- Tesla is trying to widen its investment appeal through another stock split

- Company’s business fundamentals matter the most when making a buying decision

- Tesla stock has surged more than 45% since its May low

Starting tomorrow, you won’t need to spend around $905 to buy a share of Tesla Inc (NASDAQ:TSLA). The world’s largest electric carmaker will complete a 3-for-1 stock split by Wednesday’s market close, bringing its stock price down to the $300 range.

Technically speaking, stock splits don’t change the value of a company or its investors’ holdings. However, the move illustrates the growing influence of retail investors on the market in modern times and the company’s desire to widen its investment appeal.

Tesla is just one of the many large mega-cap companies to resort to stock splits during the pandemic. Alphabet (NASDAQ:GOOG), Apple (NASDAQ:AAPL), and Amazon.com (NASDAQ:AMZN) all have already completed their splits during the past two years.

That said, investors shouldn’t make investment decisions based on stock splits. Instead, the company’s business fundamentals and its valuation matter the most.

Tesla Valuation

And when it comes to Tesla, valuation has always been hard to crack. Wall Street analysts remain sharply divided on how to value the EV giant.

Some believe Tesla is ultimately a car company and doesn’t deserve the kind of premium it enjoys over its more profitable peers, such as Toyota Motors.

Bulls, however, counter that by saying that Tesla isn’t just a car company. Its strength lies in its exposure to several new technologies, including its full self-driving (FSD) feature, solar roof tiles, and the Optimus robot. If any of these bets succeed, Tesla will bring in a type of revenue that traditional car makers can’t.

Elon Musk told investors this year that he thinks FSD will become its most important source of profit over time and repeated a prediction that the wide release of the capability will lead to one of the most significant asset-value increases in history.

Despite these divergent views, Tesla has proved to be a tremendous buy-on-the-dip bet. While the company’s investors have been through a highly unpredictable 2022, dealing with several challenges, including supply-chain disruptions in China and soaring raw material prices, the shares have been recovering surprisingly.

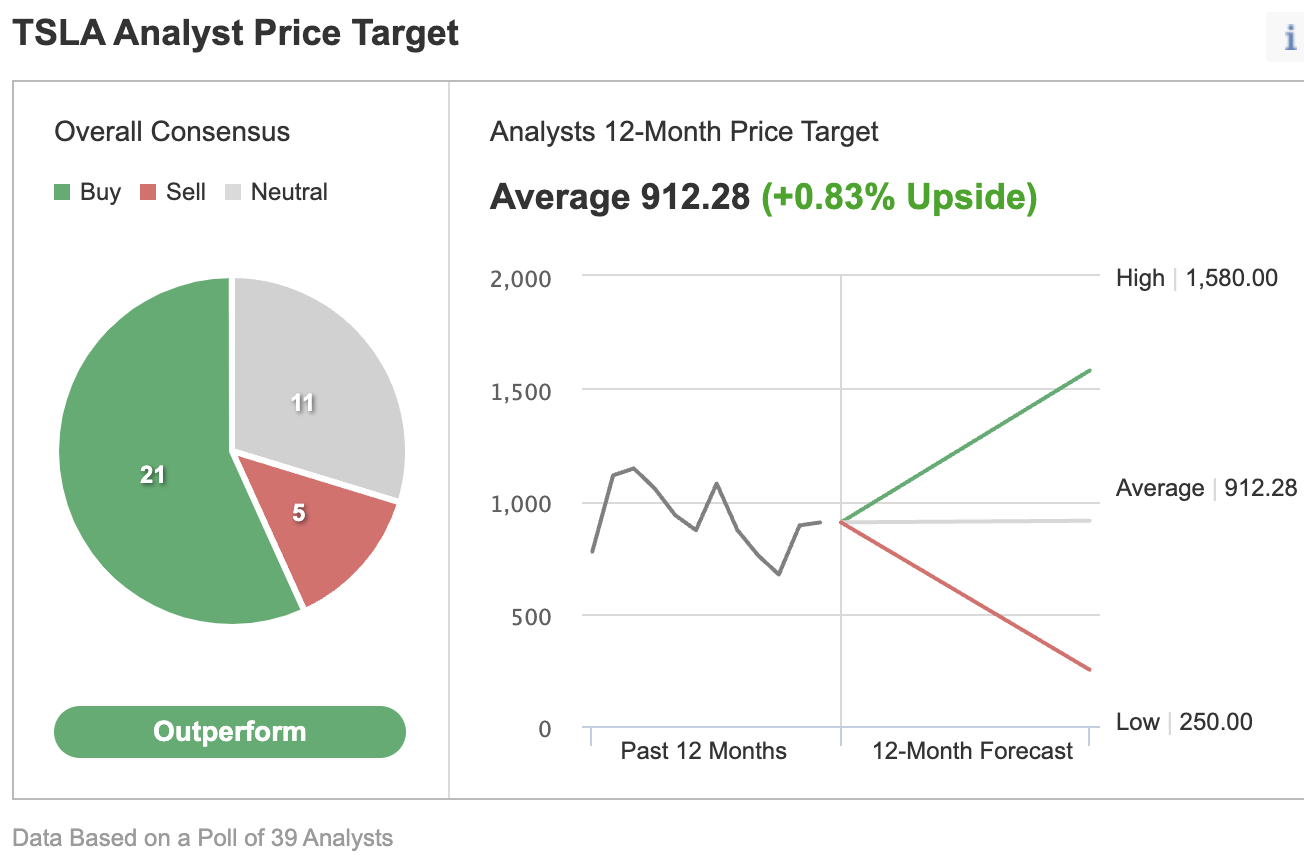

They posted a 32% gain in July for Tesla’s best month since October, fueled by strong second-quarter earnings, a climate change bill from the Biden administration, and an overall market rebound. Since hitting its May low, the stock is up about 45%, bringing the share price very close to Investing.com's analysts' price target of 912.

Source: Investing.com

Still, investing in Tesla is not for everyone, given its extreme volatility. And that problem is likely to stay, especially as a global recession weighs on consumers.

Besides these macro uncertainties, Musk’s court battle with Twitter Inc (NYSE:TWTR) also looms following his one-sided exit from a $44-billion deal he signed in April.

If Twitter can secure a favorable verdict, Tesla’s chief could be forced to complete the deal with some implications for Tesla shareholders. Earlier this month, Musk offloaded $6.9 billion worth of Tesla stock to accumulate cash ahead of a trial on the Twitter issue.

Bottom Line

Tesla’s stock split will undoubtedly broaden the company’s appeal among retail investors who believe in Elon Musk’s vision and the company’s technology appeal. That said, Tesla’s powerful rally in the past two months may take a breather as its CEO fights a court battle over his Twitter deal, and macroeconomic challenges linger.

Sitting on the sidelines and waiting patiently for a better entry point seems to be the right strategy for retail investors at this point.

Disclaimer: The writer doesn’t own shares of Tesla.