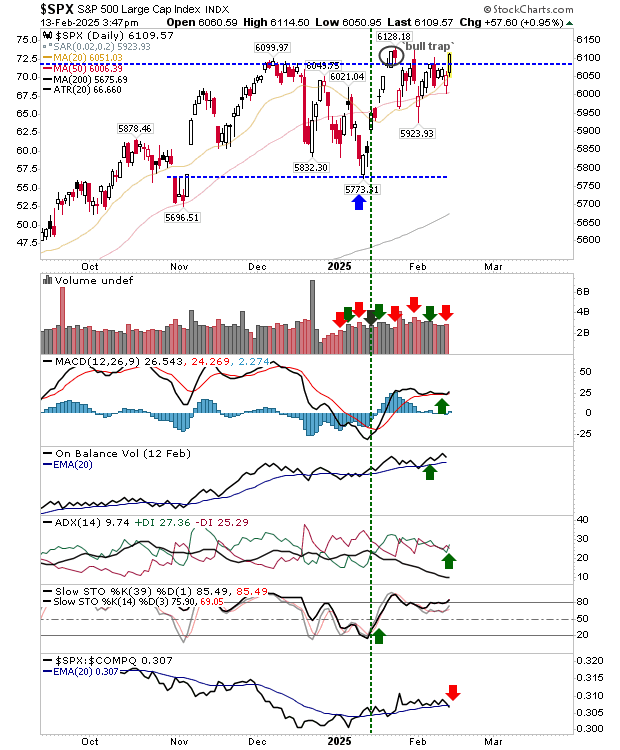

The S&P has finally managed to close inside the prior 'bull trap', and in the process, has returned technicals to a net bullish state. There have been false dawns in the past, will this time be different?

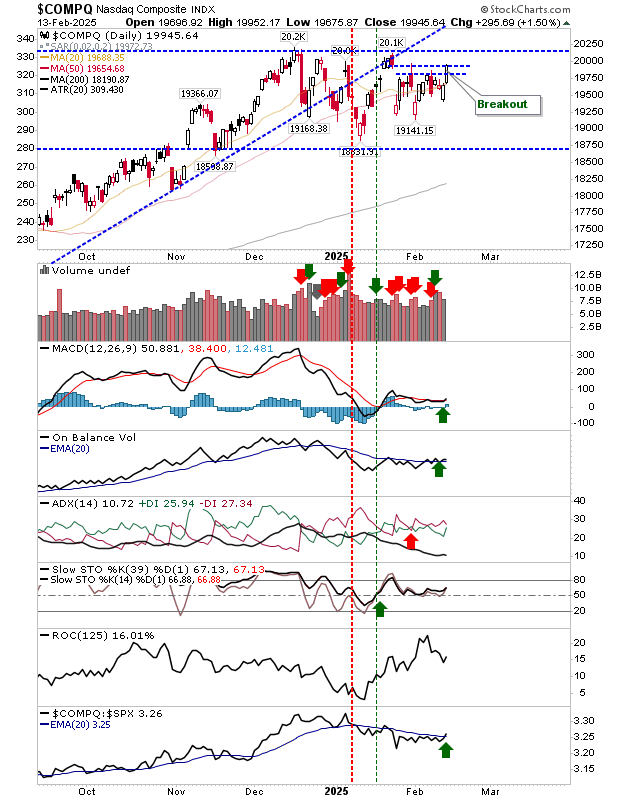

Other indices also posted gains, but not enough to change the larger technical picture. The Nasdaq finally closed the breakdown gap, negating the gap as a breakdown, but not enough to push beyond the gap.

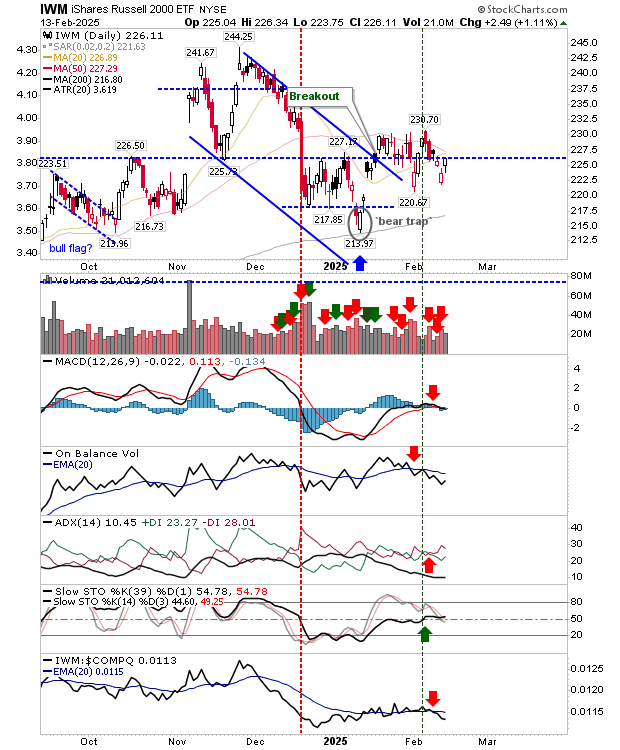

In the process of doing this, there were fresh 'buys' in the Nasdaq and On-Balance-Volume. However, Russell 2000 resistance remains, and until new highs are confirmed the broader trading range remains.

The Russell 2000 (IWM) did enough to post a gain but not enough to break aboe moving averages. There is no real change in the technical picture for this index, and it will need to do more to excite.

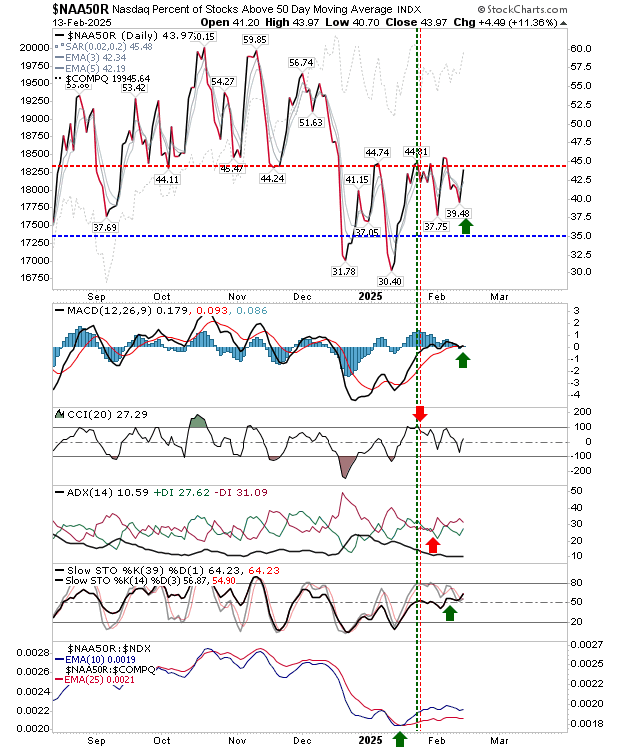

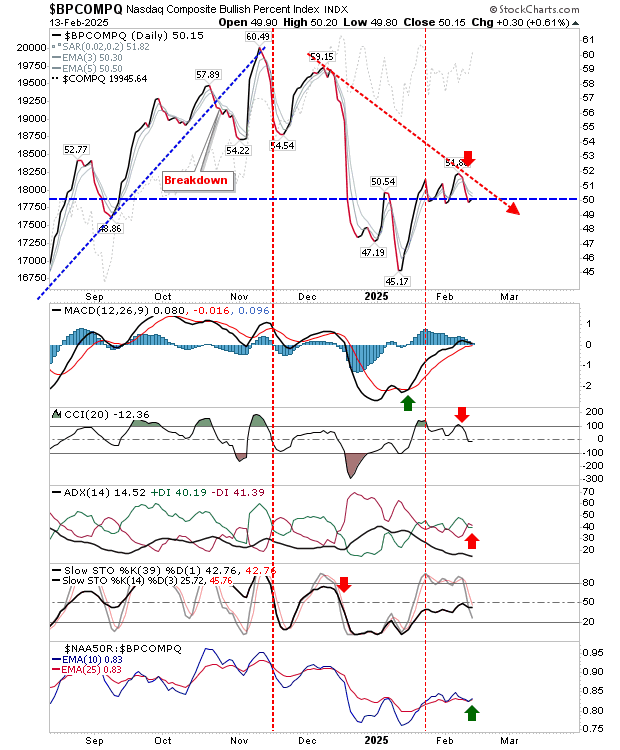

Keep an eye on breadth metrics. These are disappointing and aren't exactly recommending a 'buy'. The Percentage of Nasdaq Stocks above the 50-day MA is hovering below 50%, falling from 60% pre-Christmas.

The Nasdaq Bullish Percents (Nasdaq stocks on point-n-figure 'buy' signals) are hovering around the 50% mark, but below the 60% at Christmas.

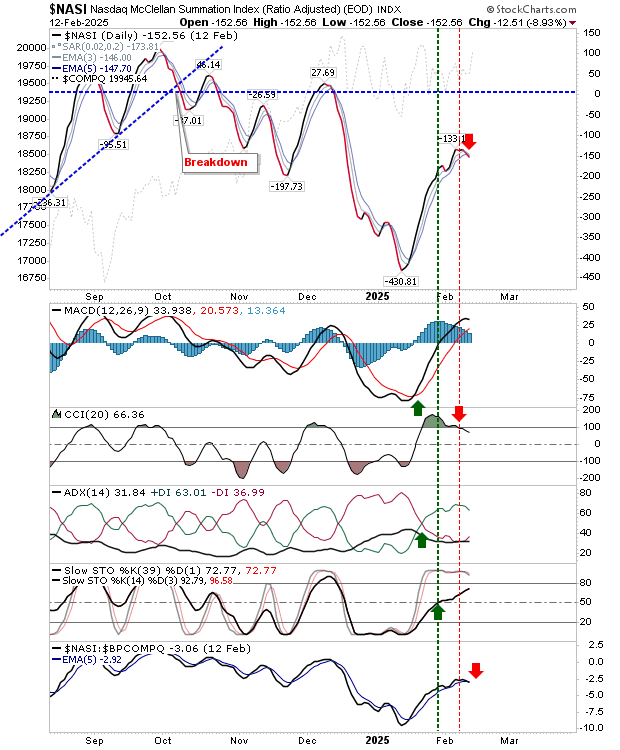

While the Nasdaq Summation Index ($NASI) has signaled a new 'sell' trigger as part of a larger bearish divergence.

Markets are improving but lingering doubts remain. The S&P looks like it will be the trailblazer and has the potential to help other indices higher. The Nasdaq remains vulnerable to selling despite closing the breakdown gap; a gain tomorrow would do much to negate that vulnerability.