by Chaim Siegel of Elazar Advisors, LLC

Yesterday’s Fed meeting was probably just another stop along this building bull market story. We’ve done enough talking about this so it’s time we ask you.

Interactive Portion, It’s Your Turn

- Are you worried about the Fed moves?

- Are you worried about the markets?

Please answer (honestly) in comments. This is the interactive portion of this report.

Our answer: if you are worried, that's totally normal.

Most are worried about markets and most are worried about the Fed. Inflation is dropping and the Fed’s not backing down from tightening. That could cause a deflationary spiral. That could set up market risk. But it hasn't. Every time we look at “action” we get a bullish readout.

“Action” is the measurement of market reaction to news. It’s been bullish.

First Let’s Discuss The Fed’s Moves Yesterday

We are not surprised to see minimal market reaction to the Fed decision yesterday because it was heavily telegraphed. The Fed had said in their minutes on May 24th that they were planning to taper bond purchases starting later this year. The CME Fed Funds Futures had a near 100% chance for a rate hike.

This was as telegraphed as it could get, so there shouldn’t have been any shocks.

The Fed raised their GDP assumption and lowered their unemployment and inflation targets for this year. More growth and less inflation would be a bullish setup.

They also gave detailed guidance on how they plan to taper their $4T bond portfolio.

The Post-Decision Press Conference’s Most Important Discussion

The most important discussion happened to be around bond “action.” Fed Chair Yellen was asked about the bond market’s light reaction given the potentially damaging news of an imminent taper.

FC Yellen said several times they have been previewing these moves for years with the intention not to surprise. She went on to say the following:

“The plan is one that is consciously intended to avoid creating market strains… Look, of course if it turns out that there is a surprise and a substantial [market] reaction that is something we would have to take into account.”

Based on lessons learned from the famous taper tantrum back in 2013, the Fed is being very careful not to rattle markets. Their strategy is built around markets having a non-negative reaction. That is, of course bullish.

It’s human nature to worry. Many are nervous. You can see that clearly if you look at the negative headlines over the weekend after the negative tech calls.

But worry is not a sign of a market top.

Bullish Stock Market Action

Just as we saw on Friday and Monday and many other days on this journey, yesterday’s S&P 500 (via SPY in the chart above) also climbed back up into the close.

Those who are worried don’t hold shares. Many are out. Hedge funds are underperforming because many are not long. Sentiment is not bullish.

Two Other Telltale Signs Investors Are Worried And Not In Stocks

The single story of the press conference was that bonds aren’t budging. Investors don’t want to let go of their risk-free assets.

Even with a few trillion dollars reduction coming in the Fed bond and debt balance sheet, investors still don’t want to part with their risk-free exposure. Why? They are worried. That is far from a market top-mentality.

Here’s bonds (via TLT):

Bond holders are scared to get into equities. They are not yet ready to jump into stocks. As long as that’s the setup, stocks appear to still have a lot of upside.

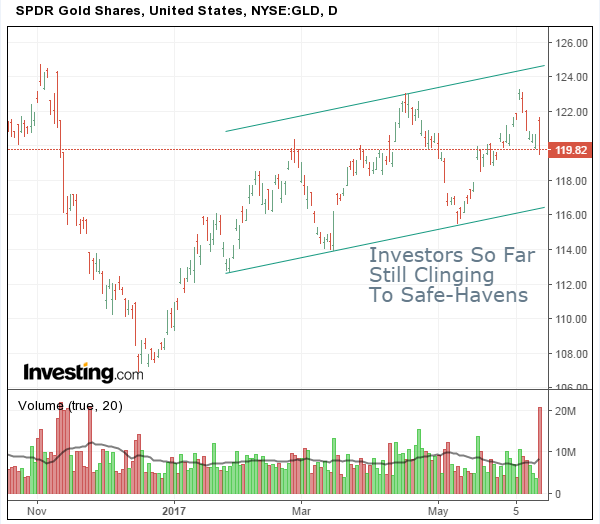

What about the other major safe-haven asset, gold? Same thing here.

Gold is also not getting thrown out with abandon. Investors are far from clearing their portfolios of safe-havens in order to speculate. When gold starts getting sold, it can be a strong signal that investors are finally rotating into equities.

If anything gold has been moving up this year.

Gold and bonds moving up is a sign of investor concern, not euphoria.

That tells you that investors have yet to sector rotate into risk assets. That’s bullish for stocks.

Conclusion

There is enough to worry about, but anyone who is worried doesn’t have enough to sell to make it matter to markets. That is an amazing sign of “bad news” “good action.” That’s yet another sign that we are far from a stock market top. Investors are worried but not in. And they will have to pile in at some point. Therefore, we remain bullish.

Disclosure: Portions of this report may have been issued in advance to subscribers or clients. All investments have many risks and can lose principal in the short and long term. This article is for information purposes only. By reading this you agree, understand and accept that you take upon yourself all responsibility for all of your investment decisions and to do your own work and hold Elazar Advisors, LLC and their related parties harmless. Any trading strategy can lose money and any investor should understand the risks.