Not everybody is an options trader, but during an election year there is at least one binary option that most of us care quite a bit about and that’s the option on the US Presidency. There are ways to trade the binary option, but my interest here is not in valuation.

People generally understand that if an option with a payoff of $1 or $0 (depending on the outcome of the event) is trading at $0.60, it means that the market is pricing a 60% chance that the event will occur. (Because 60% chance of $1 + 40% chance of $0 has an expected value, if we ignore discounting, of $0.60). But what I think many people don’t naturally understand is how the 60% chance changes over time even if nothing changes in the underlying circumstances.

If you’re not an options trader, this might be confusing. If Trump has a 60% chance of winning based on the current circumstances on July 31st, then if the exact same circumstances prevail on October 31st shouldn’t the odds of him winning still be 60% (and therefore, the price wouldn’t change)? The answer is nope, not at all.

Let’s suppose that we can summarize “the current circumstances” with one metric, that being the national polling margin.[1] Trump currently polls about 2 points ahead of Harris nationally according to the RealClearPolitics average. If that’s still true on November 5th, Trump will win (again, pretending that the winner of the popular vote automatically wins the election). The odds of him winning would be, of course, 100%. If he only drew 49% of the vote, his odds of winning would be 0%. That’s on the day of expiry, when the odds have to collapse to 100% or 0%.

Before the last day, time and volatility work in favor of the challenger and against the leader. If I am the leader, then I want nothing to change. Good things will help me, but won’t change the situation (I’m still expected to win), but bad things might change my expected win to an expected loss.

The more volatility there is, the more crazy things happen, and the more chances there are that my victory will turn into a loss. If I am behind, I want chaos, and the closer I get to ‘expiration’ the more I am willing to risk to get the chaos. Think about pulling the goalie in an elimination round in hockey or soccer…if the team is behind by 1 goal with 1 minute left, then the opposition scoring on an open goal doesn’t change anything – but having an extra man forward has a chance to change the outcome.

Key point: volatility helps the out-of-the-money option. Higher volatility raises the delta (loosely thought of as the chance of ending up in-the-money) of an out-of-the-money option. Similarly, higher volatility lowers the delta of the in-the-money option. This is why there are October surprises.

Time works on options pricing similarly to volatility (fun fact – doubling the implied volatility has the same effect as quadrupling the time to maturity, I the Black-Scholes world). As the expiry of the option approaches, the delta of an in-the-money option gradually rises until it gets to 1.0 at expiry; the delta of an out-of-the-money option gradually declines to 0.0. It’s the same reasoning. With more time to play, there are more chances for good (outcome-changing) accidents to happen to the person who is trailing, and more chances for bad accidents to happen to the person who is leading.

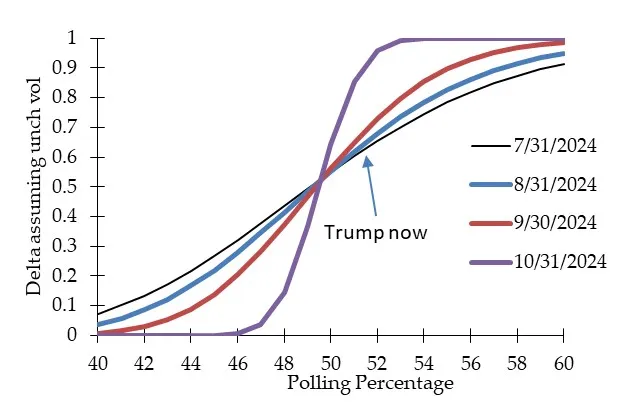

In the context of the election, here’s what this means. (Note: remember this is just an illustration, not a prediction. It’s a pricing model where I’ve made lots of assumptions so as to be able to show this point).

If Trump still has a similar lead in the national polls in two months, his odds of winning will rise – to something like 70%, versus 60% now. After that, it will rapidly go to 100% over the ensuing weeks. And so event contracts will behave likewise. Trump contracts should gradually rise, even if nothing changes, as the opportunities for changes in the race get narrower.

Two more caveats.

One: the option here is not really a European exercise that is determined on November 5th. Since there is such a thing as early voting, the effective expiry is closer. If Trump is leading on October 15th, he’s accumulating actual votes. So it’s really like some kind of weighted average-price exotic option. But the point is, the delta decay will happen faster than I’ve modeled, for that reason.

Two: I’ve assumed volatility is constant. It most assuredly is not constant. Implied volatility ought to rise as we get closer to expiry (October surprise!). That will tend to offset the delta decay that I have modeled.

In summary – don’t take this as trading advice but as a hopefully useful insight into how deltas (and binary contracts) evolve. I hope you found this interesting.

[1] We know that’s not right because the US elects Presidents based on the Electoral College process, which is the result of a compromise between those who wanted the President selected by Congress and those who wanted the President selected by popular vote. In recent years, the winner of the popular vote hasn’t always won the Presidency because the most-populous state, California, has overwhelmingly voted Democrat and skewed the popular vote numbers.